- United States

- /

- Specialty Stores

- /

- NYSE:AEO

How Investors May Respond To American Eagle Outfitters (AEO) As Trade Tensions With China Ease

Reviewed by Sasha Jovanovic

- Earlier this week, President Donald Trump softened his criticism of China, easing trade tensions and lifting market sentiment toward U.S. apparel retailers like American Eagle Outfitters.

- This shift in rhetoric highlights the considerable influence that geopolitical developments can have on retailer outlooks, particularly for companies with global supply chains.

- We’ll examine how this easing of trade tensions may affect American Eagle’s growth prospects in the face of tariff-related pressures.

Find companies with promising cash flow potential yet trading below their fair value.

American Eagle Outfitters Investment Narrative Recap

To own shares in American Eagle Outfitters, you need to believe that its efforts to drive customer engagement and optimize its supply chain will offset near-term pressures from tariffs and slower revenue growth. While this week’s easing in U.S.-China trade rhetoric gave the stock a short-term boost and may help sentiment, the most pressing risks, such as weaker consumer demand and continued margin pressure, remain largely unaddressed by the news.

Of American Eagle’s recent announcements, the company’s ongoing share repurchase program stands out, with nearly 4 million shares bought back last quarter. This capital allocation move signals confidence in future cash flows, but it does not resolve the headwinds of potential markdowns or soft sales, which continue to weigh on quarterly outlooks.

However, investors should also consider that despite these positive signals, ongoing tariff threats and rising costs could…

Read the full narrative on American Eagle Outfitters (it's free!)

American Eagle Outfitters' outlook anticipates $5.6 billion in revenue and $340.2 million in earnings by 2028. This projection is based on a 2.2% annual revenue growth rate and a $143 million increase in earnings from the current $197.1 million.

Uncover how American Eagle Outfitters' forecasts yield a $15.94 fair value, a 7% upside to its current price.

Exploring Other Perspectives

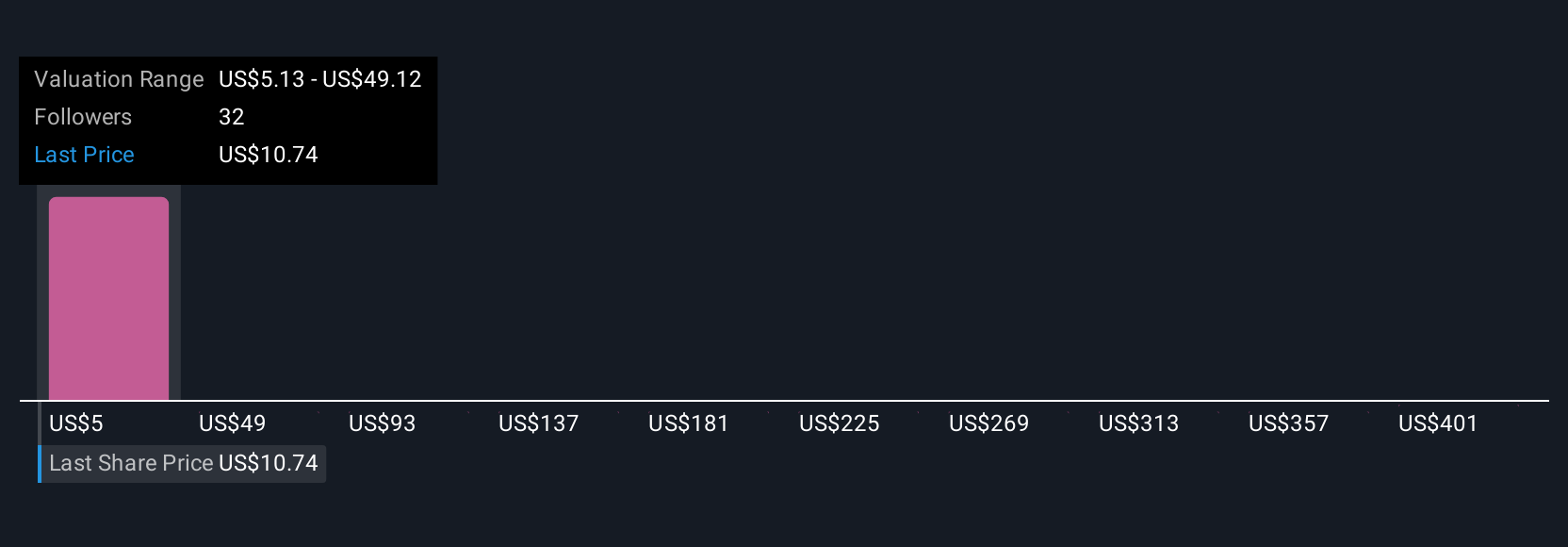

Fair value estimates from 9 Simply Wall St Community members range from US$9.13 to an outlier of US$445.03 per share. With sentiment split and uncertainty around tariff impacts, it is worth weighing multiple viewpoints on the company’s prospects.

Explore 9 other fair value estimates on American Eagle Outfitters - why the stock might be a potential multi-bagger!

Build Your Own American Eagle Outfitters Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American Eagle Outfitters research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free American Eagle Outfitters research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American Eagle Outfitters' overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AEO

American Eagle Outfitters

Operates as a multi-brand specialty retailer in the United States and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives