- United States

- /

- Health Care REITs

- /

- NYSE:WELL

How Investors Are Reacting To Welltower (WELL) Expanding Its Senior-Care Real Estate Platform

Reviewed by Sasha Jovanovic

- Welltower recently expanded its senior-care real estate platform to address growing healthcare property demand, further strengthening its position across key regions.

- This move highlights Welltower's support for senior-living operators by supplying purpose-built properties designed to enhance resident care and accessibility.

- We'll examine how Welltower's expansion into purpose-built senior-care real estate may influence its investment narrative and future growth assumptions.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Welltower Investment Narrative Recap

To be a Welltower shareholder, you need to believe in sustained demand for senior-care real estate and the company's ability to capitalize on a growing healthcare property sector. The recent expansion of Welltower’s platform directly addresses this key theme, but it does not immediately alter the company’s biggest catalyst (its operational efficiency drive via the Welltower Business System) or the most pressing risk, which remains macroeconomic uncertainty affecting occupancy and revenue in the near term.

Of the latest developments, the follow-on equity offering completed at the end of October stands out as particularly relevant. While this capital raise gives Welltower more flexibility to fund property acquisitions and development as senior-care demand rises, it also highlights concerns around higher leverage and the need to carefully balance investment growth with the risk of margin pressure if asset prices fluctuate or future market conditions tighten.

By contrast, investors should also be aware that increased acquisition activity has heightened leverage on the balance sheet, putting future margins at risk if market conditions shift...

Read the full narrative on Welltower (it's free!)

Welltower's narrative projects $14.6 billion in revenue and $2.0 billion in earnings by 2028. This requires 16.3% yearly revenue growth and an $0.9 billion increase in earnings from the current $1.1 billion.

Uncover how Welltower's forecasts yield a $192.90 fair value, in line with its current price.

Exploring Other Perspectives

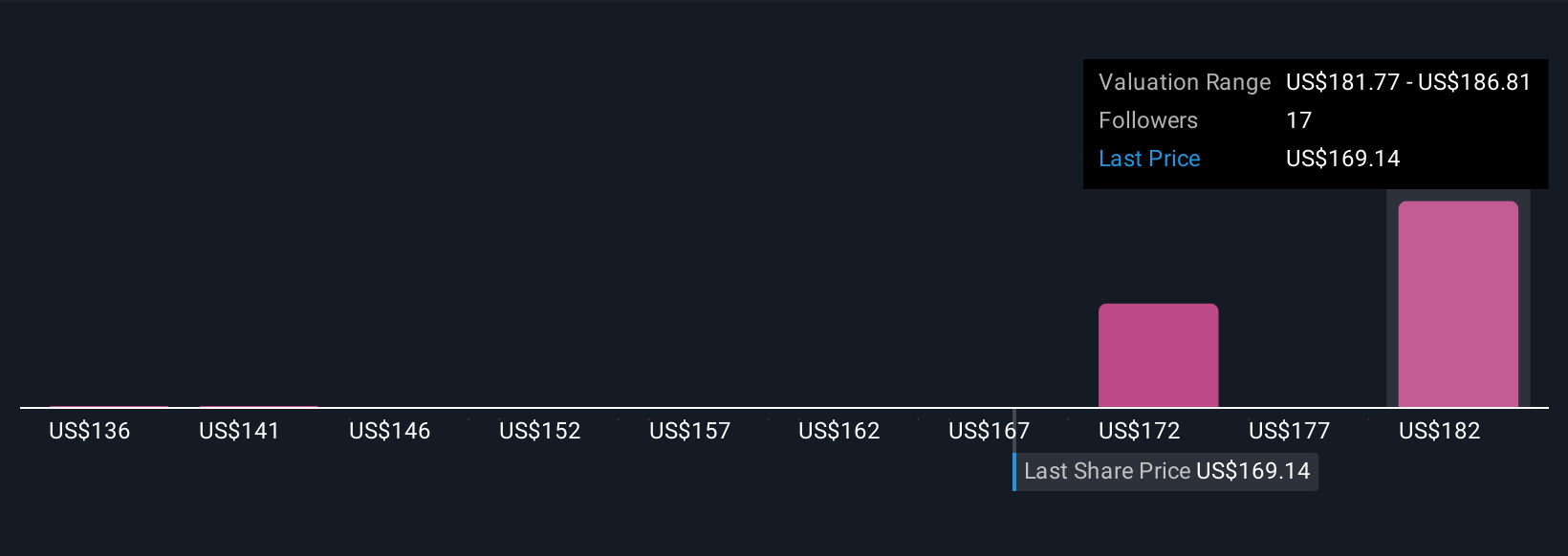

Five different fair value estimates from the Simply Wall St Community range between US$136.42 and US$192.90 per share. While these opinions vary widely, keep in mind that Welltower’s recent equity raise could influence future capital needs and balance sheet risks, prompting many investors to seek out multiple points of view.

Explore 5 other fair value estimates on Welltower - why the stock might be worth as much as $192.90!

Build Your Own Welltower Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Welltower research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Welltower research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Welltower's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Welltower might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WELL

Welltower

Welltower Inc. (NYSE: WELL), an S&P 500 company, is positioned at the center of the silver economy, focusing on rental housing for aging seniors across the United States, United Kingdom and Canada.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives