- United States

- /

- Retail Distributors

- /

- NasdaqGS:POOL

Is Pool (POOL) Undervalued? A Fresh Look at Its Current Valuation

Reviewed by Kshitija Bhandaru

See our latest analysis for Pool.

POOL’s recent share price return paints a clear picture, sliding 9.2% over the last month and bringing its one-year total shareholder return to a loss of 19.5%. Momentum has steadily faded as investors react to industry headwinds and adjust their expectations for the company’s growth potential.

If POOL’s shifting momentum has you rethinking your approach, now could be an ideal time to expand your search and discover fast growing stocks with high insider ownership

With shares lagging and fundamentals showing modest growth, is Pool currently undervalued in the market, or are investors already factoring in every ounce of future upside? The key question remains: is there a genuine buying opportunity, or has the outlook been fully priced in?

Most Popular Narrative: 13% Undervalued

Pool’s fair value, as estimated by the most widely followed narrative, stands meaningfully above its last close price. This creates a compelling context for the in-depth expectations driving the current valuation perspective.

“Sustained migration to high-growth Sun Belt regions like Florida and Arizona, with POOLCORP increasing local branches and franchise presence, positions the company to capture outsized revenue and market share gains as demographic shifts boost both new installations and recurring maintenance activity.”

What’s behind the premium? There’s more to the story than population growth. Uncover which performance drivers and numerical assumptions fuel the thesis for Pool’s current price tag. Analysts are building their case around major market trends. Dive in to see what could be keeping this stock on investors’ watchlists.

Result: Fair Value of $333.27 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high interest rates and limited new pool construction could quickly undermine optimistic growth projections for Pool. This may challenge the current bullish narrative.

Find out about the key risks to this Pool narrative.

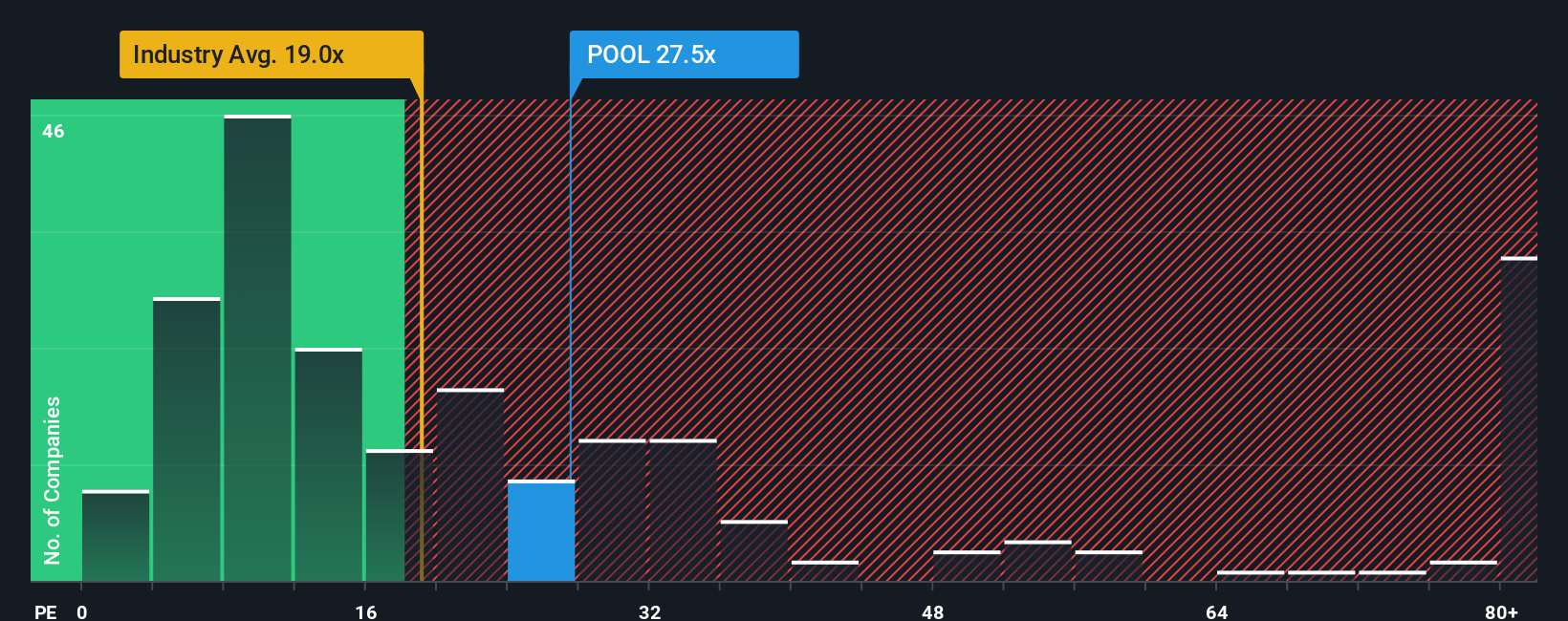

Another View: Price Ratios Signal Expensive Territory

Looking from a different angle, Pool’s current price-to-earnings ratio sits at 26.5x, which is well above both the global industry average of 19.1x and its peer group average of 19.5x. Compared to its fair ratio of 15.8x, this premium could point to elevated valuation risk if market sentiment shifts. Does the optimism baked in leave enough room for upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Pool Narrative

If you find yourself unconvinced by these takes or prefer a hands-on approach to the numbers, you can craft your own perspective on the company in just a few minutes. Do it your way.

A great starting point for your Pool research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Take action now and uncover unique opportunities beyond Pool. Don’t let the next great stock pass you by. These handpicked selections could make all the difference in your portfolio:

- Supercharge your returns by tapping into these 898 undervalued stocks based on cash flows packed with hidden gems trading well below their true potential.

- Capture tomorrow’s technology breakthroughs first by browsing these 24 AI penny stocks driving innovation in artificial intelligence.

- Secure reliable income for your future. Start with these 19 dividend stocks with yields > 3% offering strong yields and proven dividend track records.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:POOL

Pool

Distributes swimming pool supplies, equipment, related leisure, irrigation, and landscape maintenance products in the United States and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives