- United States

- /

- Specialty Stores

- /

- NasdaqGS:REAL

Can Analyst Optimism on Authentication Tech Redefine RealReal’s (REAL) Edge in Luxury Resale?

Reviewed by Sasha Jovanovic

- In recent days, several Wall Street analysts have upgraded their outlook on The RealReal, expressing optimism about the company’s revenue growth and market positioning ahead of its upcoming September-quarter earnings report. This renewed analyst confidence comes as RealReal continues to expand its reach in the luxury resale market, underpinned by expectations for higher consignment and direct revenue streams.

- Much of the analyst optimism is rooted in RealReal's ability to leverage authentication technologies and expand its inventory sources, which could help drive sustained growth despite ongoing losses.

- With analyst upgrades highlighting RealReal’s differentiated authentication platform, we’ll explore how this development may influence the company’s investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

RealReal Investment Narrative Recap

To be a shareholder of The RealReal, you need to believe in the ongoing shift toward authenticated, sustainable luxury resale, supported by technology and operational improvements that could translate higher consumer demand into steady long-term growth. The recent wave of analyst upgrades signals confidence ahead of earnings, but does not materially change the fact that near-term results depend on the company balancing inventory growth and operational efficiency against the persistent risk of margin compression from shifting product mixes. One particularly relevant recent event is Keybanc’s upgrade of The RealReal, which came with an increased price target. This highlights how current analyst enthusiasm is closely tied to optimism around upcoming quarterly earnings, as well as the company’s ongoing efforts to cement its leadership in the luxury resale segment by leveraging technology, expanding its platform, and refining consignment models. However, investors should also be aware that if average commission rates decrease faster than expected as more high-ticket items enter the mix...

Read the full narrative on RealReal (it's free!)

RealReal's narrative projects $842.8 million revenue and $40.0 million earnings by 2028. This requires 9.8% yearly revenue growth and a $75.4 million increase in earnings from -$35.4 million today.

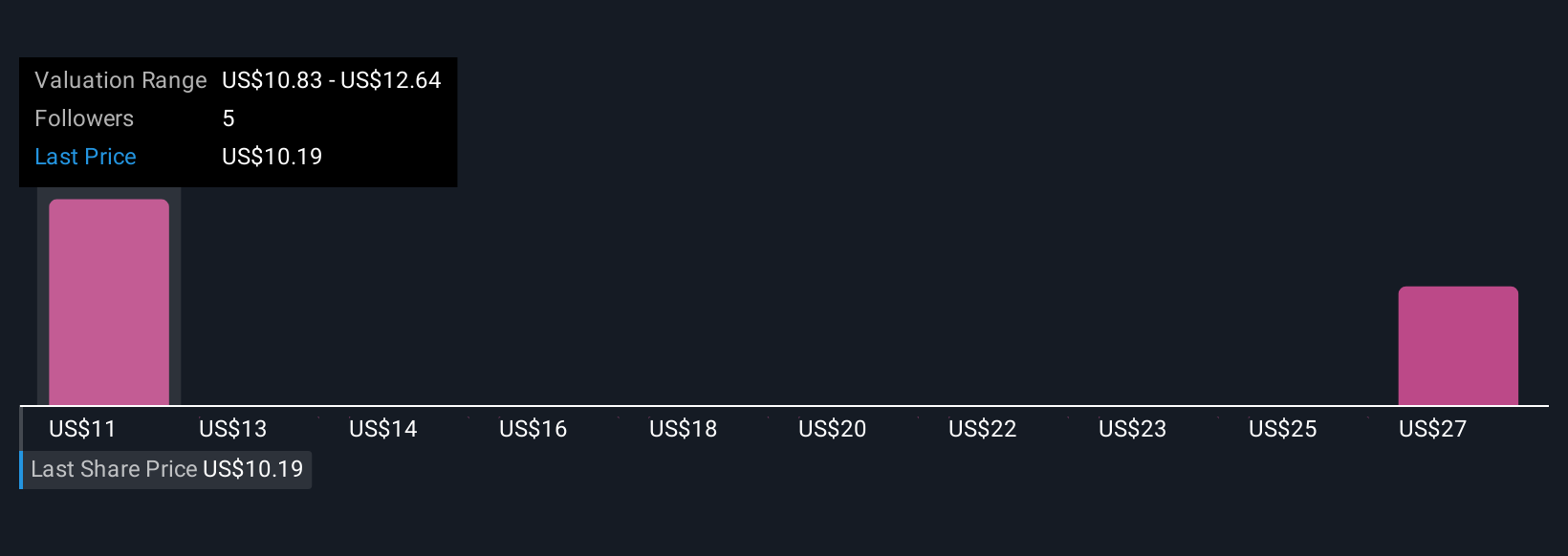

Uncover how RealReal's forecasts yield a $12.14 fair value, a 10% upside to its current price.

Exploring Other Perspectives

With fair value opinions from the Simply Wall St Community ranging from US$4.50 to US$12.14 across two estimates, views on The RealReal’s worth remain split. Shifting commission rates remain a key issue that could influence the company’s ability to convert top-line growth into improved profitability, so be sure to review how others are interpreting this challenge.

Explore 2 other fair value estimates on RealReal - why the stock might be worth less than half the current price!

Build Your Own RealReal Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your RealReal research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free RealReal research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate RealReal's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:REAL

RealReal

Operates an online marketplace for resale luxury goods worldwide.

Slight risk with worrying balance sheet.

Similar Companies

Market Insights

Community Narratives