- United States

- /

- Specialty Stores

- /

- NasdaqGS:EYE

National Vision Holdings (EYE): Evaluating Valuation Following Recent Share Price Surge

Reviewed by Kshitija Bhandaru

National Vision Holdings (EYE) has caught some attention lately, with shares moving higher over the past month. The company's stock is up nearly 19% during that period, sparking renewed interest among investors.

See our latest analysis for National Vision Holdings.

National Vision Holdings’ share price surge this month builds on a sharp rebound that has taken the stock well above where it started the year, thanks to renewed optimism about the company’s trajectory. While momentum is clearly building in the short term, it is worth noting that the past three and five years have delivered negative total shareholder returns. This recent rally stands out against a backdrop of long-term underperformance.

If you’re interested in finding more compelling opportunities beyond retail, this is a great time to broaden your perspective and discover fast growing stocks with high insider ownership

The question investors now face is whether this recent surge leaves National Vision Holdings trading at an appealing value, or if the market is already factoring in all the company’s expected growth. Could the stock still offer upside?

Most Popular Narrative: 5.5% Undervalued

With the narrative setting a fair value at $29.15, National Vision Holdings’ last close at $27.54 puts the stock slightly below target, suggesting a modest upside if its forecasts prove accurate. This price gap hinges on positive changes in the company’s outlook for revenue growth and profit margins.

“Investments in CRM, omnichannel marketing, and personalization enabled by the new Adobe platform are expected to improve customer targeting, retention, and conversion, particularly in higher income and mid-funnel cohorts, which should translate into increased customer lifetime value and improved comp sales growth.”

Want to uncover what’s driving the latest fair value? Hint: the narrative is betting on key financial improvements and bold growth in earnings and margins. What projections are at the heart of this valuation story, and could they really lift National Vision further? Unlock the full breakdown inside the complete narrative.

Result: Fair Value of $29.15 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition from online eyewear brands and continued reliance on managed care could challenge National Vision's growth ambitions and put pressure on future margins.

Find out about the key risks to this National Vision Holdings narrative.

Another View: How Does Its Sales Multiple Stack Up?

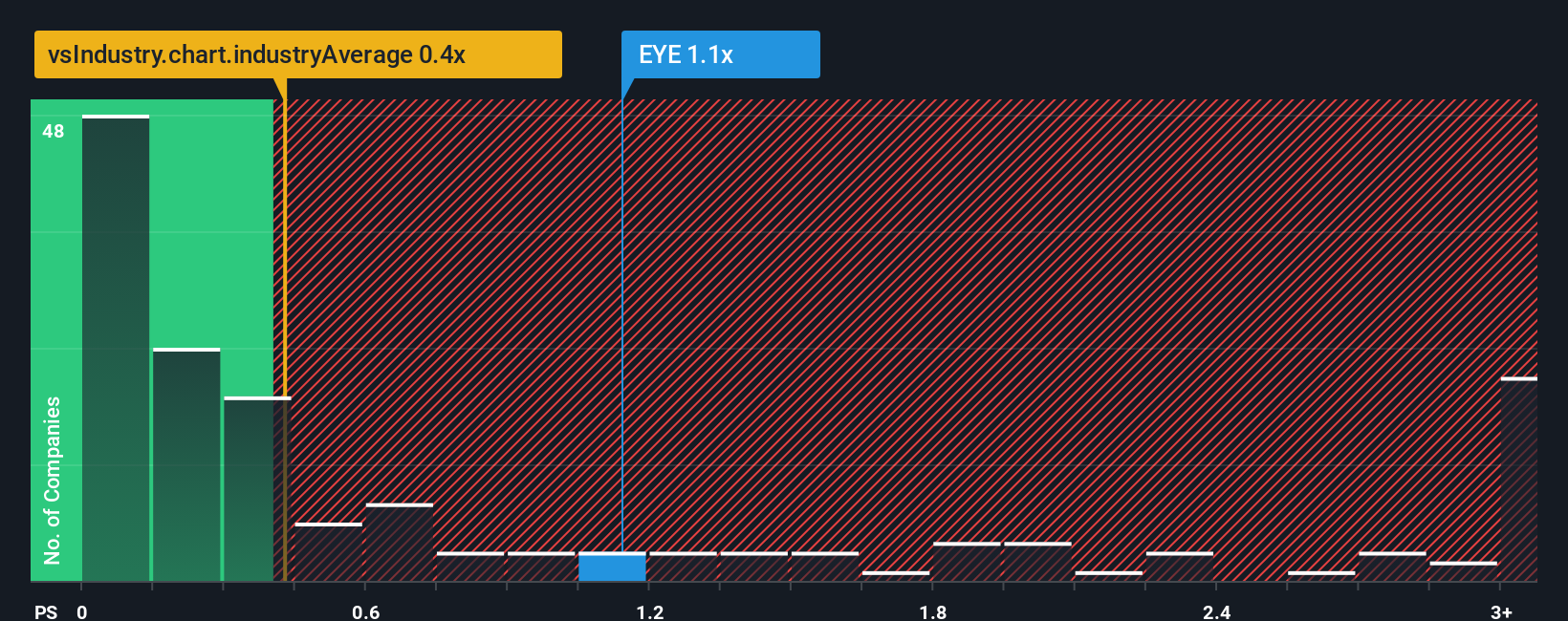

Looking at National Vision Holdings from a sales perspective adds a different angle. Its price-to-sales ratio sits at 1.2x, above the estimated fair ratio of 1.1x and far higher than the US Specialty Retail industry average of 0.5x. This highlights a premium valuation, raising the question of whether it reflects real potential or increased risk if growth slows.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own National Vision Holdings Narrative

If you would rather rely on your own research or challenge these conclusions, crafting your own take is quick and insightful. Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding National Vision Holdings.

Looking for More Smart Investment Ideas?

Your next winning move could be just a click away. Reach beyond the obvious and seize new possibilities with hand-picked opportunities that match your strategy.

- Maximize your passive income potential with steady payers by checking out these 19 dividend stocks with yields > 3%, which offers high yields and resilient balance sheets.

- Tap into tomorrow’s healthcare breakthroughs by exploring these 32 healthcare AI stocks, which is poised to revolutionize diagnostics and personalized medicine with artificial intelligence.

- Accelerate your portfolio’s growth with undervalued gems unlocking upside. Start by scanning these 887 undervalued stocks based on cash flows, reflecting strong fundamentals and compelling valuations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Vision Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EYE

National Vision Holdings

Through its subsidiaries, operates as an optical retailer in the United States.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives