- United States

- /

- Residential REITs

- /

- NYSE:SUI

Will Sun Communities' (SUI) Share Buybacks and New Partnerships Shape Its Long-Term Growth Trajectory?

Reviewed by Sasha Jovanovic

- In late October, Sun Communities released its third quarter and nine-month financial results, updated earnings guidance for the fourth quarter and full year, and detailed progress on its share repurchase program.

- Separately, Hipcamp announced a partnership to list 100 Sun Outdoors RV resorts on its app, reflecting rising demand for premium, amenity-rich camping experiences among U.S. households.

- We’ll explore how the latest earnings guidance and share buyback activity may influence Sun Communities’ long-term investment case.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Sun Communities Investment Narrative Recap

To be a shareholder in Sun Communities, an investor must believe in the long-term structural demand for affordable manufactured housing and premium RV communities, even as growth opportunities from new developments narrow. The recent Hipcamp partnership reflects rising demand for amenity-rich camping, but it is unlikely to materially shift the primary short-term catalyst, stabilizing declining transient RV revenues, nor the ongoing risk of expense pressure from inflation and property taxes.

Among the latest announcements, the sizeable share repurchase program, over US$500 million for nearly 4 million shares, stands out, signaling a focus on shareholder returns amid fewer accretive acquisitions. This aligns closely with the current need for margin protection and prudent capital allocation as Sun Communities manages volatile RV segment trends and regional operating risks.

By contrast, the expense headwinds facing Sun Communities could present a challenge that long-term investors should be aware of…

Read the full narrative on Sun Communities (it's free!)

Sun Communities is expected to reach $2.6 billion in revenue and $550.6 million in earnings by 2028. This scenario assumes a 6.9% annual decline in revenue and an increase in earnings of $629.9 million from current earnings of -$79.3 million.

Uncover how Sun Communities' forecasts yield a $139.65 fair value, a 10% upside to its current price.

Exploring Other Perspectives

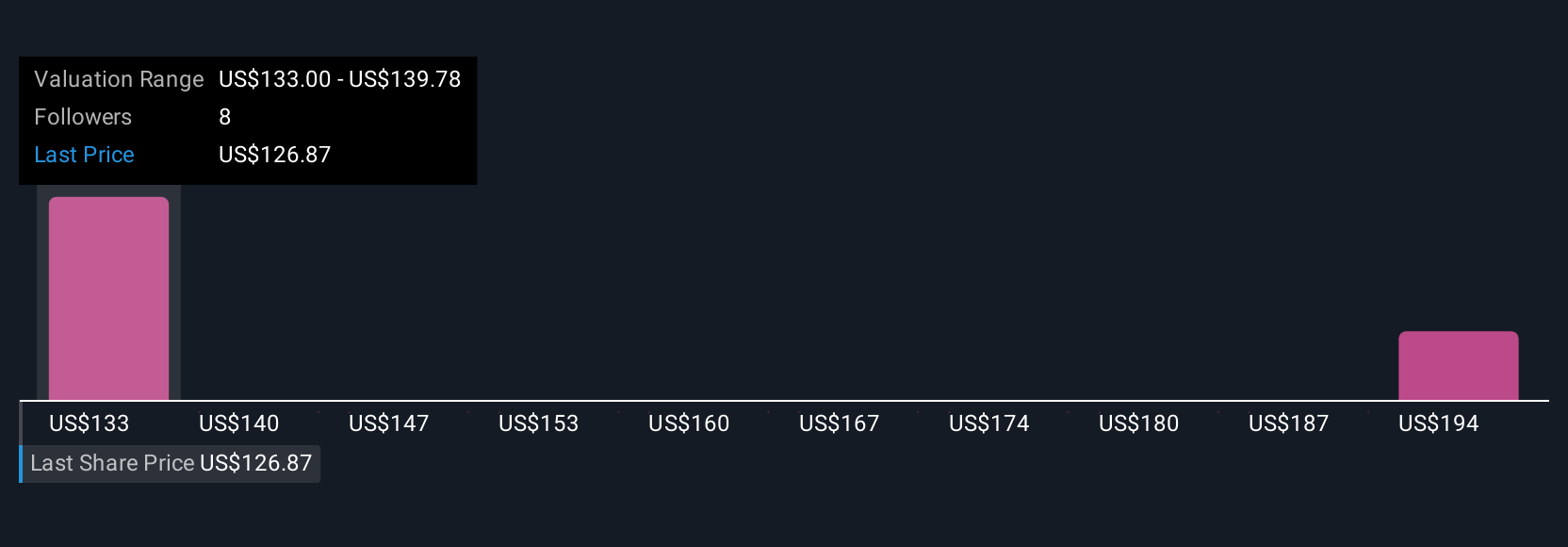

Simply Wall St Community members offered three distinct fair value estimates for Sun Communities, ranging from US$133 to US$207.73 per share. While these perspectives reflect a broad span of optimism and caution, keep in mind that ongoing expense increases remain a pivotal consideration for future earnings and cash flow stability.

Explore 3 other fair value estimates on Sun Communities - why the stock might be worth as much as 64% more than the current price!

Build Your Own Sun Communities Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sun Communities research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Sun Communities research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sun Communities' overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SUI

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives