- United States

- /

- Retail Distributors

- /

- NasdaqGM:EDUC

Is Educational Development (NASDAQ:EDUC) Using Too Much Debt?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Educational Development Corporation (NASDAQ:EDUC) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Educational Development

What Is Educational Development's Debt?

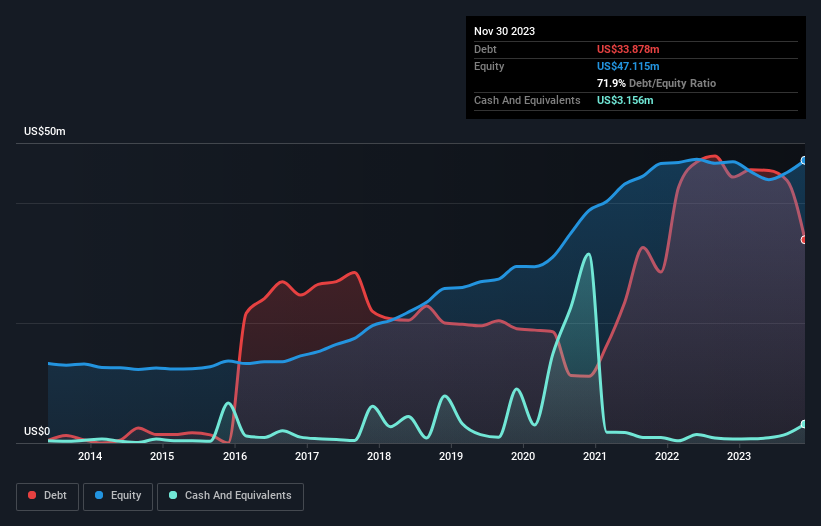

The image below, which you can click on for greater detail, shows that Educational Development had debt of US$33.9m at the end of November 2023, a reduction from US$44.3m over a year. However, because it has a cash reserve of US$3.16m, its net debt is less, at about US$30.7m.

A Look At Educational Development's Liabilities

The latest balance sheet data shows that Educational Development had liabilities of US$20.2m due within a year, and liabilities of US$28.2m falling due after that. Offsetting these obligations, it had cash of US$3.16m as well as receivables valued at US$1.85m due within 12 months. So its liabilities total US$43.4m more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the US$15.1m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. At the end of the day, Educational Development would probably need a major re-capitalization if its creditors were to demand repayment. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Educational Development will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Educational Development had a loss before interest and tax, and actually shrunk its revenue by 41%, to US$57m. That makes us nervous, to say the least.

Caveat Emptor

Not only did Educational Development's revenue slip over the last twelve months, but it also produced negative earnings before interest and tax (EBIT). Its EBIT loss was a whopping US$6.3m. Combining this information with the significant liabilities we already touched on makes us very hesitant about this stock, to say the least. Of course, it may be able to improve its situation with a bit of luck and good execution. However, we note that trailing twelve month EBIT is worse than the free cash flow of US$9.7m and the profit of US$241k. So there is arguably potential that the company is going to turn things around. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. We've identified 5 warning signs with Educational Development (at least 1 which is a bit unpleasant) , and understanding them should be part of your investment process.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Valuation is complex, but we're here to simplify it.

Discover if Educational Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:EDUC

Educational Development

Distributes children's books, educational toys and games, and related products in the United States.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

ISRG Riding the Lightning

Duolingo (DUOL): The AI Learning Architect – Trading Profits for a 100M User Vision

Dycom Industries (DY): The Broadband Backbone – Scaling the Nation’s Fiber and AI Expansion

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks