- United States

- /

- Office REITs

- /

- NYSE:VNO

Vornado Realty Trust (VNO): One-Off Gain Drives Profit, Challenging Sustainability Narrative

Reviewed by Simply Wall St

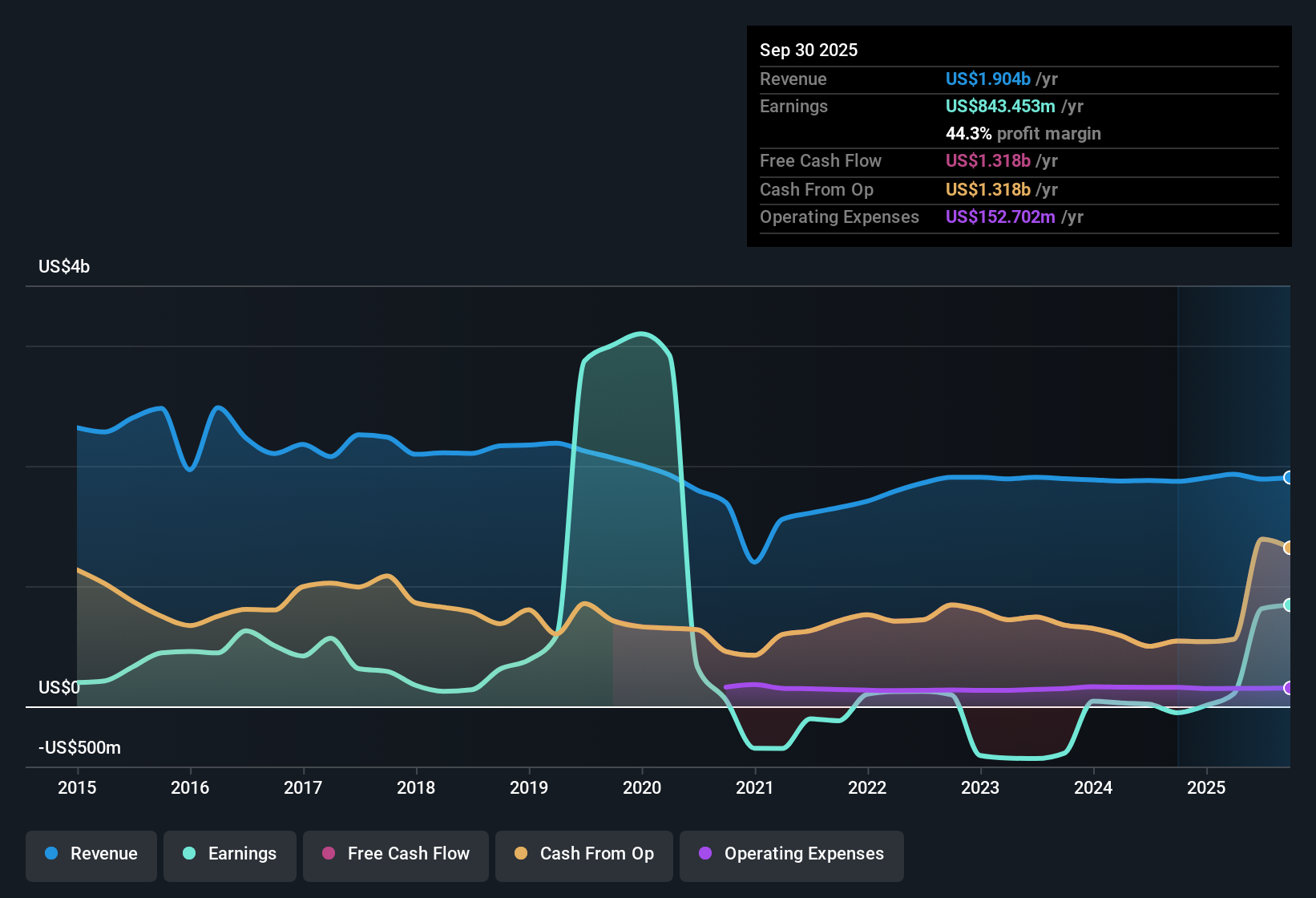

Vornado Realty Trust (VNO) has turned profitable, posting a robust 46.1% per year earnings growth rate over the last five years, but recent results were boosted by a one-off gain of $827.3 million. Although net profit margins have moved into positive territory, forecasts now call for earnings to drop sharply by 83.8% per year over the coming three years. Revenue is projected to rise at a slower 3.3% per year, which is behind the broader US market’s 10.5% per year expectation. With profits only recently established, it is tricky to benchmark these results against historical averages, but investors continue to weigh strong historical growth against a much tougher outlook.

See our full analysis for Vornado Realty Trust.The next section dives into how these headline results compare to the dominant narratives in the market, highlighting where perceptions may shift after the latest report.

See what the community is saying about Vornado Realty Trust

Premium Manhattan Assets Fuel Confidence

- Vornado’s current net profit margin stands at 43.0%, with analysts projecting a steep drop to just 1.1% in three years. This underscores the volatility tied to recent one-off gains and foreshadows a less predictable earnings path.

- Analysts’ consensus view points to investors’ faith in the company’s trophy Manhattan properties and ongoing redevelopment as prime catalysts for long-term rent and occupancy growth, even as profit margins are expected to contract sharply.

- The consensus narrative highlights anticipated sustained high demand and low supply in Class A Manhattan office space as a reason Vornado could maintain pricing power. This could support above-market revenue growth despite margin pressure.

- However, the drop in profit margins to just above breakeven levels is seen as a concrete check on bullish expectations. Any missteps in project execution or market demand could leave profits vulnerable.

- Analyst consensus expects these flagship properties to deliver long-term value, but margin compression keeps everyone watching for surprises. 📊 Read the full Vornado Realty Trust Consensus Narrative.

Valuation Signals Unusual Discount to Peers

- Vornado’s price-to-earnings ratio of 8.2x is well below the global office REITs industry average of 22.4x and the peer average of 34.2x. The latest DCF fair value stands at $42.78 versus a share price of $35.86.

- Consensus narrative emphasizes that investors appear to be pricing in substantial risks, including declining earnings and a history of non-recurring gains, resulting in a rare valuation gap despite Vornado’s premier New York footprint.

- The consensus notes that the market’s skepticism is tied directly to the projected 83.8% annual fall in earnings. The implied multiple on 2028 estimates balloons to 470.4x, which is drastically higher than sector norms.

- At the same time, the attractive current valuation relative to peers could offer upside if Vornado executes on redevelopment and cash flows stabilize sooner than consensus expects.

Analyst Price Targets Align with Current Trading Range

- With the analyst consensus price target at $39.80 and the share price at $35.86, the stock currently trades just 9.9% below where most analysts think it should be. This indicates Vornado is seen as fairly valued at present.

- According to analysts’ consensus view, this modest gap signals the market believes Vornado’s risks and opportunities are well balanced. Market participants are neither assigning a major discount for risk nor expecting a near-term re-rating.

- The lack of a large discount between market price and target reflects investor hesitation to fully endorse either the bullish case of strong asset-driven growth or the bearish case of unsustainable earnings.

- Instead, pricing suggests a “wait and see” stance as investors watch for signals that future margin compression or redevelopment payoffs will drive the next leg for the stock.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Vornado Realty Trust on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Want a fresh angle on the story? Take a few minutes to shape your own perspective on the numbers and share your outlook. Do it your way.

A great starting point for your Vornado Realty Trust research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

See What Else Is Out There

Vornado faces steeply falling earnings forecasts and highly volatile profit margins, which leaves its long-term growth outlook uncertain compared to more stable industry peers.

If you want companies with steadier growth and more predictable results, use stable growth stocks screener (2083 results) to narrow in on reliable performers built for consistency across market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VNO

Vornado Realty Trust

Vornado Realty Trust (“Vornado”) is a fully-integrated real estate investment trust (“REIT”) and conducts its business through, and substantially all of its interests in properties are held by, Vornado Realty L.P.

Moderate risk and good value.

Similar Companies

Market Insights

Community Narratives