- United States

- /

- Specialty Stores

- /

- NYSE:ANF

Abercrombie & Fitch (ANF): Does Strong Sales Guidance Signal Further Upside for the Stock’s Valuation?

Reviewed by Simply Wall St

Abercrombie & Fitch (ANF) saw its stock jump after announcing record third-quarter sales and boosting its full-year outlook. Strong performance at the Hollister brand, along with continued sales growth, has put the retailer in the spotlight.

See our latest analysis for Abercrombie & Fitch.

Abercrombie & Fitch’s blockbuster quarter set off a sharp rally, with the stock surging more than 37% in a single day as upbeat guidance and fresh sales momentum shifted market sentiment. Despite this dramatic rebound, longer-term performance is mixed, as the stock’s one-year total return remains down, even while multi-year gains are impressive. This signals momentum may be building anew after a challenging stretch.

If this turnaround story has you wondering where else opportunity is building, this could be a perfect time to discover fast growing stocks with high insider ownership

With such a dramatic share price rally and an upgraded outlook, the question now is whether Abercrombie & Fitch shares still offer value to long-term investors or if the market has already priced in the retailer’s next phase of growth.

Most Popular Narrative: 10.6% Undervalued

Abercrombie & Fitch’s fair value in the most popular narrative stands meaningfully above its last close price, suggesting analysts see further upside if recent catalysts hold.

Accelerating international expansion, digital investments, and brand revitalization are expected to broaden the market and drive long-term revenue and margin growth. Strong supply chain management, disciplined inventory control, and prudent capital allocation support sustained profitability and increased value for shareholders.

Want to know why market pros think this rebound is just the beginning? High-stakes financial assumptions power this price target, including aggressive shifts in revenue and margin forecasts. Find out which optimistic projections, if realized, could change everything for Abercrombie’s future valuation.

Result: Fair Value of $100.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent tariff headwinds and challenges in preserving brand pricing power could derail the current momentum if not addressed successfully.

Find out about the key risks to this Abercrombie & Fitch narrative.

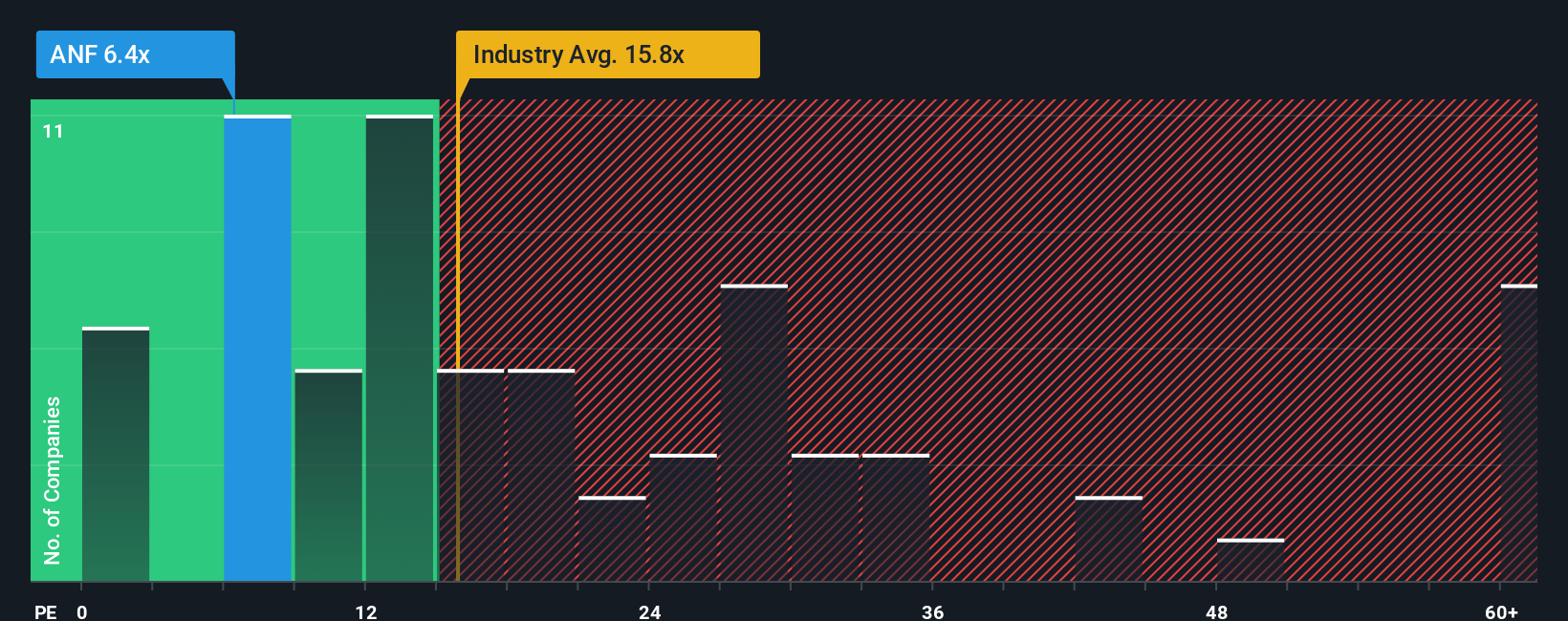

Another View: Value Ratios Put in Context

Looking at traditional value ratios, Abercrombie & Fitch trades at a Price-to-Earnings ratio of just 7.9x, significantly below both the industry average (18.9x) and its peers (20x). Even when compared with a fair ratio of 16.2x, this discount signals more value upside, unless the market knows something investors do not. Could this deep discount to peers mean an overlooked opportunity or a signal to be cautious?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Abercrombie & Fitch for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 924 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Abercrombie & Fitch Narrative

Don’t just take these narratives at face value. Dive into the data and build an argument from scratch in just a few minutes: Do it your way

A great starting point for your Abercrombie & Fitch research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready for More Investment Opportunities?

Looking to level up your investing? The Simply Wall Street Screener lets you act now on powerful themes, not just single stock ideas. Don’t miss your chance to spot tomorrow’s winners before they hit the headlines.

- Tap into high-potential future technologies by scanning these 26 quantum computing stocks for real breakthroughs in quantum computing and game-changing algorithms.

- Boost your portfolio’s income and stability as you check out these 14 dividend stocks with yields > 3% with a consistent track record of generous yields above 3% each year.

- Catch undervalued gems early by searching these 924 undervalued stocks based on cash flows that could outperform as the market recognizes their true cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ANF

Abercrombie & Fitch

Through its subsidiaries, operates as an omnichannel retailer in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success