- United States

- /

- Specialized REITs

- /

- NYSE:VICI

How Recent Casino Lease Expansions Could Impact VICI Properties Valuation in 2025

Reviewed by Bailey Pemberton

If you are staring at VICI Properties’ stock chart and wondering whether now is the time to buy, hold, or move on, you are not alone. The stock has run a fascinating course, with a 74.7% gain over five years. Recent dips of -1.0% in the past week and -4.0% over the last month might have some investors pausing for breath. Still, VICI’s year-to-date return of 11.2% paints a different, more positive picture. The past year’s 5.1% gain stands out among its peers in the net lease REIT space.

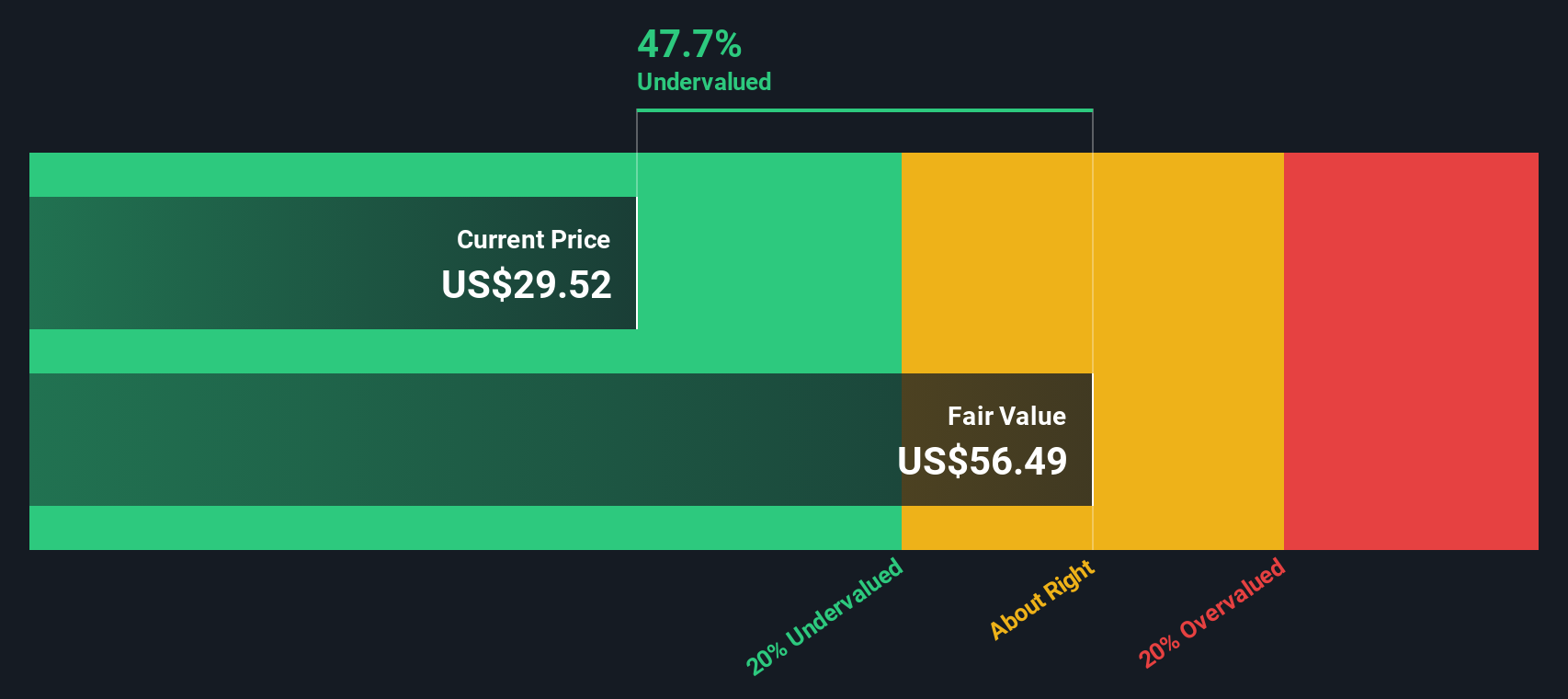

There has also been a shift in the overall perception of risk in commercial real estate, especially with VICI’s heavy focus on high-profile casino and hotel properties. Some investors view these as immune to recent market tremors, while others remain wary. Notably, VICI earns a value score of 5 out of 6 on our proprietary valuation checklist, showing that it is undervalued in nearly every key metric we track. That is a rare feat in today’s market, especially when combined with solid long-term performance.

But what do these numbers actually mean for your investment decision? To get a real sense of whether VICI Properties is a bargain, or if there is more to the story than just numbers, we will break down the main valuation approaches next and, ultimately, introduce a perspective on valuation that gives you an even deeper edge.

Approach 1: VICI Properties Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) approach estimates a company’s intrinsic value by projecting its future cash flows and then discounting those amounts back to their value today. For VICI Properties, this model uses Adjusted Funds From Operations to gauge true cash generation power over time.

Currently, VICI reports an annual Free Cash Flow of $2.37 Billion. Analyst estimates forecast continued growth, with Free Cash Flow expected to reach $2.94 Billion by 2028. While analyst projections only extend a few years, future figures up to 2035 are extrapolated, showing steady, if modest, expected growth each year.

Running these projections through the DCF model yields an estimated intrinsic value of $57.44 per share. Compared to VICI’s actual share price, this valuation suggests that the stock is trading at a 43.9% discount to its fair value, which represents a significant margin of undervaluation by this method.

For investors, this means VICI may represent a strong opportunity based on future cash flow potential and current market price.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests VICI Properties is undervalued by 43.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: VICI Properties Price vs Earnings (PE)

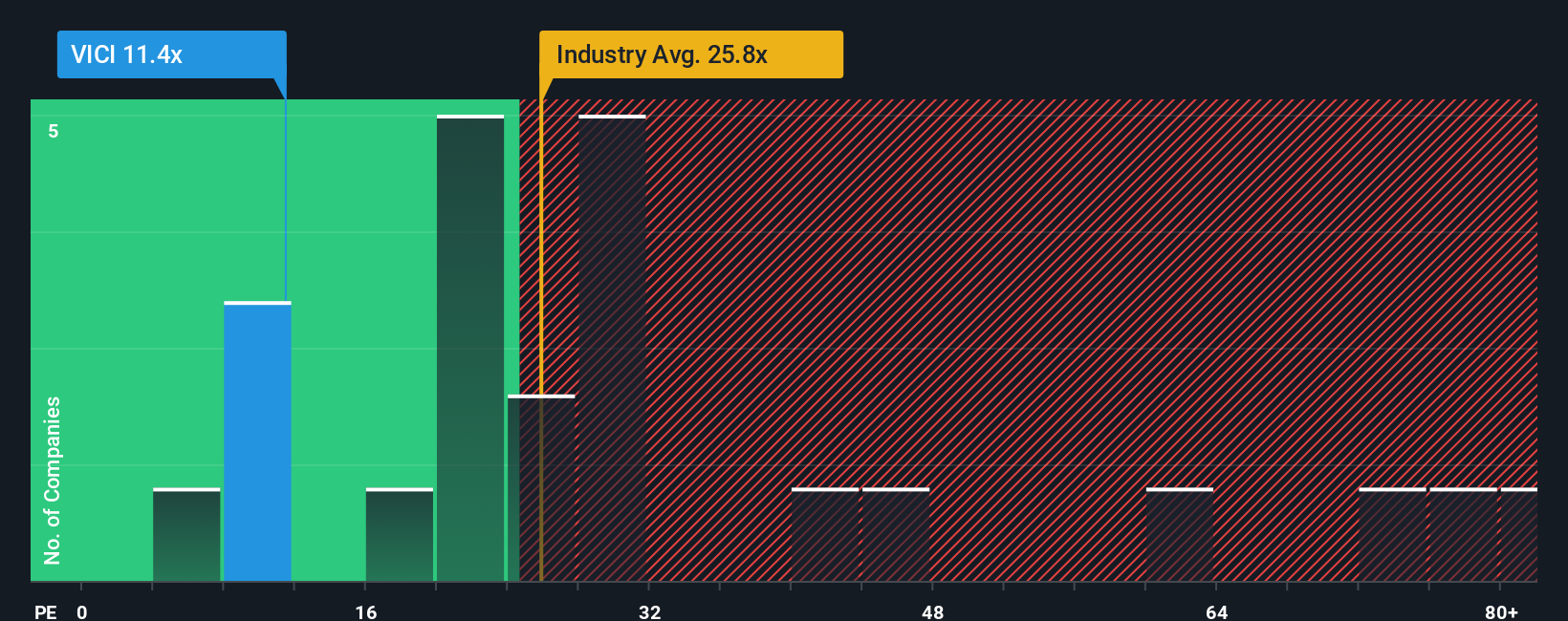

The Price-to-Earnings (PE) ratio is one of the most popular tools for valuing companies that are solidly profitable, like VICI Properties. It tells investors how much they are paying for each dollar of earnings, making it especially useful for companies with stable cash flows and positive profits.

Generally, a company with higher growth expectations or lower perceived risk can justify a higher PE ratio, while companies in mature but steady industries often trade at lower multiples. VICI’s current PE ratio stands at 12.5x, which is noticeably below the industry average of 17.7x and well under the peer group average of 45.9x. On the surface, this suggests VICI may be trading at a relative bargain.

However, rather than just comparing VICI Properties to industry or peers, we use Simply Wall St’s "Fair Ratio," which combines several factors, such as expected growth, profit margins, risk profile, market value, and industry characteristics, to estimate what a fair PE for the company should be. For VICI, this Fair Ratio is calculated at 32.3x. This means that, by this holistic measure, the stock appears meaningfully undervalued when compared to its current 12.5x PE, giving investors a potential margin of safety.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your VICI Properties Narrative

Earlier, we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a more dynamic approach that links your perspective on a company with financial forecasts and fair value estimates. A Narrative is your story behind the numbers; it combines what you believe about a company’s future (such as revenue, earnings, and margins) with how those beliefs shape its expected fair value. This approach helps investors move beyond static models by connecting the business’s real-world story to tangible forecasts and price targets. As a result, investors gain a richer context for deciding when to buy, hold, or sell.

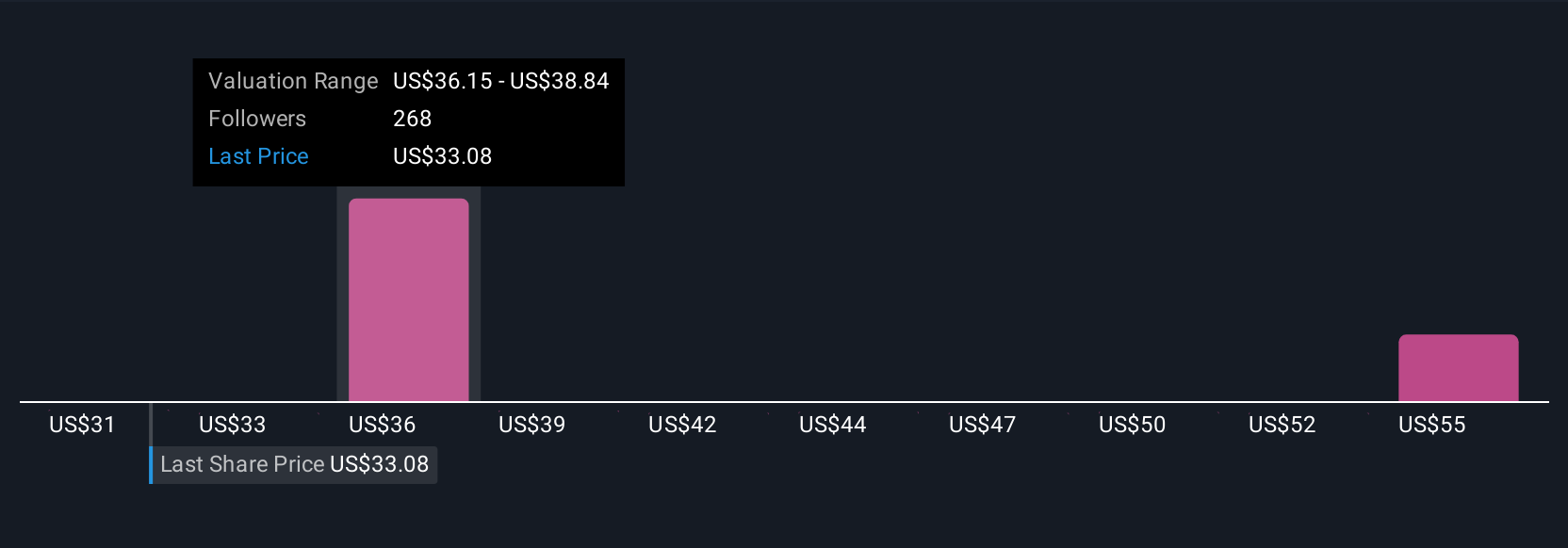

Narratives are at your fingertips on Simply Wall St’s Community page, already used by millions of investors, and are updated dynamically as soon as new information like news or earnings releases comes to light. By building and comparing Narratives, you can quickly see the difference between your fair value for VICI Properties and its current price, allowing you to act with more conviction and less guesswork. For instance, some investors see long-term demographic and experiential tailwinds justifying the most optimistic price target of $44.0. Others, who are more cautious due to risks in gaming or lending, anchor their Narratives closer to the bearish $34.0 mark.

Do you think there's more to the story for VICI Properties? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VICI

VICI Properties

An S&P 500 experiential real estate investment trust that owns one of the largest portfolios of market-leading gaming, hospitality, wellness, entertainment and leisure destinations, including Caesars Palace Las Vegas, MGM Grand and the Venetian Resort Las Vegas, three of the most iconic entertainment facilities on the Las Vegas Strip.

Very undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives