- United States

- /

- Retail Distributors

- /

- NasdaqGS:WEYS

Weyco Group (WEYS) Margin Miss Challenges Value-Focused Bull Narratives

Reviewed by Simply Wall St

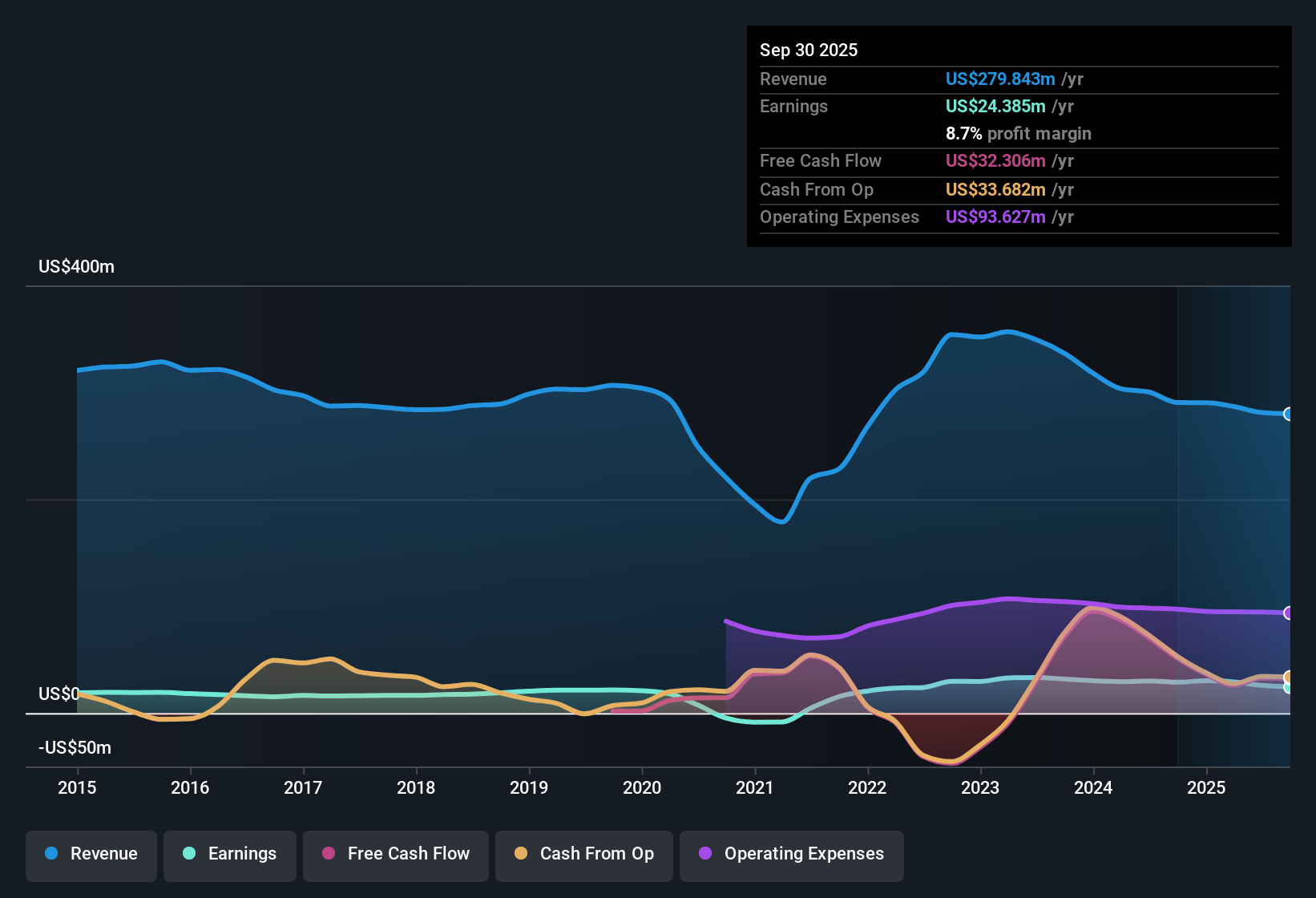

Weyco Group (WEYS) reported a net profit margin of 9.2% for the period, down from 10% last year, reflecting recent pressure on profitability. Despite this, the company stands out for its historically high earnings quality, with five-year annual earnings growth averaging a robust 31.5%. Its shares trade at $31.35, well below an estimated fair value of $90.59. Value-focused investors are likely to take note of its discounted price-to-earnings multiple and appealing dividend, although the latest dip in margins adds a note of caution to an otherwise strong track record.

See our full analysis for Weyco Group.Next, we will see how these financial results compare with the broader market narratives, highlighting where the consensus matches up and where it is about to be put to the test.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margin Contraction Overshadows Five-Year Growth

- The net profit margin slid to 9.2% from 10% last year, marking a reversal from Weyco Group’s stellar five-year average annual earnings growth of 31.5%.

- Despite the recent margin dip, the prevailing market view indicates that steady long-term growth and consistently high earnings quality continue to appeal to investors looking for resilience in the footwear sector.

- Growth at this pace over the past five years heavily supports optimism about the company’s core strength, especially when relative industry headwinds are considered.

- However, the latest contraction in profitability highlights the importance of watching for further operational or market-driven pressure moving forward.

Dividend and Value Stand Out Amid Sector Peers

- Weyco’s price-to-earnings ratio, at 11.5x, is a deep discount compared to peers (33.9x) and the global industry (18.2x). This supports the case for value-focused investors seeking both yield and upside potential.

- The prevailing market view acknowledges that this valuation gap, coupled with an attractive dividend, may draw investors who prioritize stable income and downside protection, even though margin pressure could limit near-term appreciation.

- Relative sector discount gives Weyco a cushion against volatility and provides opportunities for those willing to look past recent margin contraction.

- Without risks flagged in the filings, market watchers will be keen to see if reliable dividends compensate for elevated competitive and margin risks in the longer run.

DCF Fair Value Implies Major Upside Potential

- With shares trading at $31.35, well below the DCF fair value estimate of $90.59, Weyco’s current stock price suggests a significant disconnect between intrinsic value and market sentiment.

- The prevailing market view frames this as a potential opportunity for patient investors, as the gap between the discounted market price and underlying value could close if margins stabilize or sector sentiment improves.

- Investors attracted by a historically high earnings growth rate could see this valuation gap as a sign to accumulate shares ahead of a possible re-rating.

- Cautious participants may still demand evidence that recent margin pressure is temporary before bidding up the stock toward its estimated fair value.

See what the community is saying about Weyco Group

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Weyco Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Weyco Group's otherwise impressive growth track record is now challenged by shrinking profit margins, which could limit near-term upside and stability.

If consistent earnings and reliable results matter to you, use our stable growth stocks screener (2074 results) to find companies that have a stronger history of steady performance across different market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Weyco Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WEYS

Weyco Group

Designs, markets, and distributes footwear for men, women, and children in the United States, Canada, Australia, Asia, and South Africa.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives