- United States

- /

- Specialty Stores

- /

- NasdaqCM:NEGG

Newegg (NEGG) Valuation in Focus as SHEIN Partnership Expands Reach to Fashion-Forward Tech Shoppers

Reviewed by Simply Wall St

Newegg Commerce (NEGG) has teamed up with fashion giant SHEIN to launch a dedicated online storefront aimed at U.S. shoppers. The collaboration blends technology and style for a new wave of consumers.

See our latest analysis for Newegg Commerce.

Newegg’s big move with SHEIN comes amid a tidal shift in its stock momentum. The 1-month share price return stands at an eye-catching 59.8%, and its total shareholder return over the past year has exploded by more than 500%. While there has been plenty of volatility, this latest upswing suggests investors are starting to see fresh growth potential as the company works to broaden its reach.

If you’re interested in spotting fast-growth stories as they develop, now is a great time to expand your search and discover fast growing stocks with high insider ownership

With shares jumping nearly 60% in a month, investors are left wondering if Newegg is still flying under the radar or if the recent rally has already factored in the company’s next chapter of growth.

Price-to-Sales of 1.1x: Is it justified?

Newegg Commerce is trading at a price-to-sales ratio of 1.1x, which is significantly higher than both the U.S. Specialty Retail industry average of 0.4x and the peer average of 1.1x. At the last close of $70.73, shares are at a premium relative to the broader sector.

The price-to-sales ratio reflects how much investors are willing to pay for a dollar of revenue. It is a useful yardstick for retail and e-commerce businesses where profits may be volatile or negative, providing a quick snapshot of market expectations for revenue generation.

Right now, Newegg's premium price-to-sales ratio suggests that the market anticipates robust sales expansion or that there is something unique about its business model attracting this higher valuation. However, the company is unprofitable, and its losses have increased over the last five years. Without clear signs of a turnaround or revenue acceleration, such a high multiple could signal the stock is priced for perfection relative to peers.

Given the industry multiple is far lower and Newegg's own performance hasn't demonstrated outsized growth, the market is currently placing a steep premium on the stock. Whether this is sustainable will hinge on upcoming growth and execution.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Sales of 1.1x (OVERVALUED)

However, risks remain if profit trends do not improve or if the stock’s valuation proves too optimistic, especially given ongoing net losses and market volatility.

Find out about the key risks to this Newegg Commerce narrative.

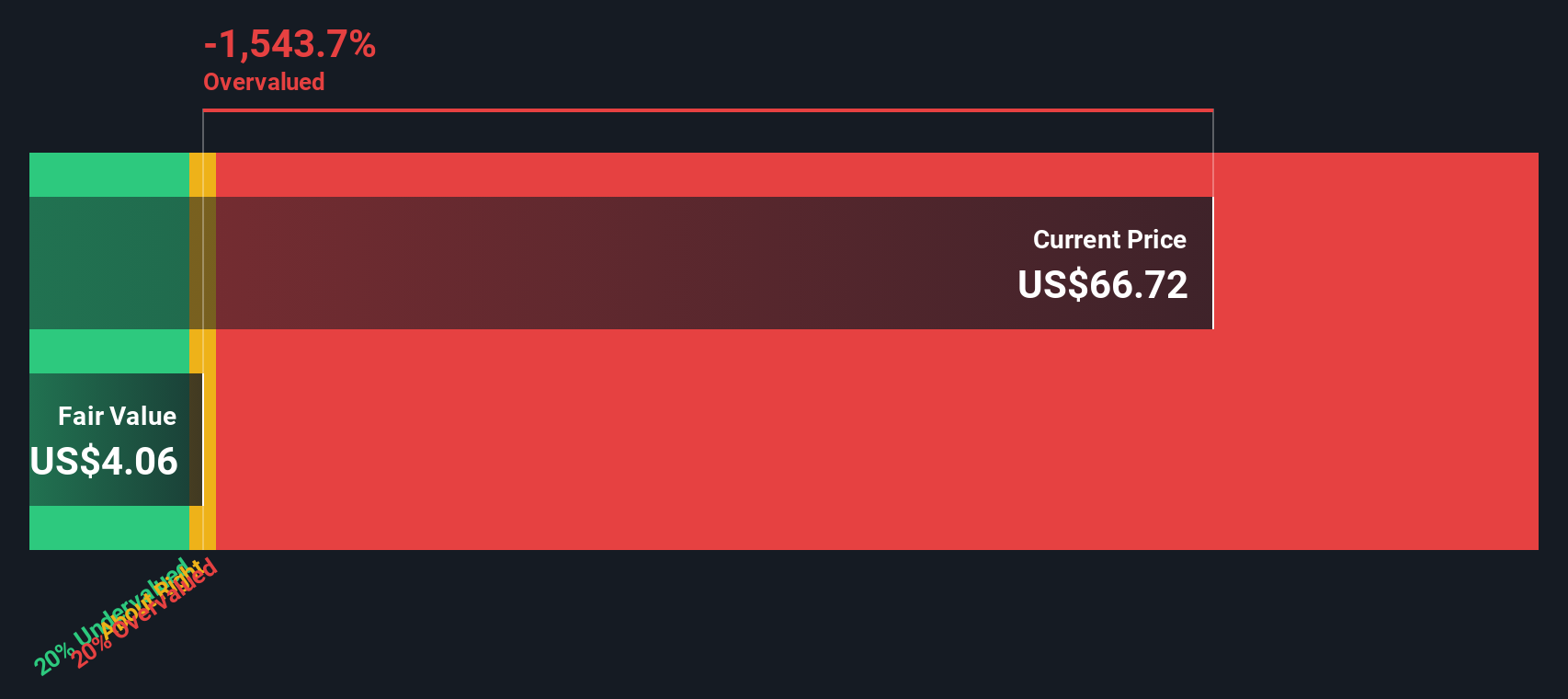

Another View: Discounted Cash Flow Signals Overvaluation

For a second opinion, consider our DCF model, which estimates fair value based on long-term cash flows. According to this approach, Newegg shares are trading far above their DCF fair value ($70.73 vs. $4.18). This deep disconnect raises questions about whether the market is too optimistic or if there are other factors at play.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Newegg Commerce for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 924 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Newegg Commerce Narrative

Keep in mind, if this perspective doesn't resonate or you're eager to dig deeper on your own terms, you can easily construct your own narrative in just a few minutes. Do it your way

A great starting point for your Newegg Commerce research is our analysis highlighting 2 important warning signs that could impact your investment decision.

Looking for more smart investment ideas?

Momentum like Newegg's doesn’t come around every day. Broaden your opportunity set and take the lead by scouting these unique stock ideas today:

- Capture potential market upswings by searching for overlooked value in these 924 undervalued stocks based on cash flows that are still trading at attractive prices.

- Tap into the future of medicine and innovation by checking out these 30 healthcare AI stocks making transformative breakthroughs with artificial intelligence.

- Unlock a stream of passive income by seeing which companies offer compelling yields with these 17 dividend stocks with yields > 3% for your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Newegg Commerce might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NEGG

Newegg Commerce

Operates as an electronics-focused e-retailer in the United States, Canada, and internationally.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives