- United States

- /

- Retail Distributors

- /

- NasdaqCM:AENT

Is Alliance Entertainment Holding (NASDAQ:AENT) A Risky Investment?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Alliance Entertainment Holding Corporation (NASDAQ:AENT) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

What Is Alliance Entertainment Holding's Debt?

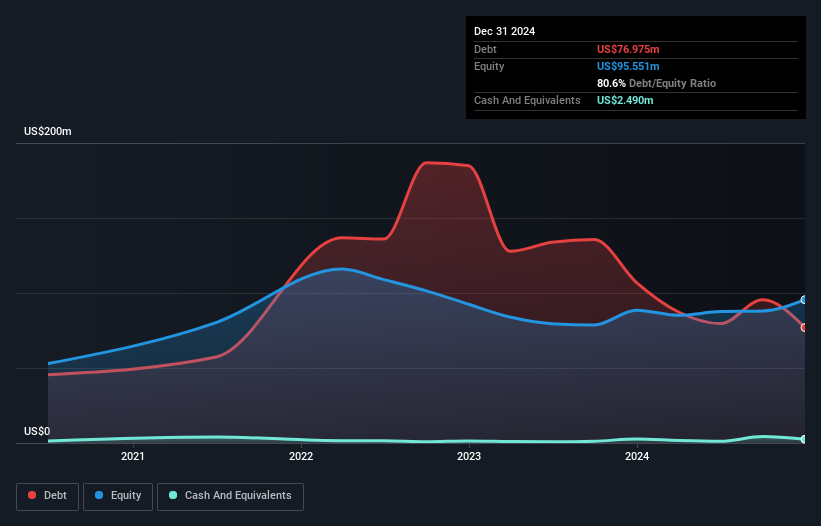

The image below, which you can click on for greater detail, shows that Alliance Entertainment Holding had debt of US$77.0m at the end of December 2024, a reduction from US$106.9m over a year. However, it does have US$2.49m in cash offsetting this, leading to net debt of about US$74.5m.

How Strong Is Alliance Entertainment Holding's Balance Sheet?

According to the last reported balance sheet, Alliance Entertainment Holding had liabilities of US$204.3m due within 12 months, and liabilities of US$101.9m due beyond 12 months. Offsetting this, it had US$2.49m in cash and US$147.0m in receivables that were due within 12 months. So its liabilities total US$156.6m more than the combination of its cash and short-term receivables.

This is a mountain of leverage relative to its market capitalization of US$194.1m. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

Check out our latest analysis for Alliance Entertainment Holding

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

While we wouldn't worry about Alliance Entertainment Holding's net debt to EBITDA ratio of 3.0, we think its super-low interest cover of 1.7 times is a sign of high leverage. It seems clear that the cost of borrowing money is negatively impacting returns for shareholders, of late. The good news is that Alliance Entertainment Holding grew its EBIT a smooth 66% over the last twelve months. Like the milk of human kindness that sort of growth increases resilience, making the company more capable of managing debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Alliance Entertainment Holding can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Happily for any shareholders, Alliance Entertainment Holding actually produced more free cash flow than EBIT over the last two years. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

Alliance Entertainment Holding's conversion of EBIT to free cash flow was a real positive on this analysis, as was its EBIT growth rate. In contrast, our confidence was undermined by its apparent struggle to cover its interest expense with its EBIT. Considering this range of data points, we think Alliance Entertainment Holding is in a good position to manage its debt levels. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Alliance Entertainment Holding is showing 3 warning signs in our investment analysis , and 2 of those make us uncomfortable...

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:AENT

Alliance Entertainment Holding

Operates as a wholesaler and e-commerce provider for the entertainment industry worldwide.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success