- United States

- /

- Specialty Stores

- /

- NasdaqGS:ULTA

How Ulta Beauty’s (ULTA) Kuwait Launch with Alshaya Group Could Shape Its Global Growth Strategy

Reviewed by Sasha Jovanovic

- Ulta Beauty recently opened its first store in the Middle East at The Avenues in Kuwait through a partnership with Alshaya Group, offering a curated selection of over 300 brands and tailored services for the regional market.

- This move marks a material step in Ulta Beauty's international ambitions, as the company extends its reach with additional stores planned for the United Arab Emirates and Saudi Arabia in early 2026.

- We'll explore how Ulta Beauty's international debut with Alshaya Group could shape the company's global growth investment narrative.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Ulta Beauty Investment Narrative Recap

For Ulta Beauty shareholders, the core belief centers on the company’s ability to expand internationally while maintaining its reputation for exclusive brands, strong loyalty programs, and omnichannel experiences. The recent opening of Ulta’s first Middle East store in Kuwait is a meaningful entry point to new markets and supports its long-term global growth catalyst. However, it does not materially change the company’s most important short-term catalyst, continued US revenue growth and omnichannel execution, or the biggest risk, which remains margin pressure from elevated operating costs and store investments.

Among Ulta’s latest announcements, the entry into Mexico through new store openings is highly relevant in context with the Kuwait launch. This demonstrates Ulta’s ongoing commitment to international expansion as it establishes a presence in underpenetrated but promising markets, aligning with its catalyst of widening geographic reach and adding new revenue streams. Together, these expansions give investors new growth angles, while the pace of margin recovery continues to be closely watched.

On the other hand, investors should not overlook that ongoing cost pressures tied to global expansion and higher SG&A could...

Read the full narrative on Ulta Beauty (it's free!)

Ulta Beauty's narrative projects $13.8 billion revenue and $1.3 billion earnings by 2028. This requires 5.9% yearly revenue growth and a $0.1 billion earnings increase from $1.2 billion.

Uncover how Ulta Beauty's forecasts yield a $574.57 fair value, a 11% upside to its current price.

Exploring Other Perspectives

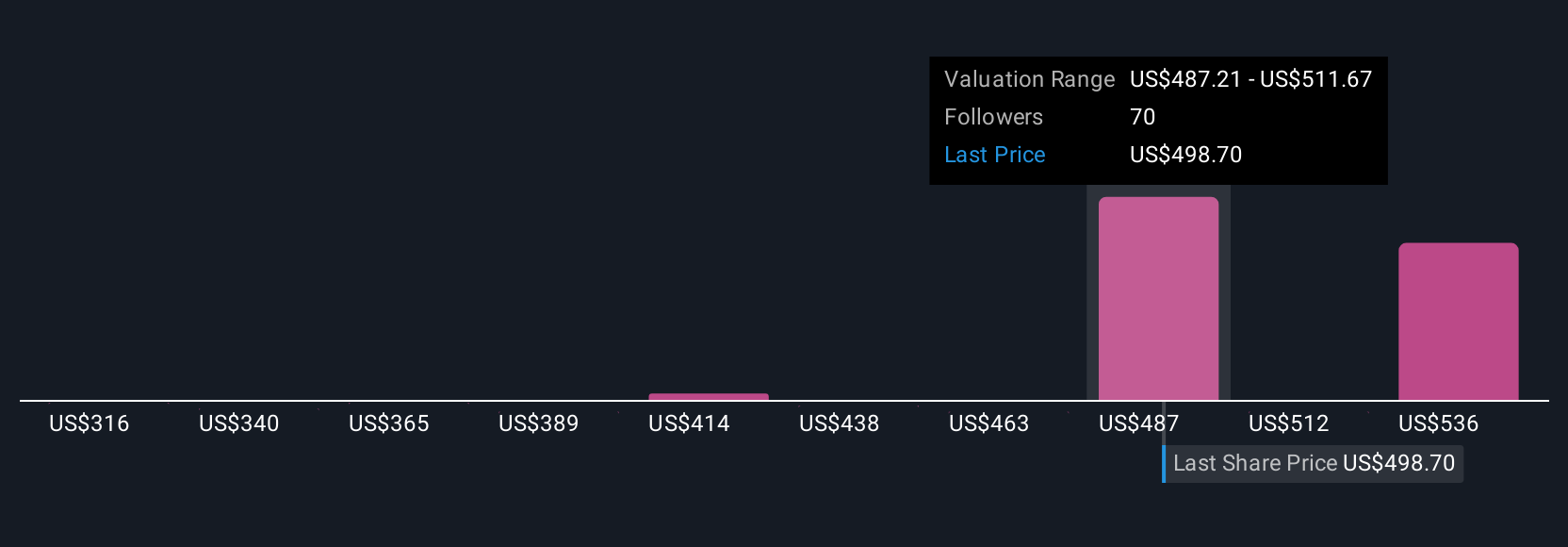

Across 9 fair value estimates from the Simply Wall St Community, opinions range from US$362.91 to US$574.57 per share. While many see upside in Ulta’s international ambitions, careful attention to the risk of rising costs and margin pressure will shape how these targets play out over time.

Explore 9 other fair value estimates on Ulta Beauty - why the stock might be worth 30% less than the current price!

Build Your Own Ulta Beauty Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- Our free Ulta Beauty research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ulta Beauty's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ULTA

Ulta Beauty

Operates as a specialty beauty retailer in the United States, Mexico, and Kuwait.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives