- United States

- /

- Retail Distributors

- /

- NasdaqGM:EDUC

Will Educational Development (NASDAQ:EDUC) Repeat Its Return Growth Of The Past?

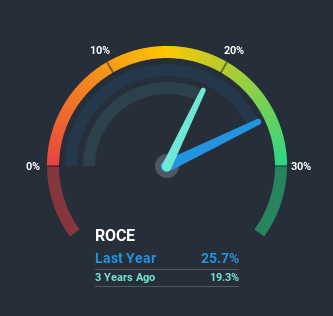

What are the early trends we should look for to identify a stock that could multiply in value over the long term? Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. Speaking of which, we noticed some great changes in Educational Development's (NASDAQ:EDUC) returns on capital, so let's have a look.

Return On Capital Employed (ROCE): What is it?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. To calculate this metric for Educational Development, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.26 = US$12m ÷ (US$85m - US$38m) (Based on the trailing twelve months to August 2020).

Therefore, Educational Development has an ROCE of 26%. While that is an outstanding return, the rest of the Retail Distributors industry generates similar returns, on average.

Check out our latest analysis for Educational Development

Historical performance is a great place to start when researching a stock so above you can see the gauge for Educational Development's ROCE against it's prior returns. If you want to delve into the historical earnings, revenue and cash flow of Educational Development, check out these free graphs here.

The Trend Of ROCE

Educational Development is displaying some positive trends. The data shows that returns on capital have increased substantially over the last five years to 26%. The amount of capital employed has increased too, by 267%. This can indicate that there's plenty of opportunities to invest capital internally and at ever higher rates, a combination that's common among multi-baggers.

On a side note, Educational Development's current liabilities are still rather high at 45% of total assets. This effectively means that suppliers (or short-term creditors) are funding a large portion of the business, so just be aware that this can introduce some elements of risk. Ideally we'd like to see this reduce as that would mean fewer obligations bearing risks.The Bottom Line

To sum it up, Educational Development has proven it can reinvest in the business and generate higher returns on that capital employed, which is terrific. And with the stock having performed exceptionally well over the last five years, these patterns are being accounted for by investors. So given the stock has proven it has promising trends, it's worth researching the company further to see if these trends are likely to persist.

If you want to continue researching Educational Development, you might be interested to know about the 1 warning sign that our analysis has discovered.

If you'd like to see other companies earning high returns, check out our free list of companies earning high returns with solid balance sheets here.

If you’re looking to trade Educational Development, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Educational Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqGM:EDUC

Educational Development

Distributes children's books, educational toys and games, and related products in the United States.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

DroneShield: Structural Tailwind, Execution Still the Real Test

ISRG Riding the Lightning

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks