- United States

- /

- Specialty Stores

- /

- NYSE:AEO

American Eagle Outfitters (AEO): Assessing Valuation After Strong Buy Analyst Reports and Renewed Investor Interest

Reviewed by Simply Wall St

American Eagle Outfitters (AEO) has been catching investor attention lately as recent analyst reports point to a strong buy rating. Upbeat earnings expectations and attractive valuation metrics are driving renewed interest in the stock.

See our latest analysis for American Eagle Outfitters.

Momentum has been picking up for American Eagle Outfitters lately, with the share price surging 54% over the last 90 days as investors warm up to its growth story and attractive valuation. Even though the one-year total shareholder return remains negative, the longer-term three-year total shareholder return of 66% suggests the company has rewarded patient investors despite recent ups and downs.

If you’re on the lookout for fresh opportunities beyond retail, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

Given the strong momentum and analyst optimism, the key question now is whether American Eagle Outfitters is still trading below its true value or if the recent rally means future growth is already factored in. Is there still a buying opportunity here?

Most Popular Narrative: 3.7% Overvalued

Compared to the last close price, the consensus narrative sees American Eagle Outfitters trading a touch above its fair value. The current market enthusiasm is running ahead of what the core financial story supports, at least for now.

The analysts have a consensus price target of $15.167 for American Eagle Outfitters based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $21.5, and the most bearish reporting a price target of just $10.0.

Curious what big assumptions could tip the scales? This narrative relies on ambitious improvements in profit margins and earnings, along with a declining share count. The consensus builds its story around transformative growth drivers. Want to peek behind the curtain and uncover how they reach that fair value?

Result: Fair Value of $15.94 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent consumer uncertainty and the possibility of higher operating costs could quickly shift the outlook, putting pressure on both margins and earnings growth.

Find out about the key risks to this American Eagle Outfitters narrative.

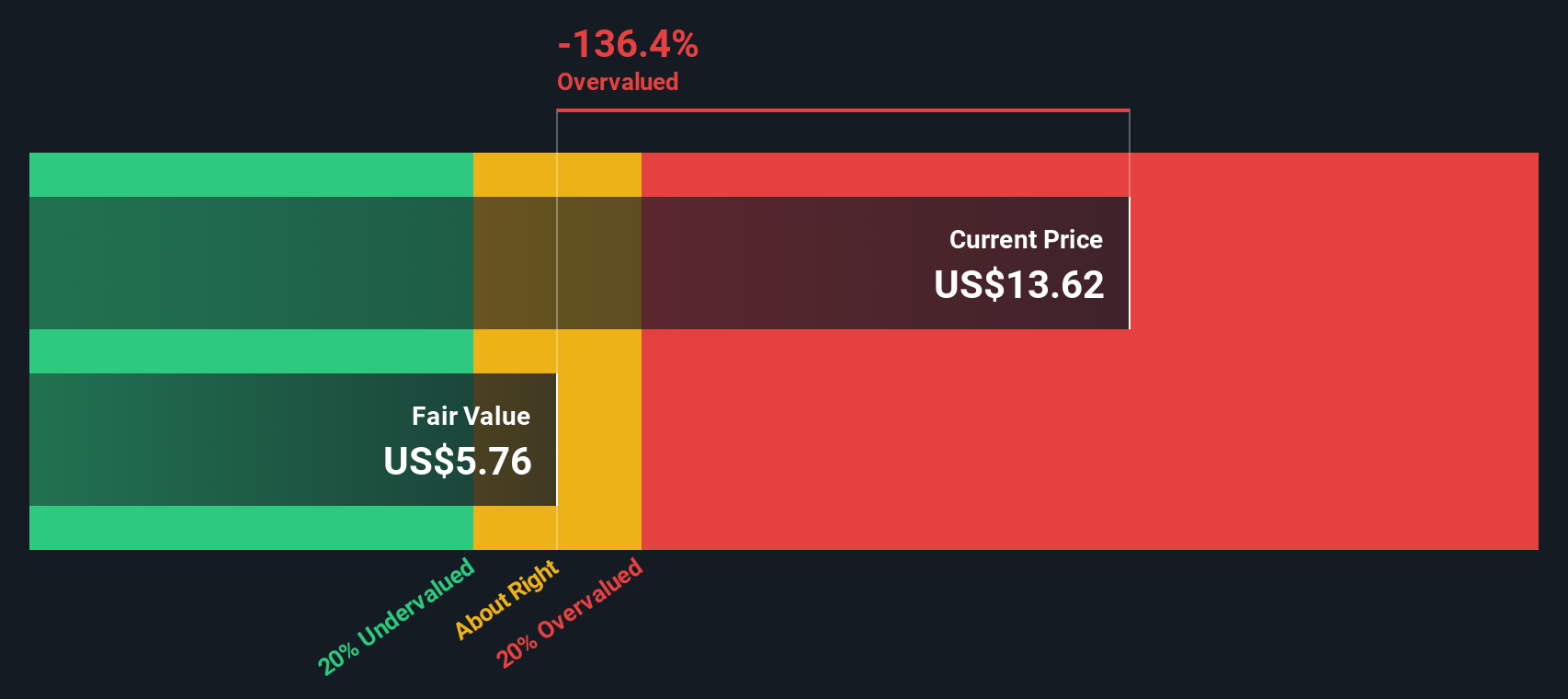

Another View: SWS DCF Model Signals Overvaluation

Looking at American Eagle Outfitters through the lens of the SWS DCF model, the stock tells a different story. Our DCF analysis estimates fair value at $10.55, which is well below the current share price. This suggests that investors may be pricing in more optimism than the underlying cash flows support. Could there be more risk ahead than it seems?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own American Eagle Outfitters Narrative

If you see things differently or want to dig into the numbers on your own, you can craft your own story for American Eagle Outfitters in just a few minutes. Do it your way

A great starting point for your American Eagle Outfitters research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Set yourself up for success by acting now. See what’s shaking up the market and get ahead of the next big trend before everyone else does.

- Uncover stocks with real potential by checking out these 834 undervalued stocks based on cash flows, which are priced below their cash flow value but still show solid fundamentals.

- Capitalize on monthly income opportunities and stability by browsing these 24 dividend stocks with yields > 3%, offering yields above 3%.

- Boost your portfolio’s growth prospects by tapping into these 26 AI penny stocks, featuring breakthroughs in artificial intelligence and automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AEO

American Eagle Outfitters

Operates as a multi-brand specialty retailer in the United States and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives