- United States

- /

- Specialty Stores

- /

- NasdaqGS:REAL

A Fresh Look at RealReal (REAL) Valuation After Analyst Upgrades Highlight Luxury Resale Growth Potential

Reviewed by Simply Wall St

Several analysts have recently upgraded RealReal (REAL), highlighting its market leadership in luxury resale. This signals growing optimism as investors look ahead to the next earnings report. The upgrades come amid ongoing debate over earnings strength.

See our latest analysis for RealReal.

RealReal’s share price has had a whirlwind year, with a recent 16.3% jump over the past month and a standout 67.5% share price return in the past 90 days signaling renewed momentum. While it has dealt with bouts of volatility linked to wider market swings, the long-term story is remarkable. Total shareholder return soared 192% over the past year and an impressive 570% across three years, even though it remains below its IPO level over five years. Analyst upgrades and better-than-expected quarterly results suggest investors may be warming up to RealReal’s growth potential as attention turns to its upcoming earnings report.

If the action around RealReal has you looking for your next idea, it could be the perfect moment to explore fast growing stocks with high insider ownership.

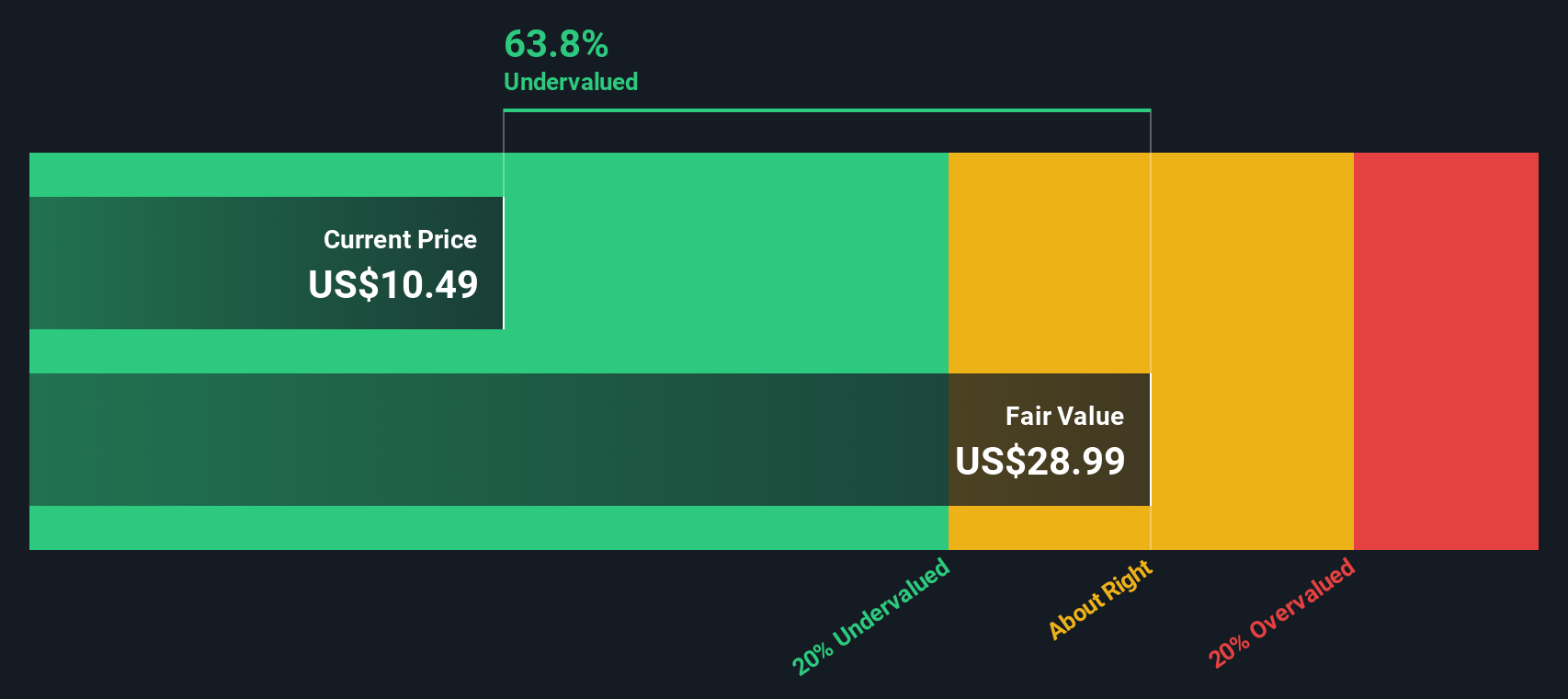

But as analyst optimism pushes shares higher, the key question now is whether RealReal remains undervalued based on its prospects, or if the market has already factored future growth into its current price. Could there still be a true buying opportunity?

Most Popular Narrative: 9.5% Undervalued

Compared to its last close price of $10.99, the most widely tracked narrative sees RealReal’s fair value at $12.14. This estimate is shaped by improving revenue outlook and lower perceived risk, offering a case for further upside, even after recent strong gains.

"Continuous investment in AI-driven automation (Athena and other initiatives) is delivering ongoing reductions in processing costs per unit and streamlining authentication, enabling scalable operational efficiencies that lower unit costs and support sustained margin expansion and improved EBITDA."

Want to know how RealReal’s AI investments and operational upgrades could fuel an ambitious long-term trajectory? There’s a surprising assumption about future profitability and a bold profit multiple that may catch even seasoned investors off guard. Find out the numbers behind this bullish take in the full narrative.

Result: Fair Value of $12.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower supply growth or delays in AI efficiency gains could quickly disrupt this upbeat outlook and put pressure on RealReal’s long-term profit ambitions.

Find out about the key risks to this RealReal narrative.

Another View: What Do the Numbers Say?

Taking a different angle, our SWS DCF model suggests RealReal may, in fact, be trading above its estimated fair value. The fair value stands at $4.48 a share. This model takes cash flows and discount rates into account and raises the question of whether recent analyst optimism is fully justified. Could market excitement be running ahead of fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own RealReal Narrative

If these perspectives spark your curiosity or you want to dig into the data yourself, you can craft a unique take in just a few minutes. Do it your way.

A great starting point for your RealReal research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Ready for More Smart Investment Opportunities?

Don’t miss your chance to spot the next breakout winner. Use the Simply Wall Street Screener to uncover bold opportunities and sharpen your investing edge.

- Unlock the hidden potential of undervalued companies by checking out these 876 undervalued stocks based on cash flows, where pricing power is combined with resilient financials.

- Tap into the explosive rise of artificial intelligence as you browse these 25 AI penny stocks, featuring pioneering businesses driving innovation across industries.

- Capture consistent income by seeking out these 16 dividend stocks with yields > 3% with generous yields and the strength to remain steady through market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:REAL

RealReal

Operates an online marketplace for resale luxury goods worldwide.

Slight risk with worrying balance sheet.

Similar Companies

Market Insights

Community Narratives