- United States

- /

- Specialty Stores

- /

- NasdaqGS:ULTA

Ulta Beauty (ULTA): Exploring Valuation as Global Expansion Begins With Middle East Entry and New US Brand Launch

Reviewed by Simply Wall St

Ulta Beauty (ULTA) is taking a big step beyond US borders this week, officially opening its first store in Kuwait on November 7. This Middle East debut is part of the company's ongoing global expansion push.

See our latest analysis for Ulta Beauty.

Ulta Beauty’s recent debut in Kuwait comes shortly after its US partnership with amika, putting fresh momentum behind its global and domestic growth strategies. The company’s 20.65% year-to-date share price return signals growing optimism around its international expansion and evolving brand lineup, while its 34.40% total shareholder return over the past year speaks to solid long-term value creation.

If these moves have you thinking broader, this could be the perfect time to discover fast growing stocks with high insider ownership.

With shares up more than 20% this year and the stock trading roughly 11% below its average analyst price target, the question now is whether Ulta Beauty is trading at a bargain or if the market already anticipates future growth.

Most Popular Narrative: 9.9% Undervalued

Compared to the last close at $517.79, the most widely followed narrative points to a fair value well above today's share price. The debate centers on whether Ulta's big bets on global expansion and digital transformation can support this optimistic outlook.

Enhanced investment in digital infrastructure, including new personalization and automation tools, as well as omnichannel fulfillment with half of e-commerce orders being fulfilled by stores, supports increased e-commerce penetration and customer retention, directly driving growth in revenue and improved operating leverage.

Want to see how strategic tech investments and omnichannel magic could turbocharge Ulta’s future profits? The narrative’s calculations weave together hidden variables and bullish expansion assumptions, but which forecasts truly move the needle? Uncover the playbook that shapes this eye-catching price target.

Result: Fair Value of $574.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising costs for physical stores and the loss of the Target partnership could challenge Ulta's earnings growth if new initiatives underperform.

Find out about the key risks to this Ulta Beauty narrative.

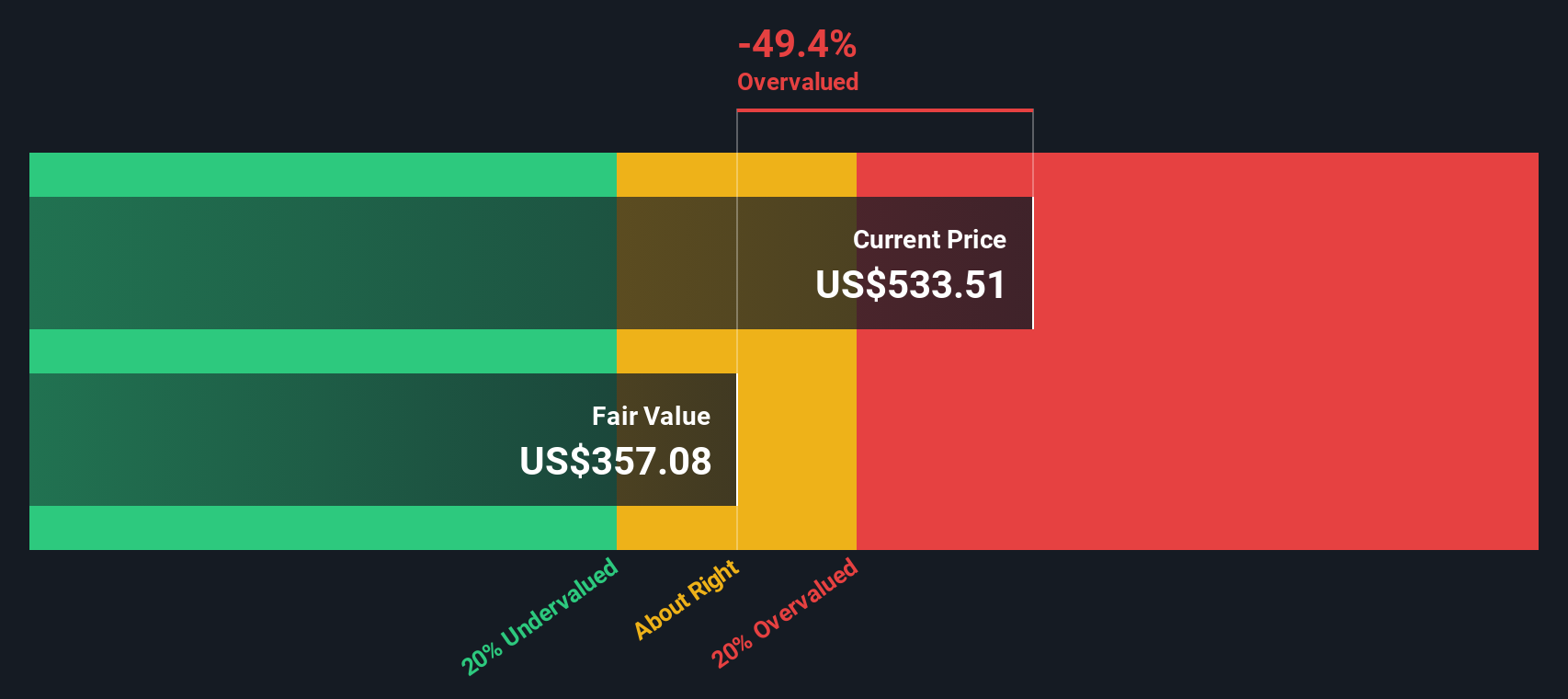

Another View: Watch Out for the DCF

While analyst targets point to Ulta Beauty being undervalued, the SWS DCF model tells a different story. By estimating fair value based on future cash flows, our DCF places Ulta’s worth around $362.91 per share, which is significantly below today’s price. Is the market too optimistic, or does the DCF model overlook Ulta’s real-world momentum?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ulta Beauty for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 874 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ulta Beauty Narrative

If you’re the kind who likes to dig into the details or chart your own path, it takes just a few minutes to shape a narrative that fits your view. Do it your way

Prefer to form your own view? Our platform makes it easy to explore a stock's fundamentals and create your own narrative in minutes.

Looking for More Investment Ideas?

Unlock your next winning strategy by searching for stocks with fast growth, sector innovation, or attractive yields. These standouts could reshape your portfolio.

- Uncover the potential of market disruptors by checking out these 3589 penny stocks with strong financials that combine growth and strong financials.

- Capitalize on breakthrough innovation and future tech by zeroing in on these 25 AI penny stocks reshaping the artificial intelligence landscape.

- Take advantage of steady returns sooner by seeing these 16 dividend stocks with yields > 3% and build a portfolio with healthy income potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ULTA

Ulta Beauty

Operates as a specialty beauty retailer in the United States, Mexico, and Kuwait.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives