- United States

- /

- Retail REITs

- /

- NYSE:WSR

Whitestone REIT (WSR): Earnings Surge Driven by $15.2 Million One-Off Challenges Quality Narrative

Reviewed by Simply Wall St

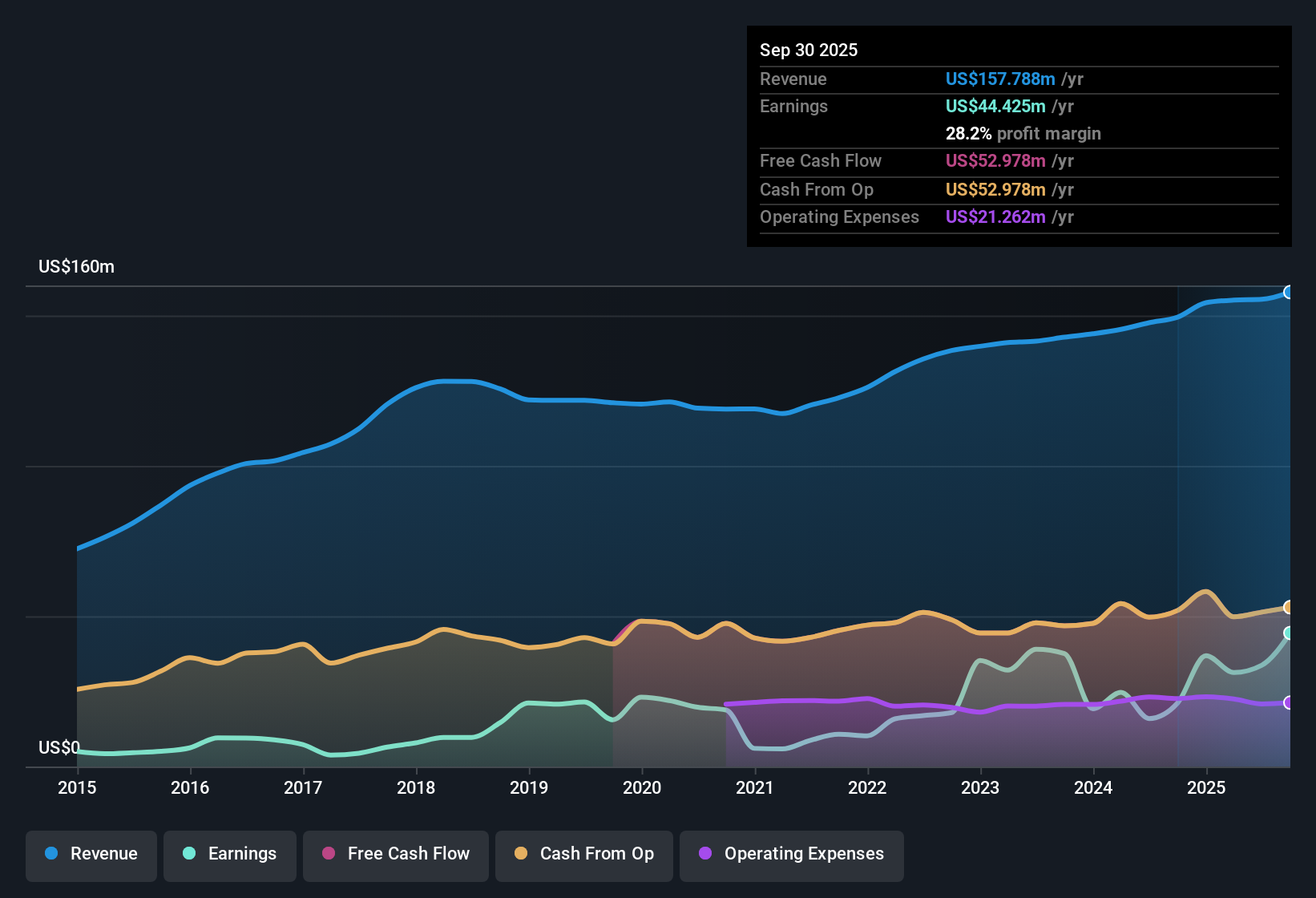

Whitestone REIT (WSR) posted a net profit margin of 21.7%, nearly doubling last year’s 10.8%, and notched 111.3% earnings growth over the past year compared to its five-year average of 23.5% per year. Shares recently changed hands at $12.95, below the estimated fair value of $14.70, with the price-to-earnings ratio sitting at 19.6x, lower than both sector and peer group averages. While forward earnings and revenue growth are expected to lag the broader market, the company’s headline numbers are flattered by a $15.2 million one-off gain, raising questions for investors about ongoing earnings quality and dividend stability.

See our full analysis for Whitestone REIT.Next up, we’re sizing up Whitestone REIT’s latest numbers against the market narrative to see which themes hold up and which ones get shaken.

See what the community is saying about Whitestone REIT

Profit Margins Projected to Decline

- Analysts forecast net profit margins will shrink from 21.7% today to 14.7% within three years, despite the current surge in profitability.

- Analysts' consensus view highlights that while Whitestone’s Sunbelt market concentration continues to drive higher rents and strong occupancy, they expect that increased operating costs and more competition will put pressure on margins over time.

- The consensus notes robust leasing demand and tenant quality do support profits now, but margin compression is expected as both population flows and asset supply moderate.

- This expected margin squeeze partly explains the more muted earnings growth forecast of 7.6% per year versus the five-year historical trend of 23.5%.

- For more on how analysts balance these strengths and risks, read the full consensus narrative. 📊 Read the full Whitestone REIT Consensus Narrative.

One-Off Gains Cloud Earnings Quality

- The most recent earnings surge includes a non-recurring $15.2 million gain, which temporarily inflates net profit and obscures what ongoing, sustainable earnings might look like in future periods.

- Consensus narrative acknowledges that redevelopment and capital recycling in affluent neighborhoods have supported profit growth, but critics highlight that these one-time boosts do not reflect recurring operational strength.

- Bears emphasize the risk that headline growth rates and profitability fade as non-recurring gains are lapped or fail to repeat in the coming years.

- This concern about sustainability is heightened by forecasts of earnings falling from $33.7 million today to $25.6 million by 2028, alongside only modest revenue gains.

Valuation Still Offers Upside, But With a Catch

- Shares trade at $12.95, below both the analyst price target of $14.93 and the DCF fair value of $14.70; the price-to-earnings ratio of 19.6x is cheaper than both the US Retail REIT industry average of 26.4x and peers at 22.3x.

- According to the consensus narrative, Whitestone’s discounted valuation relative to sector peers does attract attention, but there’s tension. To hit the $14.93 analyst target, the company would need to achieve future earnings and margin levels that current forecasts suggest are unlikely, especially with expected margin compression outpacing growth in earnings and rents.

- Analysts warn the stock would need to rerate to a much higher 39.5x PE by 2028 to justify that price, while actual earnings could shrink.

- This dynamic prompts caution, as the apparent discount may not persist if profit growth doesn’t materialize as hoped.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Whitestone REIT on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the figures? Share your perspective and build a unique narrative in just a few minutes. Do it your way

A great starting point for your Whitestone REIT research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Whitestone REIT’s reliance on non-recurring gains and forecasts of shrinking margins highlight the risk that current profitability and growth may not be sustained.

If you want steadier returns and fewer earnings surprises, use stable growth stocks screener (2112 results) to discover companies delivering consistent expansion regardless of one-off events.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Whitestone REIT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WSR

Whitestone REIT

Whitestone REIT (NYSE: WSR) is a community-centered real estate investment trust (REIT) that acquires, owns, operates, and develops open-air, retail centers located in some of the fastest growing markets in the country: Phoenix, Austin, Dallas-Fort Worth, Houston and San Antonio.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives