- United States

- /

- Specialty Stores

- /

- NasdaqGS:ASO

How Investors May Respond To Academy Sports and Outdoors (ASO) Completing 24-Store Opening Initiative and Community Push

Reviewed by Sasha Jovanovic

- Academy Sports + Outdoors recently opened five new stores across Arkansas, Texas, and Indiana, rounding out a total of 24 new locations launched in fiscal 2025 and creating more than 1,400 jobs.

- Each grand opening included targeted community initiatives and donations, underscoring the company's emphasis on local engagement alongside retail expansion.

- We'll examine how the completion of an ambitious store rollout and community investments may reshape Academy Sports and Outdoors' investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Academy Sports and Outdoors Investment Narrative Recap

For shareholders in Academy Sports and Outdoors, the core belief centers on the company's ability to drive top-line growth through physical expansion into high-potential markets, while managing profitability in the face of cost pressures and an increasingly competitive promotional environment. The recent news of 24 store openings signals continued confidence in this strategy but does not meaningfully change the near-term focus for investors, the key catalyst remains new store productivity, whereas risks tied to margin compression and uneven customer demand persist.

Among recent announcements, the company reaffirmed its raised fiscal 2026 sales and earnings guidance in September, which frames the significance of the new store rollouts for growth expectations. However, despite the visible progress in expanding presence, margin headwinds and pricing dynamics remain central to the broader story.

By contrast, investors should be aware that as the promotional environment heats up, margin pressures may accelerate even for...

Read the full narrative on Academy Sports and Outdoors (it's free!)

Academy Sports and Outdoors is projected to reach $7.2 billion in revenue and $460.3 million in earnings by 2028. This outlook assumes annual revenue growth of 6.6% and an earnings increase of $89.4 million from current earnings of $370.9 million.

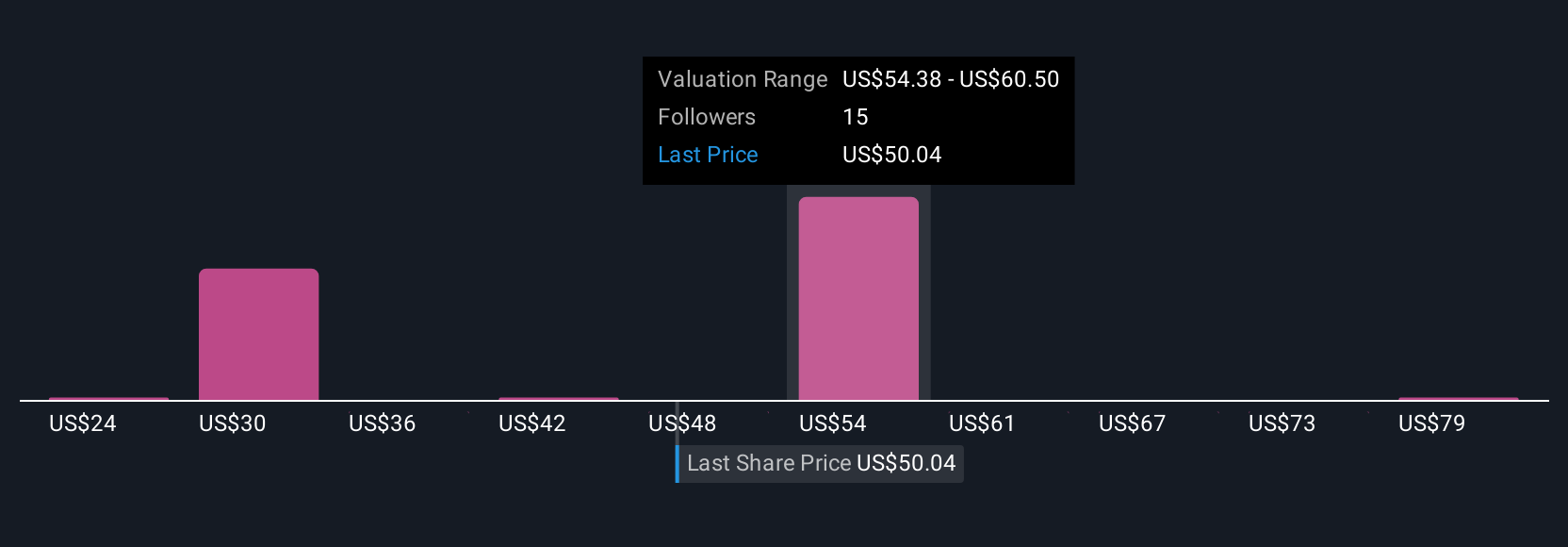

Uncover how Academy Sports and Outdoors' forecasts yield a $57.50 fair value, a 30% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community fair value estimates for Academy Sports and Outdoors range from US$23.75 to US$67.69 across four investor analyses. While growth ambitions are clear, sharper focus on pricing pressures highlights potential volatility in future profitability, compare these perspectives to deepen your own view.

Explore 4 other fair value estimates on Academy Sports and Outdoors - why the stock might be worth as much as 53% more than the current price!

Build Your Own Academy Sports and Outdoors Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Academy Sports and Outdoors research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Academy Sports and Outdoors research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Academy Sports and Outdoors' overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ASO

Academy Sports and Outdoors

Through its subsidiaries, operates as a sporting goods and outdoor recreational retailer in the United States.

Very undervalued with excellent balance sheet.

Market Insights

Community Narratives