- United States

- /

- Office REITs

- /

- NYSE:VNO

Is Vornado Realty Trust a Bargain After a 16.6% Drop in 2025?

Reviewed by Bailey Pemberton

- Wondering if Vornado Realty Trust might be a bargain or just another name to skip? Let's break down what savvy investors are curious about before you make your move.

- Shares have dropped by 5.6% this week and 13.8% over the last month, adding to a year-to-date loss of 16.6%. The three-year return remains a notable 65.1% gain.

- These recent price swings come as major headlines highlight both shifting demand in the commercial real estate sector and Vornado's continued repositioning of its core assets. News of high-profile property deals and evolving market sentiment have kept the spotlight on the company's future prospects.

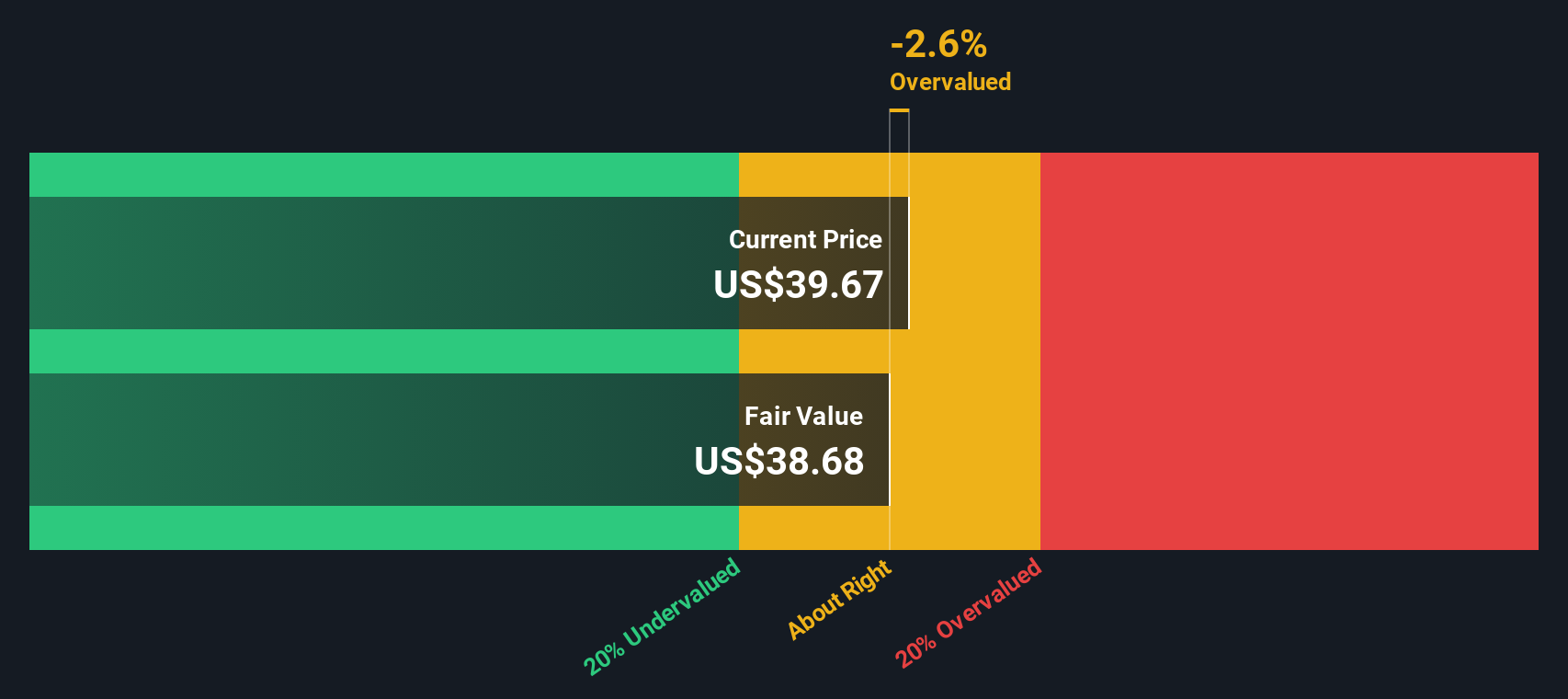

- Right now, Vornado scores a 4 out of 6 on our undervaluation checks. This is a solid showing, but as you'll see, standard assessments only tell part of the story. We'll dig into those valuation models next and wrap up with an even smarter way to interpret whether the stock is truly undervalued.

Approach 1: Vornado Realty Trust Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows, specifically adjusted funds from operations in this case, and discounting them back to today's value. This allows investors to judge whether the current share price reflects the company’s true earning power and future growth prospects.

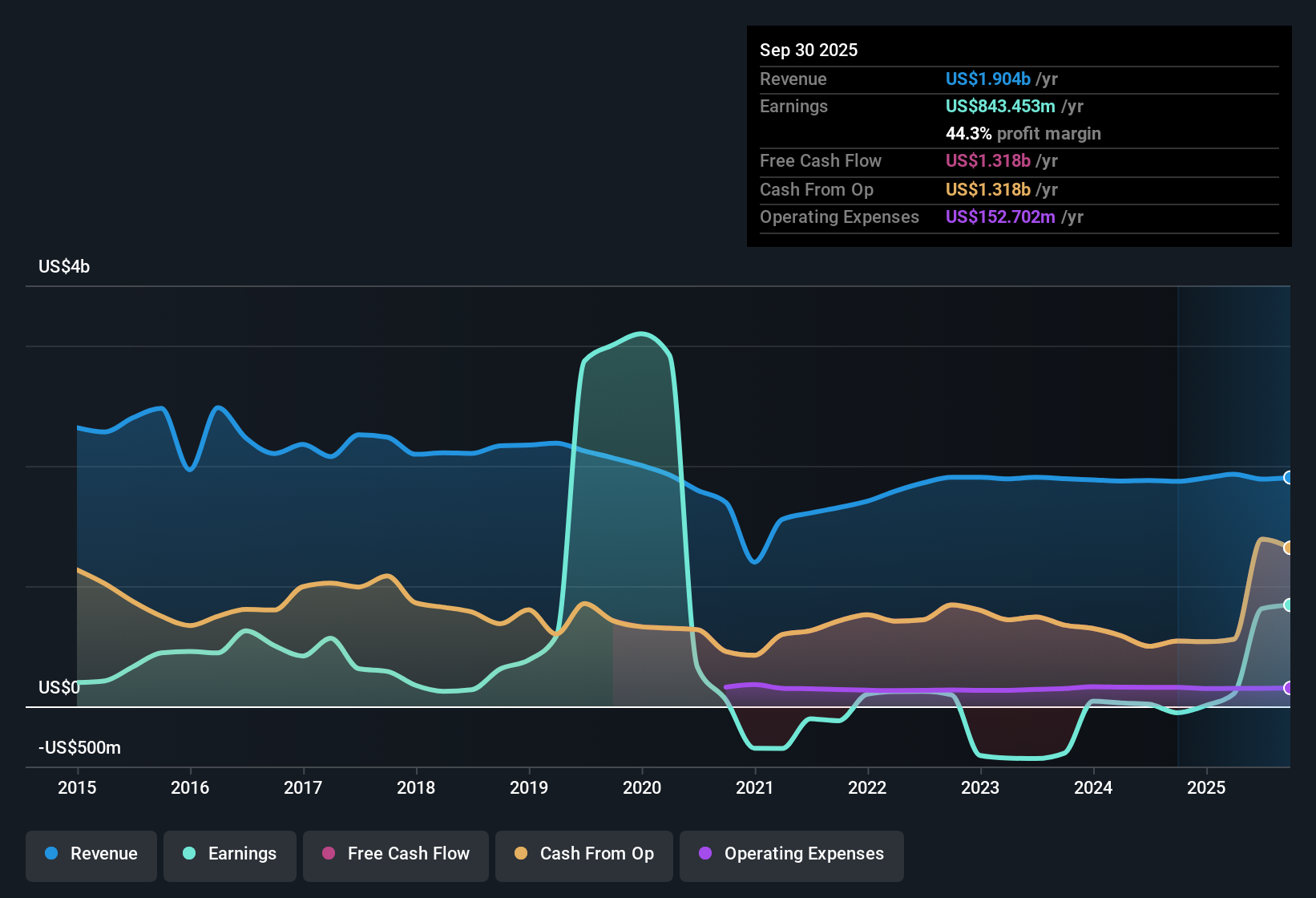

For Vornado Realty Trust, the latest reported Free Cash Flow stands at $468.47 million. Analyst forecasts suggest that this figure will shift modestly in the next five years, with Simply Wall St extrapolating further growth for the following five years. By 2029, Free Cash Flow is projected to reach $444.26 million, showing a relatively steady trend.

Using the DCF model, the estimated fair value for Vornado’s shares is $42.50. This is about 16.4% higher than the current market price. This suggests that Vornado Realty Trust is undervalued at present and may offer a margin of safety for buyers willing to take a long-term perspective.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Vornado Realty Trust is undervalued by 16.4%. Track this in your watchlist or portfolio, or discover 849 more undervalued stocks based on cash flows.

Approach 2: Vornado Realty Trust Price vs Earnings

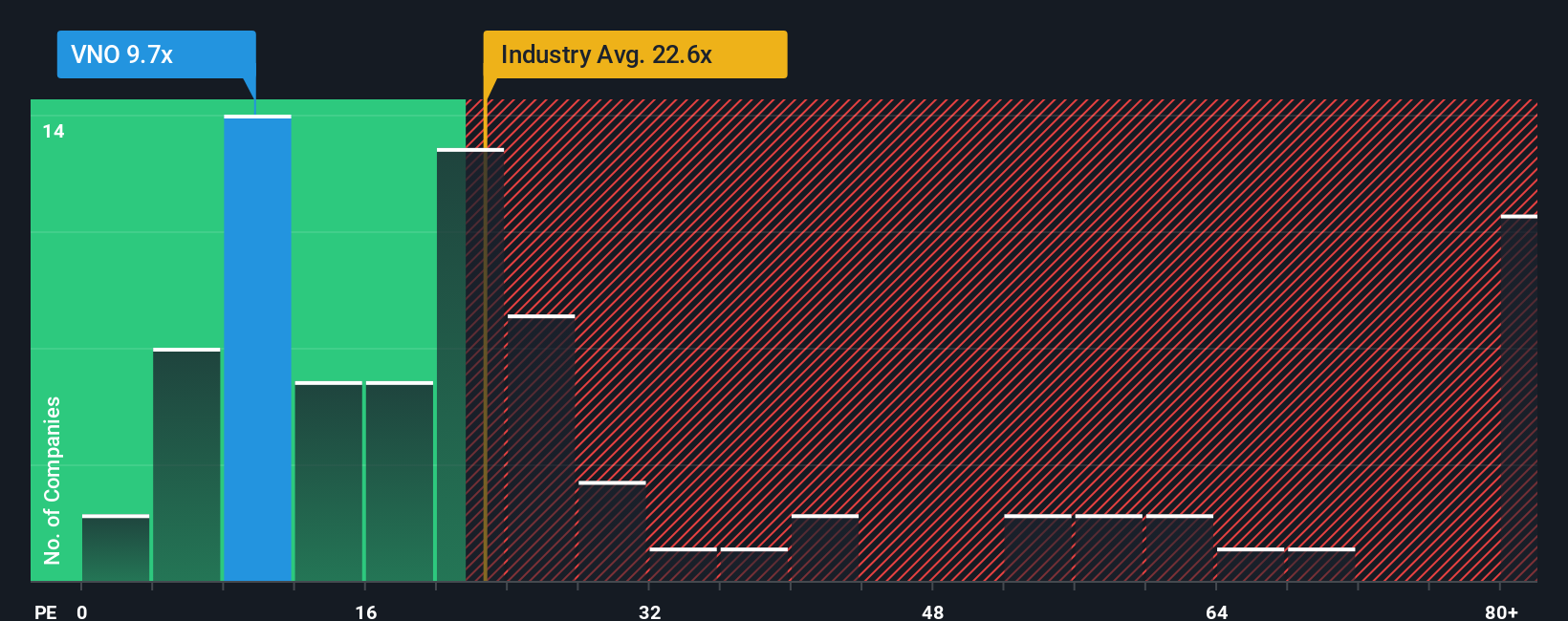

The price-to-earnings (PE) ratio is a classic metric for valuing profitable companies like Vornado Realty Trust because it relates the share price to the company’s bottom line. For established firms with consistent profits, the PE ratio helps investors gauge how much they’re paying for each dollar of earnings.

What’s considered a “normal” or “fair” PE ratio isn’t set in stone and often depends on expectations for future growth and risk. Typically, companies with brighter growth prospects or less perceived risk trade at higher PE ratios, while slower-growing or riskier businesses have lower ratios.

Vornado Realty Trust currently has a PE ratio of 8.1x. That is well below the office REIT industry average of 22.4x and the average among close peers, which stands at 34.5x. On paper, this could signal a bargain, but surface comparisons can be tricky.

This is where Simply Wall St’s “Fair Ratio” comes in. It calculates what a reasonable PE ratio should be for Vornado based on factors like its earnings growth outlook, profit margins, industry trends, company size, and specific risks. Unlike basic peer or industry comparisons, the Fair Ratio offers a more tailored benchmark that is actually grounded in the business’s unique story.

Vornado’s Fair Ratio lands at 10.4x, only a little higher than the company’s current multiple of 8.1x. That modest gap means the stock is trading close to what would be expected based on a holistic valuation model, neither stretched nor especially cheap.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1407 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Vornado Realty Trust Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple yet powerful way for you to connect your view of Vornado Realty Trust's story to the numbers behind its future, by linking your forecasts for revenue, earnings, and margins directly to a fair value and price target.

Instead of relying solely on standard valuation ratios, Narratives let you express why you believe the company will outperform or underperform, whether it's based on strong Manhattan property demand, redevelopment successes, or concerns about remote work trends and margin pressure. These personalized perspectives are accessible and easy to create on the Simply Wall St Community page, where millions of investors compare their Narratives, discuss assumptions, and share actionable insights.

Narratives are especially useful because they allow you to see instantly how your expectations translate into a fair value estimate, and how that compares to Vornado’s current share price, so you can make informed buy or sell decisions. Best of all, Narratives are dynamic, meaning they update automatically as new news and earnings come in, keeping your view relevant at all times.

For example, some investors in the Community are bullish, projecting a fair value as high as $46.00 if demand for premium office space and successful redevelopments continue, while others are cautious, seeing fair value as low as $30.00 due to risks like shrinking profit margins and remote work adoption. This shows the power of Narratives to reflect a range of market perspectives.

Do you think there's more to the story for Vornado Realty Trust? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VNO

Vornado Realty Trust

Vornado Realty Trust (“Vornado”) is a fully-integrated real estate investment trust (“REIT”) and conducts its business through, and substantially all of its interests in properties are held by, Vornado Realty L.P.

Moderate risk and good value.

Similar Companies

Market Insights

Community Narratives