- United States

- /

- Industrial REITs

- /

- NYSE:STAG

STAG Industrial (STAG) Margin Boost from $60M One-Off Gain Challenges Bullish Narratives

Reviewed by Simply Wall St

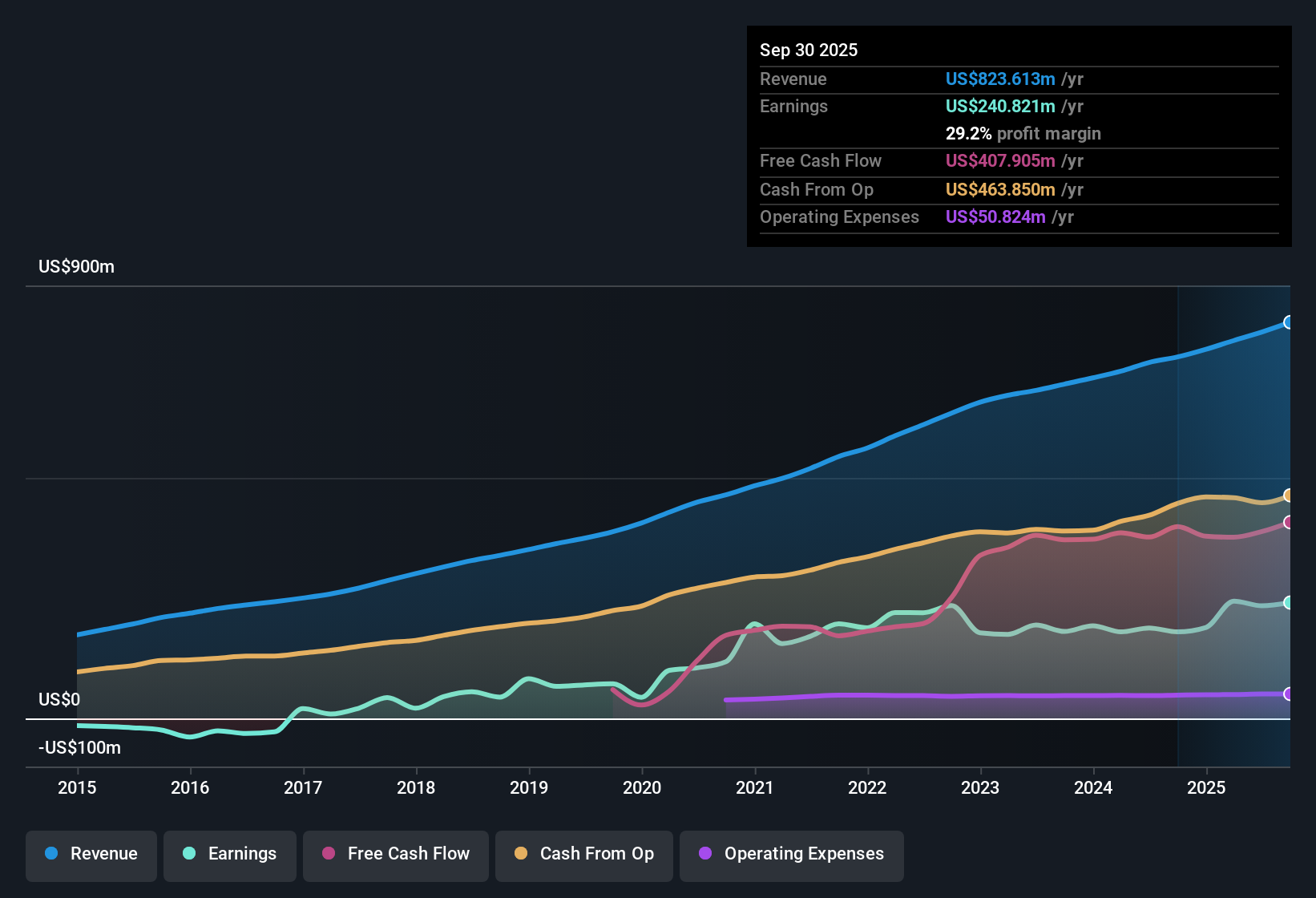

STAG Industrial (STAG) posted earnings growth of 24.5% over the past year, outpacing its five-year average rate of 4.6% per year. Net profit margins jumped to 29.1% from last year's 25.4%, helped by a significant one-off gain of $60 million that contributed to the latest results. Despite favorable margin expansion, the presence of non-recurring income and forecasts pointing to a -7.4% annual decline in earnings over the next three years set a mixed tone for the future.

See our full analysis for STAG Industrial.Next, we will stack these headline numbers up against the dominant narratives in the market to see which views hold up and which might need a rethink.

See what the community is saying about STAG Industrial

DCF Fair Value Offers Upside at Current Price

- STAG Industrial’s current share price of $38.54 trades at a discount to its DCF fair value of $52.21. This leaves a potential upside of roughly 36% if valuation models hold true.

- Analysts' consensus view weighs this gap against a forecast for annual profit margin shrinkage from 29.1% now to 21.1% by 2028, highlighting mixed signals for investors:

- The discounted share price aligns with slower expected revenue growth rates (9.7% per year) compared to the US market (10.3% per year), which complicates the argument for a significant re-rating.

- With analyst targets sitting slightly above the current price at $38.83, the muted re-rating expectations suggest the discount does not fully account for longer-term structural growth challenges in the industrial REIT sector.

One-Off Gain Skews Margin Strength

- The recent $60 million one-off gain has inflated net profit margins to 29.1%, higher than last year’s 25.4%, but this surge may not persist going forward.

- According to the analysts' consensus view, margin expansion driven by non-recurring income creates an optical boost that could mask an otherwise downward earnings trajectory:

- An expected -7.4% annual earnings decline through 2028 is at odds with the current margin. This suggests underlying operating momentum is weaker than headline figures imply.

- Vacancies and longer lease-up times noted in analyst commentary could further exacerbate this pressure, making normalized profitability a bigger concern than recent headline metrics suggest.

Premium P/E Ratio Signals Market Skepticism

- STAG currently trades at a price-to-earnings ratio of 27.4x, which is elevated relative to both global and US industrial REIT peers (28.2x for US sector). This is projected to rise to 45.6x by 2028 if consensus earnings forecasts play out.

- Analysts' consensus view points out that this hefty multiple reflects a narrow margin of safety for investors if projected earnings disappoint:

- The possibility of major tenants consolidating into larger, custom facilities presents downside risks for STAG’s mid-sized warehouse focus. This could pressure both occupancy and financial multiples.

- Despite institutional investor enthusiasm and recent portfolio growth, inconsistent performance across key markets may justify the cautious market approach embedded in today’s valuation gap.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for STAG Industrial on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different interpretation of the data? Share your insights and construct your personal investment narrative in just a few minutes. Do it your way

A great starting point for your STAG Industrial research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite STAG Industrial’s attractive valuation gap, its projected earnings decline and decreasing profit margins highlight concerns about sustainable growth in the years ahead.

If you want stocks with a proven record of steady expansion instead, check out companies offering consistent performance, stronger fundamentals, and less volatility with stable growth stocks screener (2111 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:STAG

STAG Industrial

A real estate investment trust focused on the acquisition, development, ownership, and operation of industrial properties throughout the United States.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives