- United States

- /

- Specialized REITs

- /

- NYSE:WY

Weyerhaeuser (WY): Assessing Valuation After Board Appointment of Industry Leader Rick Beckwitt

Reviewed by Simply Wall St

Weyerhaeuser (WY) has appointed Rick Beckwitt, known for his many years leading Lennar Corporation, to its board of directors. Investors are watching how his industry background might influence the company’s future strategy and partnerships.

See our latest analysis for Weyerhaeuser.

Shares of Weyerhaeuser have shown some short-term momentum, with a recent 7-day share price return of 3.7 percent. However, the longer-term picture has been more challenging, as total shareholder return is down nearly 30 percent over the past year. Recent executive moves and a steady dividend announcement have piqued interest in whether a strategic shift could help stem the downward trend and spark renewed growth for shareholders.

If you’re curious about other opportunities with strong growth stories and company insiders buying in, now is a great time to discover fast growing stocks with high insider ownership

Given the stock’s recent declines and notable discounts to analyst price targets, is Weyerhaeuser now trading at an attractive valuation for new investors, or has the market already factored in the company’s future growth potential?

Most Popular Narrative: 27.0% Undervalued

Weyerhaeuser’s current share price of $22.14 stands well below the narrative-driven fair value estimate, which points to sizable upside based on projected growth and margin expansion. The latest perspectives from analysts highlight operational transformation and capacity investments as major influences on future value.

"Weyerhaeuser's transition to lower elevation and lower-cost harvest operations in the West is expected to decrease log and haul costs, improving net margins. Increasing demand for export logs in Japan due to decreased shipments of European lumber may enhance sales volumes and revenue."

Want to see why this forecast is so bullish? Analysts are betting on dramatic improvements to margins and future earnings. What are their underlying numbers? How bold are their assumptions for Weyerhaeuser's revenue and profit growth? Click to discover where this expected upside really comes from.

Result: Fair Value of $30.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, uncertainty in global lumber markets and potential operational disruptions remain risks that could challenge these positive margin and revenue expectations.

Find out about the key risks to this Weyerhaeuser narrative.

Another View: Is Value Really on Sale?

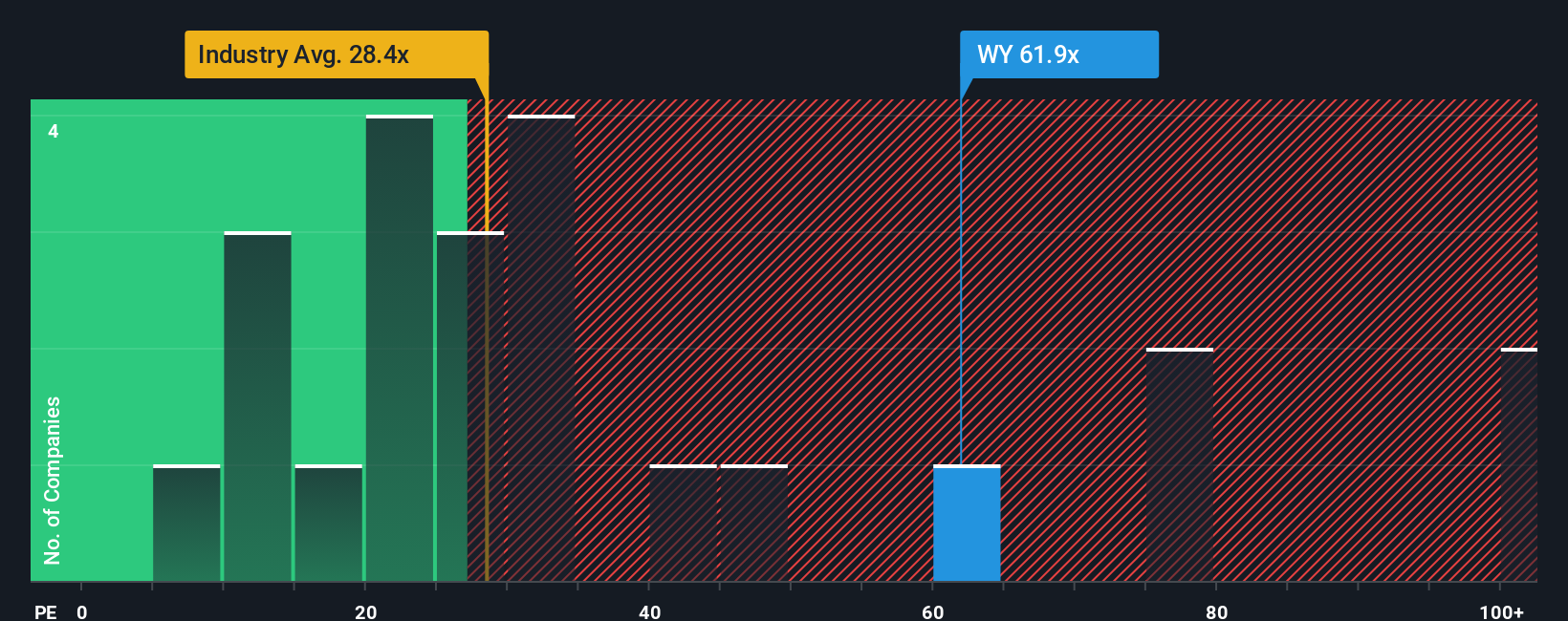

Looking at Weyerhaeuser’s valuation from a multiple perspective shows a different picture. The company is trading at a price-to-earnings ratio of 48.2 times, which is higher than both the industry average of 28.3 and the fair ratio of 43.8. This suggests downside valuation risk if the market corrects. Could the premium be justified, or does it point to limited upside for today’s buyers?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Weyerhaeuser Narrative

If you want a different perspective or prefer running your own numbers, you can quickly craft a narrative of your own in just a few minutes: Do it your way

A great starting point for your Weyerhaeuser research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for More Investment Opportunities?

The smart investor never settles for just one idea. Why stop at Weyerhaeuser when you could discover outstanding opportunities other investors may be missing in today’s fast-moving market?

- Explore high-yield potential by reviewing these 14 dividend stocks with yields > 3% with returns above 3 percent.

- Find the next generation of industry leaders when you analyze these 26 AI penny stocks that are advancing artificial intelligence and driving innovation.

- Stay ahead of the curve by evaluating these 924 undervalued stocks based on cash flows offering strong fundamental value and attractive upside signals right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Weyerhaeuser might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WY

Weyerhaeuser

Weyerhaeuser Company, one of the world's largest private owners of timberlands, began operations in 1900 and today owns or controls approximately 10.4 million acres of timberlands in the U.S., as well as additional public timberlands managed under long-term licenses in Canada.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success