- United States

- /

- Specialty Stores

- /

- NYSE:ANF

Abercrombie & Fitch Co.'s (NYSE:ANF) 26% Share Price Surge Not Quite Adding Up

Abercrombie & Fitch Co. (NYSE:ANF) shares have continued their recent momentum with a 26% gain in the last month alone. The last 30 days were the cherry on top of the stock's 335% gain in the last year, which is nothing short of spectacular.

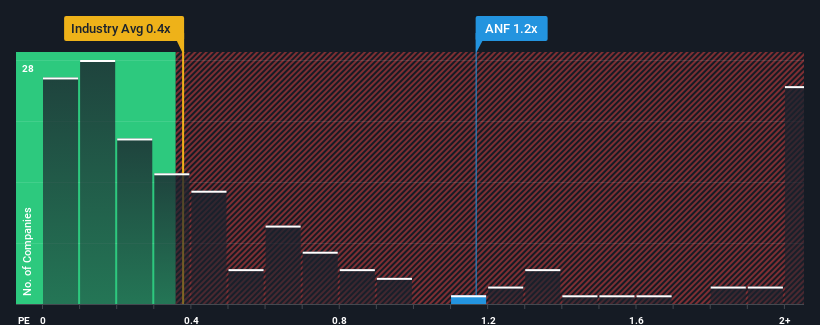

Since its price has surged higher, when almost half of the companies in the United States' Specialty Retail industry have price-to-sales ratios (or "P/S") below 0.4x, you may consider Abercrombie & Fitch as a stock probably not worth researching with its 1.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Abercrombie & Fitch

What Does Abercrombie & Fitch's P/S Mean For Shareholders?

Abercrombie & Fitch certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Abercrombie & Fitch.How Is Abercrombie & Fitch's Revenue Growth Trending?

In order to justify its P/S ratio, Abercrombie & Fitch would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered a decent 10% gain to the company's revenues. The latest three year period has also seen a 26% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 6.8% as estimated by the eight analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 5.5%, which is not materially different.

With this information, we find it interesting that Abercrombie & Fitch is trading at a high P/S compared to the industry. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Abercrombie & Fitch's P/S?

The large bounce in Abercrombie & Fitch's shares has lifted the company's P/S handsomely. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Given Abercrombie & Fitch's future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. A positive change is needed in order to justify the current price-to-sales ratio.

Before you settle on your opinion, we've discovered 2 warning signs for Abercrombie & Fitch that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ANF

Abercrombie & Fitch

Through its subsidiaries, operates as an omnichannel retailer in the United States, Europe, the Middle East, Asia, the Asia-Pacific, Canada, and internationally.

Very undervalued with outstanding track record.