- United States

- /

- Specialty Stores

- /

- NasdaqGS:ASO

A Look at Academy Sports and Outdoors (ASO) Valuation After Barclays Spotlights Expansion Plans and Competitive Risks

Reviewed by Kshitija Bhandaru

Barclays’ recent initiation of coverage on Academy Sports and Outdoors (ASO) put the spotlight on the company’s national growth ambitions and private label strategy. The report also highlighted several hurdles for investors to consider.

See our latest analysis for Academy Sports and Outdoors.

Academy Sports and Outdoors has been drawing renewed market focus after Barclays’ coverage highlighted both its ambitious expansion plans and operational risks. Following earlier swings on earnings results and analyst calls, the stock’s momentum has cooled, with a one-year total shareholder return of around zero. The business continues to invest in growth and efficiency for the long haul.

If you’re weighing options beyond the headlines, now could be a smart time to broaden your search and discover fast growing stocks with high insider ownership

The recent mix of cautious analyst ratings and ambitious company targets leaves investors with a key question: Is Academy Sports and Outdoors at an attractive entry point, or is the market already factoring in the road ahead?

Most Popular Narrative: 6% Undervalued

With Academy Sports and Outdoors trading at $53.85, the most widely followed narrative sets fair value at $57.50, implying a modest upside. The gap between today’s price and this consensus view revolves around optimistic assumptions for growth and margins in the years ahead.

“Analysts are assuming Academy Sports and Outdoors's revenue will grow by 6.6% annually over the next 3 years. Analysts assume that profit margins will increase from 6.2% today to 6.4% in 3 years time.”

What bold forecasts are fueling this higher price target? Buried in the model are some head-turning projections for margin expansion and top-line growth. These numbers may surprise even seasoned retail investors. Want to know which big-leap assumptions actually drive the story? Discover how those future earnings and sales estimates set this fair value above market.

Result: Fair Value of $57.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing cost pressures and heavy reliance on higher-income customers could challenge the upbeat outlook if economic or competitive conditions change unexpectedly.

Find out about the key risks to this Academy Sports and Outdoors narrative.

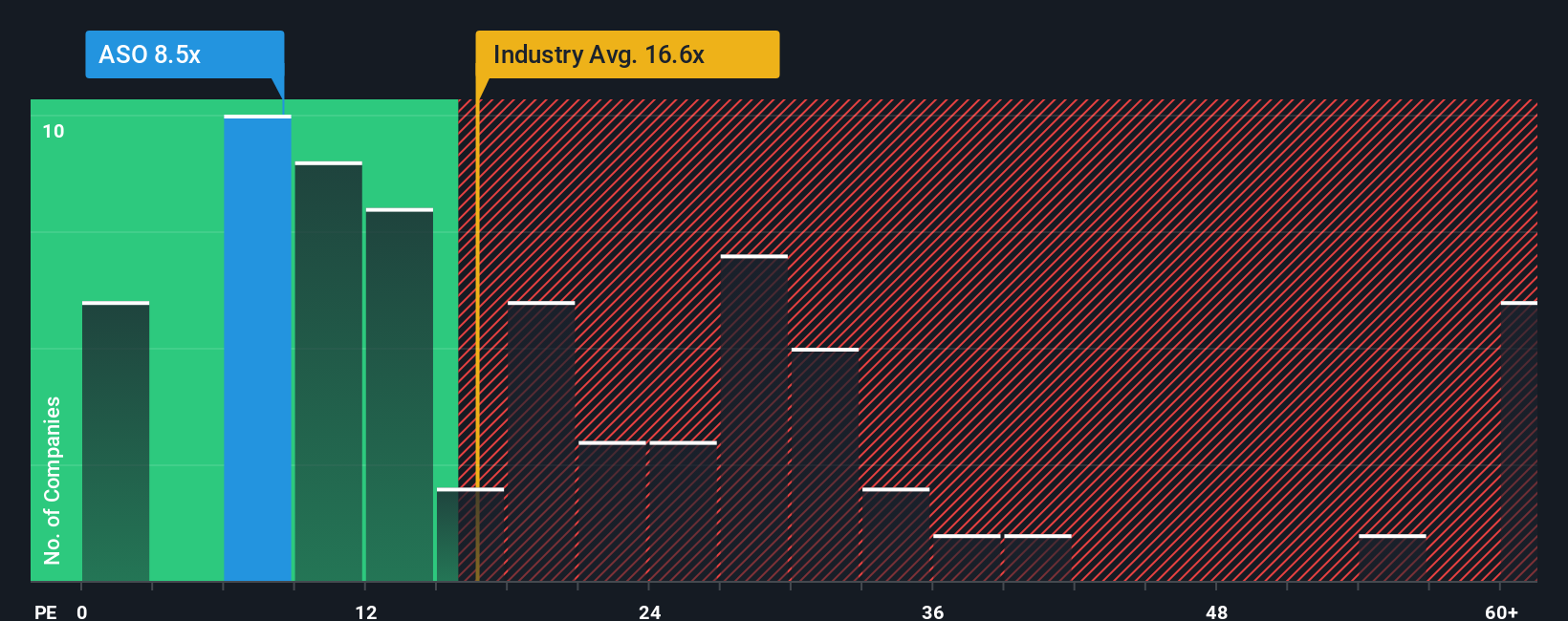

Another Perspective: Market Comparisons

Looking from a different angle, the company’s earnings multiple sits at just 9.7x, well below both the US Specialty Retail industry average of 17.2x and a peer average of 32.5x. The fair ratio signals a potential move toward 15.9x, suggesting the market may be underestimating Academy’s value. But does this discount point to a real opportunity, or reflect doubts about the path ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Academy Sports and Outdoors for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Academy Sports and Outdoors Narrative

If you have your own vision for how Academy’s story should play out, or want to dig through the numbers firsthand, you can assemble a custom narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Academy Sports and Outdoors.

Looking for more investment ideas?

Steer your portfolio toward tomorrow’s opportunities by checking out stock picks tailored to your interests and goals. Don’t stand still while others get ahead.

- Capture solid income streams by checking out these 19 dividend stocks with yields > 3%, which offers yields above 3% so your money keeps working for you.

- Spot game-changing innovations by tracking these 24 AI penny stocks, which are at the forefront of artificial intelligence transformation and technology leadership.

- Turn undervalued potential into real gains by reviewing these 896 undervalued stocks based on cash flows to see which stocks look most attractive based on their cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ASO

Academy Sports and Outdoors

Through its subsidiaries, operates as a sporting goods and outdoor recreational retailer in the United States.

Very undervalued with excellent balance sheet.

Market Insights

Community Narratives