Stock Analysis

- United States

- /

- Healthtech

- /

- NasdaqCM:MEDS

Earnings Release: Here's Why Analysts Cut Their Trxade Group, Inc. (NASDAQ:MEDS) Price Target To US$10.00

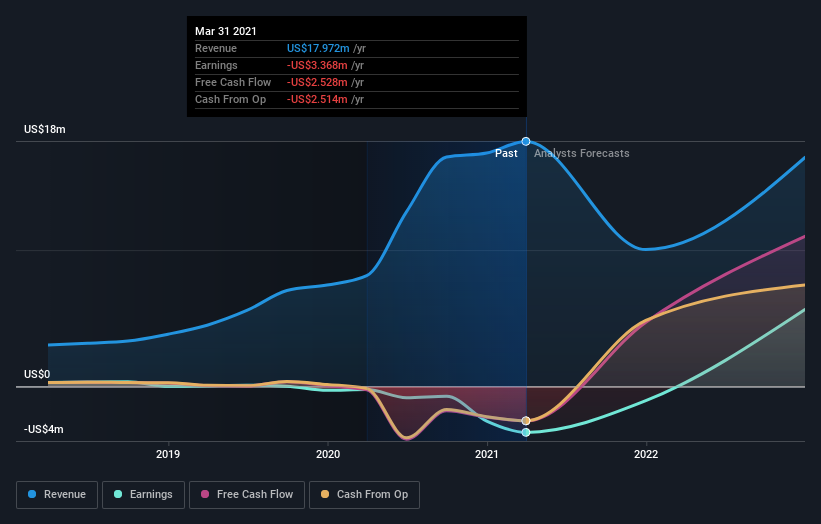

As you might know, Trxade Group, Inc. (NASDAQ:MEDS) recently reported its quarterly numbers. Revenues came in 39% better than analyst models expected, at US$3.1m, although statutory losses ballooned 45% to US$0.08, which is much worse than what was forecast. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. We thought readers would find it interesting to see the analysts latest (statutory) post-earnings forecasts for next year.

View our latest analysis for Trxade Group

Taking into account the latest results, the three analysts covering Trxade Group provided consensus estimates of US$10.0m revenue in 2021, which would reflect a stressful 44% decline on its sales over the past 12 months. The loss per share is expected to greatly reduce in the near future, narrowing 68% to US$0.14. Before this latest report, the consensus had been expecting revenues of US$10.0m and US$0.14 per share in losses.

As a result, it's unexpected to see that the consensus price target fell 13% to US$10.00, with the analysts seemingly becoming more concerned about ongoing losses, despite making no major changes to their forecasts. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. The most optimistic Trxade Group analyst has a price target of US$15.00 per share, while the most pessimistic values it at US$9.50. There are definitely some different views on the stock, but the range of estimates is not wide enough as to imply that the situation is unforecastable, in our view.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. We would highlight that sales are expected to reverse, with a forecast 54% annualised revenue decline to the end of 2021. That is a notable change from historical growth of 47% over the last five years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 17% per year. It's pretty clear that Trxade Group's revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The most obvious conclusion is that the analysts made no changes to their forecasts for a loss next year. On the plus side, there were no major changes to revenue estimates; although forecasts imply revenues will perform worse than the wider industry. Furthermore, the analysts also cut their price targets, suggesting that the latest news has led to greater pessimism about the intrinsic value of the business.

With that in mind, we wouldn't be too quick to come to a conclusion on Trxade Group. Long-term earnings power is much more important than next year's profits. We have forecasts for Trxade Group going out to 2022, and you can see them free on our platform here.

Plus, you should also learn about the 3 warning signs we've spotted with Trxade Group .

When trading Trxade Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether TRxADE HEALTH is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:MEDS

TRxADE HEALTH

Operates as a health services information technology (IT) company in the United States.

Medium with adequate balance sheet.