- United States

- /

- Retail Distributors

- /

- NasdaqGS:POOL

Assessing Pool Corp (POOL) Valuation Following Q3 Results and Outlook for Recovery

Reviewed by Simply Wall St

Pool (POOL) attracted attention after releasing its third-quarter 2025 results, which highlighted steady sales and net income in a challenging economic environment. The company pointed to consistent demand for maintenance and renovation equipment as a key driver.

See our latest analysis for Pool.

Despite steady operating results and the company reaffirming its full-year guidance and dividend, momentum in Pool’s stock has faded lately. The year-to-date share price return is -19.8%, and the total shareholder return over the past year is down 25.4%. Shares have trended lower as investors adjust expectations for growth and valuation in a tougher environment, even though the company continues to demonstrate consistent demand in its core maintenance segments.

If you're weighing what else is moving in the broader market, now is a perfect moment to broaden your investing universe and discover fast growing stocks with high insider ownership

With shares down sharply this year but analyst price targets still pointing higher, the question now is whether Pool is offering real value at current levels or if the market has already accounted for its future prospects.

Most Popular Narrative: 19.9% Undervalued

With Pool’s last close at $267.06 and the most popular narrative suggesting a fair value of $333.27, current trading levels look meaningfully discounted against consensus projections. This narrative shines a spotlight on the company’s core value drivers, preparing the ground for what is seen as a major catalyst for its future prospects.

Growing consumer emphasis on home-based leisure and wellness is maintaining structurally elevated demand for pools and related services, driving resilient recurring revenue for maintenance and enhancements, which should support top-line stability and growth even during new construction lulls.

Want to know what assumptions justify this surprising upside? Behind the calculation are bold forecasts for profit margins and shrinking share count. Find out which growth levers and aggressive numbers are behind that valuation jump. Tap in to uncover what justifies this premium.

Result: Fair Value of $333.27 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high interest rates and lingering housing market weakness could keep Pool’s growth below forecasts, which may challenge the bullish narrative for now.

Find out about the key risks to this Pool narrative.

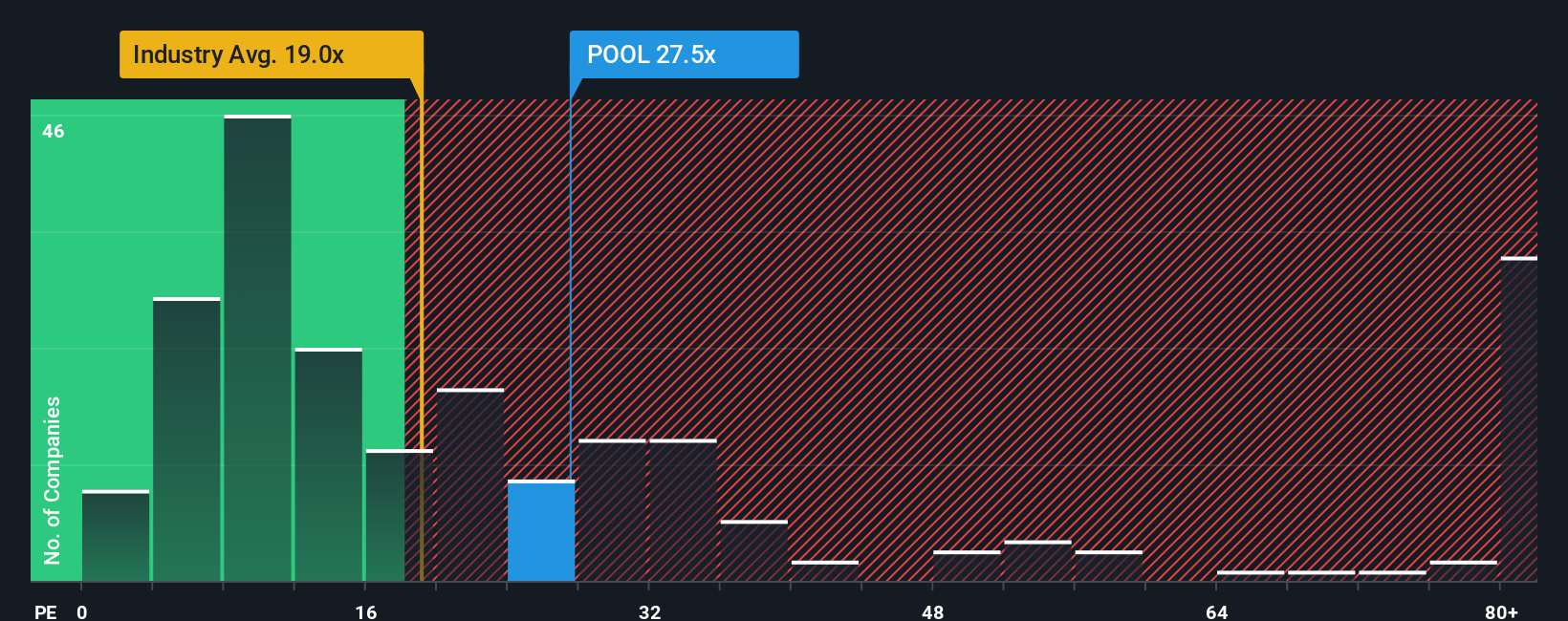

Another View: The Market Multiple Test

Looking beyond analyst models, Pool is currently trading at a price-to-earnings ratio of 24.3. This is noticeably higher than the industry average of 18.1 and its peers’ 19.9, and well above the fair ratio of 15.6. Such a premium suggests that investors may be taking on extra valuation risk. Could this high multiple reflect optimistic expectations, or is there reason for caution here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Pool Narrative

If you see Pool’s story differently or want to draw your own conclusions, you can quickly build your own perspective from the numbers in just a few minutes. Do it your way

A great starting point for your Pool research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Actionable Investment Ideas?

Don’t let your momentum stop with Pool. Take control of your portfolio and gain an edge by screening for tomorrow’s standouts using these select strategies.

- Capture true value by targeting under-loved stocks with strong cash flows using these 832 undervalued stocks based on cash flows and find candidates often missed by the crowd.

- Boost your passive income goals and growth potential by scanning these 22 dividend stocks with yields > 3% offering reliable yields above 3% and robust fundamentals.

- Get ahead of tech transformations sooner by seeking out next-generation breakthroughs through these 26 AI penny stocks leading the charge in artificial intelligence innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:POOL

Pool

Distributes swimming pool supplies, equipment, related leisure, irrigation, and landscape maintenance products in the United States and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives