- United States

- /

- Specialty Stores

- /

- NYSE:AEO

A Look at American Eagle (AEO) Valuation Following Recent Share Price Rally

Reviewed by Simply Wall St

American Eagle Outfitters (AEO) shares have been on the move lately, gaining nearly 3% in the most recent trading session. Investors may be curious about what is driving the shift in momentum, especially with retail stocks in focus.

See our latest analysis for American Eagle Outfitters.

American Eagle Outfitters’ recent 15% one-month share price return and an impressive 57% gain over the past 90 days suggest that momentum is picking up, especially after a string of solid retail updates. Despite these short-term gains, the company’s longer-term performance shows a more modest 6% total shareholder return over the past year and a 32% return over three years. This indicates that while the rally has intensified lately, long-term investors have experienced steadier, gradual growth.

If you’re curious about other fast-moving stocks with strong growth trends, this could be the right moment to broaden your scope and discover fast growing stocks with high insider ownership

With shares trading well above the average analyst price target after a sharp rally, investors are left to wonder if American Eagle Outfitters is undervalued or if all the potential upside is already reflected in the price.

Most Popular Narrative: 16.5% Overvalued

American Eagle Outfitters’ consensus fair value, according to the most widely followed narrative, sits well below the latest closing price, raising questions about whether the recent surge may have pushed expectations too far.

The company is optimizing operations by investing strategically in their store fleet and digital platforms to support multi-channel growth, enhance speed, and agility in their supply chain. These efforts are expected to improve net margins through efficiency gains.

Wondering what ambitious margin moves and supply chain bets are baked in here? The financial roadmap behind this narrative goes far beyond basic earnings. See what assumptions are driving this bold call on value.

Result: Fair Value of $16.39 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing consumer uncertainty and the risk of higher tariffs remain key challenges. These factors could quickly shift sentiment despite recent momentum.

Find out about the key risks to this American Eagle Outfitters narrative.

Another View: What Do the Multiples Say?

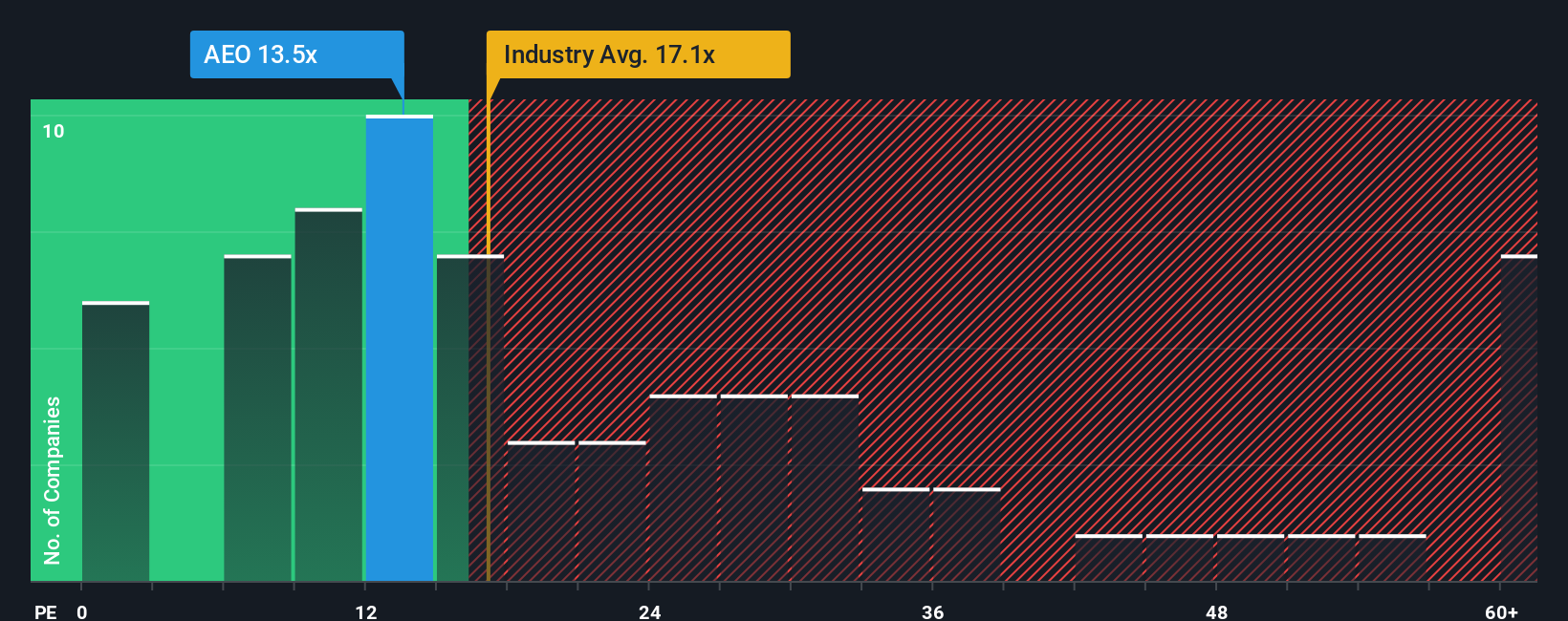

Switching perspectives, American Eagle Outfitters' price-to-earnings ratio of 16.4x currently sits below both its peer average (17x) and the US Specialty Retail industry average (18.2x). It is also well under the 22.5x fair ratio our analysis suggests the market could eventually move toward. This points to possible valuation upside, but does it compensate for the risks the future holds?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own American Eagle Outfitters Narrative

If you have different ideas or want to dig into the numbers yourself, you can easily craft your own narrative in just a few minutes with Do it your way.

A great starting point for your American Eagle Outfitters research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let the next big wave in the market pass you by. Put yourself in a position to spot unique opportunities and grow your portfolio with these powerful screening tools from Simply Wall Street.

- Boost your passive income by scanning for strong, reliable yields through these 14 dividend stocks with yields > 3%, offering returns above the market average.

- Capture the future of medicine by tapping into innovation leaders with these 30 healthcare AI stocks, driving AI breakthroughs in healthcare and biotech.

- Get ahead of the curve as blockchain transforms financial systems by investigating these 81 cryptocurrency and blockchain stocks, focused on cryptocurrency growth and fintech disruption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AEO

American Eagle Outfitters

Operates as a multi-brand specialty retailer in the United States and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success