- United States

- /

- Specialty Stores

- /

- NYSE:ANF

Could Abercrombie & Fitch's (ANF) Holiday Store Expansion Reveal New Strengths in Its Consumer Strategy?

Reviewed by Sasha Jovanovic

- Abercrombie & Fitch recently opened a new store in a refreshed space at Westfield Old Orchard Mall ahead of the key Thanksgiving shopping weekend, joining a roster of incoming retailers amid the mall's holiday events.

- This retail move positions the brand to capture increased seasonal foot traffic and consumer engagement as shoppers flock to the mall for festivities and gift-buying.

- We'll examine how Abercrombie & Fitch's latest high-traffic store opening could shape its investment narrative and holiday sales outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

Abercrombie & Fitch Investment Narrative Recap

To be a shareholder in Abercrombie & Fitch today, you need to believe in the potential for successful store expansion and brand revitalization offsetting sector headwinds like shifting consumer preferences and rising fixed costs. The recent high-profile store opening at Westfield Old Orchard could help drive stronger foot traffic during a peak season, but it is unlikely to meaningfully move the needle against broader risks such as persistent cost pressures and thin margins in the short term.

Among the company’s recent announcements, the strengthened partnership with the NFL stands out for its potential to draw in younger, sports-focused consumers during the lucrative holiday shopping period. Aligning major store launches with buzzy collaborative campaigns enhances Abercrombie’s seasonal appeal, supporting an important holiday sales catalyst even as traditional retail faces profit challenges.

Yet, despite these positive catalysts, investors should be aware that rising fixed costs from store expansion may weigh more heavily if e-commerce sales fail to keep pace...

Read the full narrative on Abercrombie & Fitch (it's free!)

Abercrombie & Fitch is forecast to reach $5.8 billion in revenue and $489.4 million in earnings by 2028. This outlook assumes 4.3% annual revenue growth, but reflects a decline in earnings of $51.6 million from current earnings of $541.0 million.

Uncover how Abercrombie & Fitch's forecasts yield a $100.89 fair value, a 49% upside to its current price.

Exploring Other Perspectives

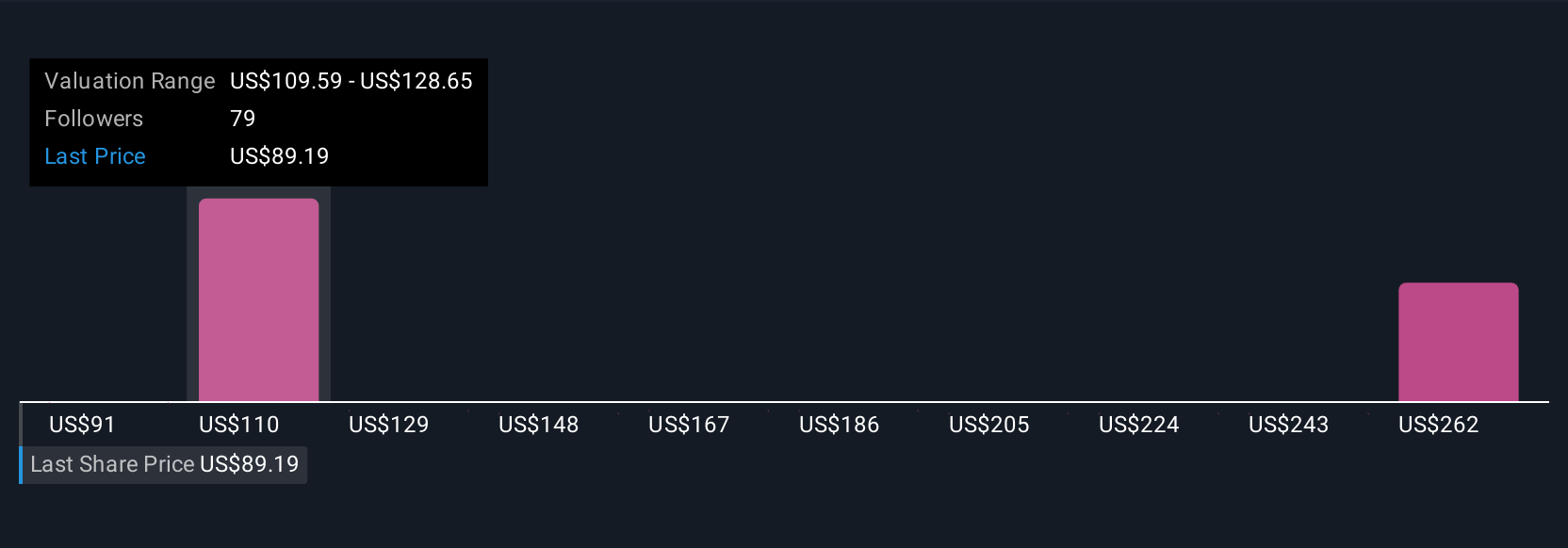

Thirteen community contributors at Simply Wall St have posted fair value estimates for Abercrombie & Fitch, ranging from US$84 to US$145.75. While contributors see opportunity, the risk from incremental store costs highlights why your view on digital growth could shape your own outlook, there is a wide spectrum of interpretation, so compare approaches to inform your next step.

Explore 13 other fair value estimates on Abercrombie & Fitch - why the stock might be worth over 2x more than the current price!

Build Your Own Abercrombie & Fitch Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Abercrombie & Fitch research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Abercrombie & Fitch research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Abercrombie & Fitch's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ANF

Abercrombie & Fitch

Through its subsidiaries, operates as an omnichannel retailer in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives