- United States

- /

- Specialty Stores

- /

- NasdaqGS:WOOF

Petco Health and Wellness Company's (NASDAQ:WOOF) Returns On Capital Not Reflecting Well On The Business

What underlying fundamental trends can indicate that a company might be in decline? More often than not, we'll see a declining return on capital employed (ROCE) and a declining amount of capital employed. Ultimately this means that the company is earning less per dollar invested and on top of that, it's shrinking its base of capital employed. In light of that, from a first glance at Petco Health and Wellness Company (NASDAQ:WOOF), we've spotted some signs that it could be struggling, so let's investigate.

What Is Return On Capital Employed (ROCE)?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. Analysts use this formula to calculate it for Petco Health and Wellness Company:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.0099 = US$42m ÷ (US$5.4b - US$1.1b) (Based on the trailing twelve months to February 2024).

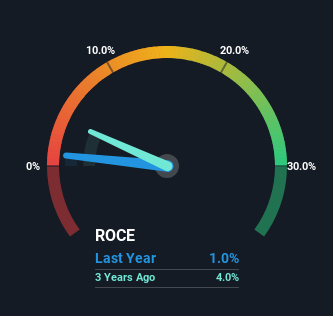

So, Petco Health and Wellness Company has an ROCE of 1.0%. In absolute terms, that's a low return and it also under-performs the Specialty Retail industry average of 14%.

Check out our latest analysis for Petco Health and Wellness Company

In the above chart we have measured Petco Health and Wellness Company's prior ROCE against its prior performance, but the future is arguably more important. If you'd like to see what analysts are forecasting going forward, you should check out our free analyst report for Petco Health and Wellness Company .

What Does the ROCE Trend For Petco Health and Wellness Company Tell Us?

There is reason to be cautious about Petco Health and Wellness Company, given the returns are trending downwards. Unfortunately the returns on capital have diminished from the 3.7% that they were earning five years ago. On top of that, it's worth noting that the amount of capital employed within the business has remained relatively steady. This combination can be indicative of a mature business that still has areas to deploy capital, but the returns received aren't as high due potentially to new competition or smaller margins. So because these trends aren't typically conducive to creating a multi-bagger, we wouldn't hold our breath on Petco Health and Wellness Company becoming one if things continue as they have.

The Key Takeaway

All in all, the lower returns from the same amount of capital employed aren't exactly signs of a compounding machine. This could explain why the stock has sunk a total of 91% in the last three years. That being the case, unless the underlying trends revert to a more positive trajectory, we'd consider looking elsewhere.

One more thing to note, we've identified 1 warning sign with Petco Health and Wellness Company and understanding this should be part of your investment process.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:WOOF

Petco Health and Wellness Company

Operates as a health and wellness company, focuses on enhancing the lives of pets, pet parents, and its Petco partners in the United States, Mexico, and Puerto Rico.

Fair value with moderate growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success