- United States

- /

- Retail Distributors

- /

- NasdaqGM:EDUC

Should You Take Comfort From Insider Transactions At Educational Development Corporation (NASDAQ:EDUC)?

We've lost count of how many times insiders have accumulated shares in a company that goes on to improve markedly. On the other hand, we'd be remiss not to mention that insider sales have been known to precede tough periods for a business. So shareholders might well want to know whether insiders have been buying or selling shares in Educational Development Corporation (NASDAQ:EDUC).

What Is Insider Selling?

It's quite normal to see company insiders, such as board members, trading in company stock, from time to time. However, such insiders must disclose their trading activities, and not trade on inside information.

We would never suggest that investors should base their decisions solely on what the directors of a company have been doing. But logic dictates you should pay some attention to whether insiders are buying or selling shares. For example, a Columbia University study found that 'insiders are more likely to engage in open market purchases of their own company’s stock when the firm is about to reveal new agreements with customers and suppliers'.

Check out our latest analysis for Educational Development

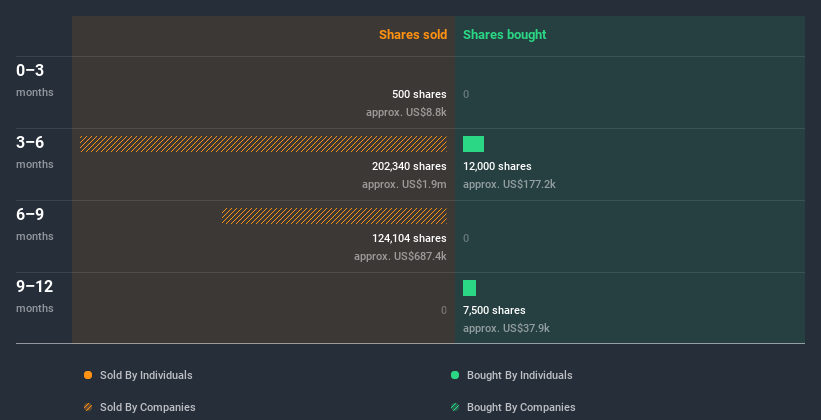

The Last 12 Months Of Insider Transactions At Educational Development

In the last twelve months, the biggest single purchase by an insider was when Independent Director Joshua Peters bought US$177k worth of shares at a price of US$14.77 per share. That implies that an insider found the current price of US$15.71 per share to be enticing. Of course they may have changed their mind. But this suggests they are optimistic. While we always like to see insider buying, it's less meaningful if the purchases were made at much lower prices, as the opportunity they saw may have passed. The good news for Educational Development share holders is that insiders were buying at near the current price.

In the last twelve months insiders purchased 19.50k shares for US$213k. But they sold 500.00 shares for US$8.8k. In the last twelve months there was more buying than selling by Educational Development insiders. The average buy price was around US$10.92. We don't deny that it is nice to see insiders buying stock in the company. However, you should keep in mind that they bought when the share price was meaningfully below today's levels. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. By clicking on the graph below, you can see the precise details of each insider transaction!

Educational Development is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Are Educational Development Insiders Buying Or Selling?

We have seen a bit of insider selling at Educational Development, over the last three months. Independent Director Ronald McDaniel sold just US$8.8k worth of shares in that time. It's not great to see insider selling, nor the lack of recent buyers. But the volume sold is so low that it really doesn't bother us.

Insider Ownership

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. A high insider ownership often makes company leadership more mindful of shareholder interests. It appears that Educational Development insiders own 24% of the company, worth about US$32m. This level of insider ownership is good but just short of being particularly stand-out. It certainly does suggest a reasonable degree of alignment.

What Might The Insider Transactions At Educational Development Tell Us?

We did not see any insider buying in the last three months, but we did see selling. However, the sales are not big enough to concern us at all. However, our analysis of transactions over the last year is heartening. Insiders do have a stake in Educational Development and their transactions don't cause us concern. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Educational Development. Case in point: We've spotted 1 warning sign for Educational Development you should be aware of.

But note: Educational Development may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you’re looking to trade Educational Development, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Educational Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:EDUC

Educational Development

Distributes children's books, educational toys and games, and related products in the United States.

Good value with slight risk.

Similar Companies

Market Insights

Community Narratives