- United States

- /

- Specialty Stores

- /

- NYSE:ANF

Can Abercrombie & Fitch’s (ANF) Holiday Discounts Offset Margin Pressures in the Long Run?

Reviewed by Sasha Jovanovic

- Abercrombie & Fitch recently launched major sales promotions, including a 25% off Black Friday event and a secret Fall Favorites sale, featuring discounted popular collections and early sign-up incentives for shoppers.

- Despite these efforts to drive traffic and refresh product appeal, analysts have issued negative earnings revisions for the upcoming quarter, pointing to ongoing profitability concerns even as revenue is projected to rise.

- We'll explore how analyst downgrades and profit margin worries may influence Abercrombie & Fitch's longer-term investment outlook following this wave of holiday promotions.

Find companies with promising cash flow potential yet trading below their fair value.

Abercrombie & Fitch Investment Narrative Recap

To own Abercrombie & Fitch stock, investors need confidence that ongoing brand revitalization and global expansion will overcome near-term profit margin pressures, particularly as heavy discounting raises questions about pricing power and operational leverage. The timing and scale of the latest holiday sales promotions may temporarily boost traffic, but do not offset the most important short-term catalyst, restoring margin consistency, while persistent margin risk remains the top concern for the business.

Among recent developments, the major Black Friday and Fall Favorites sales are particularly relevant given their timing ahead of quarterly earnings. These events showcase Abercrombie & Fitch’s efforts to stimulate demand through promotions tied to popular products, but also bring renewed attention to the challenge of balancing sales growth with healthy profit margins as competitive pressures rise.

Yet, with analysts lowering earnings forecasts even as revenue expectations increase, investors should be mindful of the potential for margin compression driven by deeper, more frequent discounting…

Read the full narrative on Abercrombie & Fitch (it's free!)

Abercrombie & Fitch's outlook anticipates revenues reaching $5.8 billion and earnings of $489.4 million by 2028. This projection is based on expected annual revenue growth of 4.3%, but an earnings decrease of $51.6 million from current earnings of $541.0 million.

Uncover how Abercrombie & Fitch's forecasts yield a $106.44 fair value, a 51% upside to its current price.

Exploring Other Perspectives

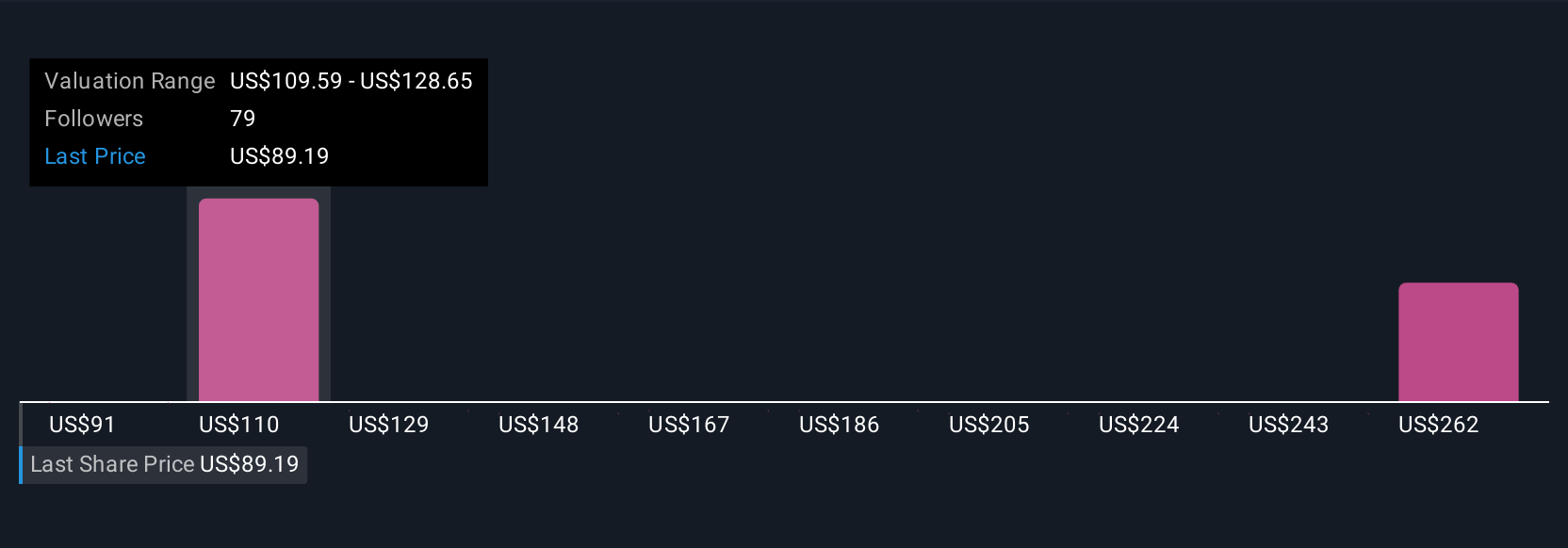

Simply Wall St Community members provided 13 fair value estimates for Abercrombie & Fitch, spanning from US$84.00 to US$145.75 per share. Many cite the risk that margin erosion from ongoing promotions and heightened competition could challenge these assessments over time, suggesting a wide range of scenarios for future performance.

Explore 13 other fair value estimates on Abercrombie & Fitch - why the stock might be worth over 2x more than the current price!

Build Your Own Abercrombie & Fitch Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Abercrombie & Fitch research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Abercrombie & Fitch research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Abercrombie & Fitch's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ANF

Abercrombie & Fitch

Through its subsidiaries, operates as an omnichannel retailer in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives