- United States

- /

- Specialty Stores

- /

- NasdaqCM:NEGG

Will Newegg's (NEGG) SHEIN Partnership Redefine Its Appeal to Trend-Conscious Gamers?

Reviewed by Sasha Jovanovic

- On November 11, 2025, SHEIN announced a new partnership with Newegg, launching a curated Newegg storefront on SHEIN’s U.S. platform featuring over 1,000 technology products tailored to gamers who value both style and functionality.

- This collaboration blends fashion and technology, highlighting the rising influence of women in gaming and the growing importance of personal style in tech purchases.

- Given the emphasis on attracting trend-conscious gamers, we’ll examine how the SHEIN partnership could broaden Newegg’s investment narrative and customer reach.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Newegg Commerce's Investment Narrative?

To believe in Newegg Commerce as a shareholder, you have to trust the company's ambition to transform itself from a pure-play electronics retailer into a broader lifestyle brand. The new partnership with SHEIN is a swing at tapping into next-gen customers who see tech as an extension of personal style, particularly among women gamers who are an increasingly influential segment. With the SHEIN storefront and other recent moves like the new gamer arena and enhanced community tools, Newegg has more touch points than ever. Yet this bold pivot comes amid ongoing losses, a volatile share price, and a pricing that appears expensive versus peers. If the SHEIN deal succeeds in driving sustainable order volume and customer stickiness, it could reshape the short-term narrative for the better. Otherwise, the loss risk and valuation disconnect may stay front of mind. But the struggle to achieve consistent profitability is harder to ignore than ever.

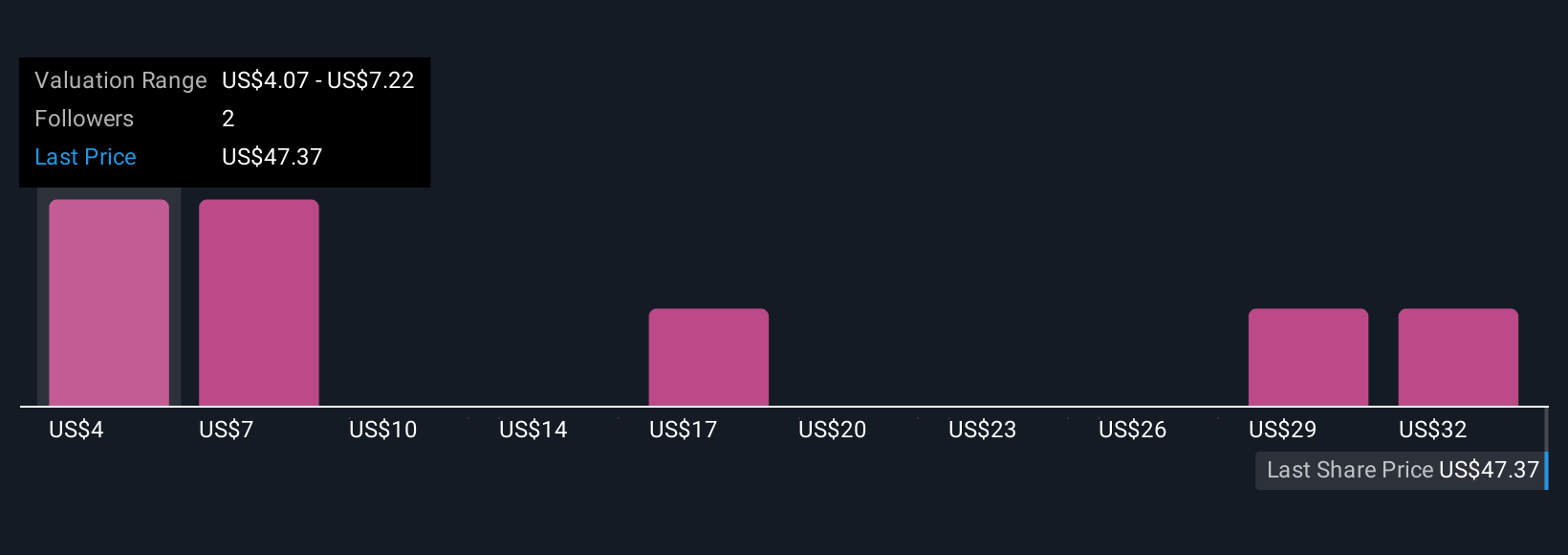

Newegg Commerce's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 6 other fair value estimates on Newegg Commerce - why the stock might be worth less than half the current price!

Build Your Own Newegg Commerce Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Newegg Commerce research is our analysis highlighting 2 important warning signs that could impact your investment decision.

- Our free Newegg Commerce research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Newegg Commerce's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Newegg Commerce might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NEGG

Newegg Commerce

Operates as an electronics-focused e-retailer in the United States, Canada, and internationally.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives