- United States

- /

- Health Care REITs

- /

- NYSE:VTR

Did Raised 2025 Guidance and Profit Surge Just Shift Ventas' (VTR) Investment Narrative?

Reviewed by Sasha Jovanovic

- Ventas, Inc. recently reported third-quarter 2025 earnings with revenue reaching US$1.49 billion and net income significantly higher at US$66.05 million compared to the prior year, alongside an increase in full-year earnings guidance.

- The jump in key profitability metrics and an upward revision in guidance underscores management's confidence in ongoing operational improvements across its portfolio.

- We’ll examine how Ventas’ raised 2025 earnings outlook enhances the company’s investment narrative driven by operational momentum in core assets.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

Ventas Investment Narrative Recap

At its core, Ventas offers exposure to the accelerating need for senior housing and healthcare facilities, underpinned by demographic trends and disciplined portfolio management. The latest quarterly results, which include higher revenue and a significant uptick in net income, reinforce operational momentum, yet the most important short-term catalyst remains sustained occupancy and NOI growth, while the largest risk is operator performance within its expanding Senior Housing Operating Portfolio (SHOP). For now, the boosted guidance provides a confidence signal, though it does not materially change these underlying factors.

The company's decision to increase its 2025 earnings guidance, from a net income per share range of US$0.47–0.52 to US$0.49–0.52, is the most relevant recent announcement. This upward revision reflects improving fundamentals and management’s expectations for continued progress, tying directly into the narrative of margin expansion as occupancy rises and operational execution improves across SHOP and medical office segments.

However, investors should also recognize that if operator performance in the SHOP segment fails to keep up with expectations, especially if occupancy remains sluggish...

Read the full narrative on Ventas (it's free!)

Ventas' outlook forecasts $6.9 billion in revenue and $443.6 million in earnings by 2028. This is based on an assumed annual revenue growth rate of 9.3% and a $252.4 million increase in earnings from the current $191.2 million.

Uncover how Ventas' forecasts yield a $78.25 fair value, a 6% upside to its current price.

Exploring Other Perspectives

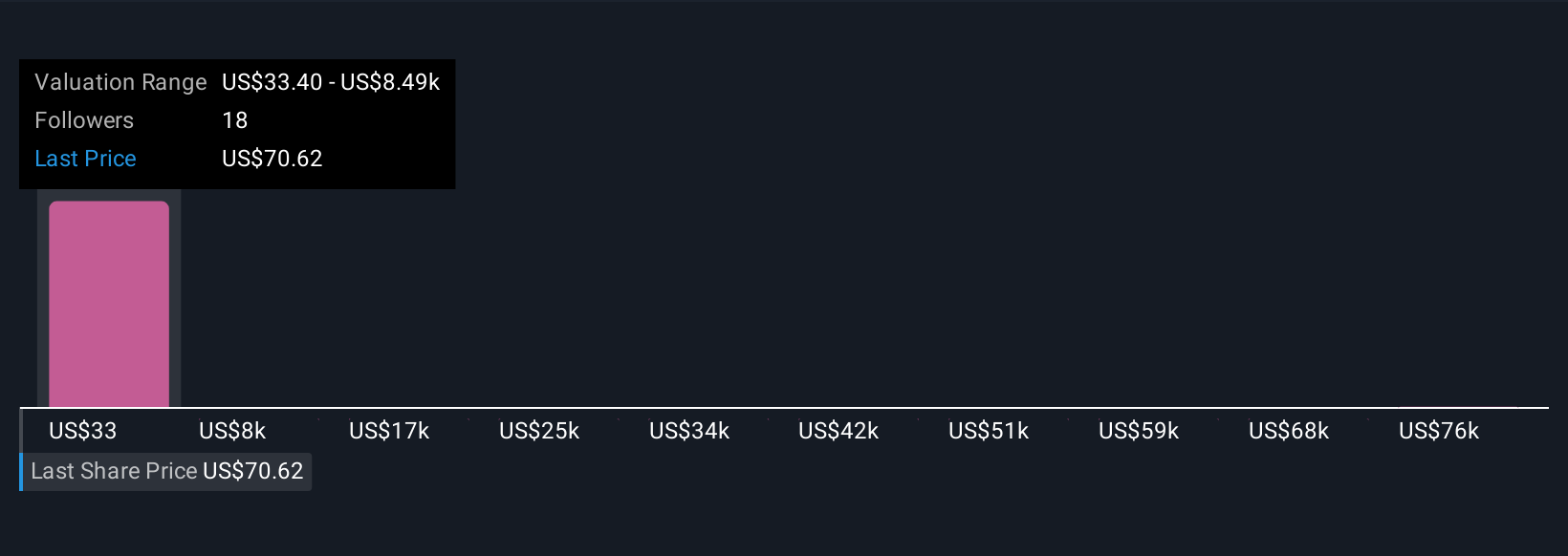

Five distinct community fair value estimates for Ventas range widely from US$33.40 to US$84,622.13, with the majority below US$8,492.27. While these perspectives diverge sharply, the analyst view stresses the importance of ongoing execution and integration in the SHOP operating model, which could influence future performance outcomes. Explore these viewpoints to see how your expectations align.

Explore 5 other fair value estimates on Ventas - why the stock might be a potential multi-bagger!

Build Your Own Ventas Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ventas research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Ventas research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ventas' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VTR

Ventas

Ventas, Inc. (NYSE: VTR) is a leading S&P 500 real estate investment trust enabling exceptional environments that benefit a large and growing aging population.

Reasonable growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives