- United States

- /

- Industrial REITs

- /

- NYSE:STAG

STAG Industrial (STAG): Evaluating Valuation After Earnings Beat and Management's Upbeat Outlook

Reviewed by Simply Wall St

STAG Industrial (STAG) just reported better than expected Q3 earnings, with both funds from operations and revenue beating analyst estimates. Leadership echoed optimism, pointing to the portfolio’s ongoing stability and healthy market fundamentals.

See our latest analysis for STAG Industrial.

STAG Industrial’s strong quarter helped extend its positive momentum, with the share price climbing 18.3% so far this year and the company posting a 1-year total shareholder return of 11.6%. Momentum appears to be building as investors respond to management’s upbeat outlook and consistent operational results.

If STAG’s steady upward trend caught your attention, now is a good time to broaden your perspective and discover fast growing stocks with high insider ownership

But with shares rallying and strong fundamentals fueling optimism, the crucial question remains: is STAG Industrial’s growth outlook fully reflected in its current price, or are investors still overlooking a fresh buying opportunity?

Most Popular Narrative: 5.3% Undervalued

Compared to its last close of $39.05, the most widely followed narrative sets STAG Industrial’s fair value at $41.25, hinting that the market may still be playing catch-up with the company’s true potential. Digging deeper, the narrative framework reflects a more nuanced outlook shaped by both sector trends and company-specific factors.

Despite the near-term focus on supply constraints and favorable rent spreads, large tenants increasingly prefer mega-fulfillment and build-to-suit assets. Continued consolidation among major logistics users could erode demand for STAG's core single-tenant, mid-sized facilities, posing downside risk to occupancy, leasing spreads, and long-term net operating income.

What exactly is driving this valuation premium? The assumptions behind the headline number rely on a bold set of growth forecasts and margin shifts, plus a future profit multiple that turns heads in any industrial REIT debate. Find out which financial forecasts and valuation leaps sit at the heart of the narrative and could spark a new round of analyst battles.

Result: Fair Value of $41.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent vacancy in key markets and tenant migration toward larger fulfillment centers could challenge STAG’s growth outlook if sector conditions deteriorate further.

Find out about the key risks to this STAG Industrial narrative.

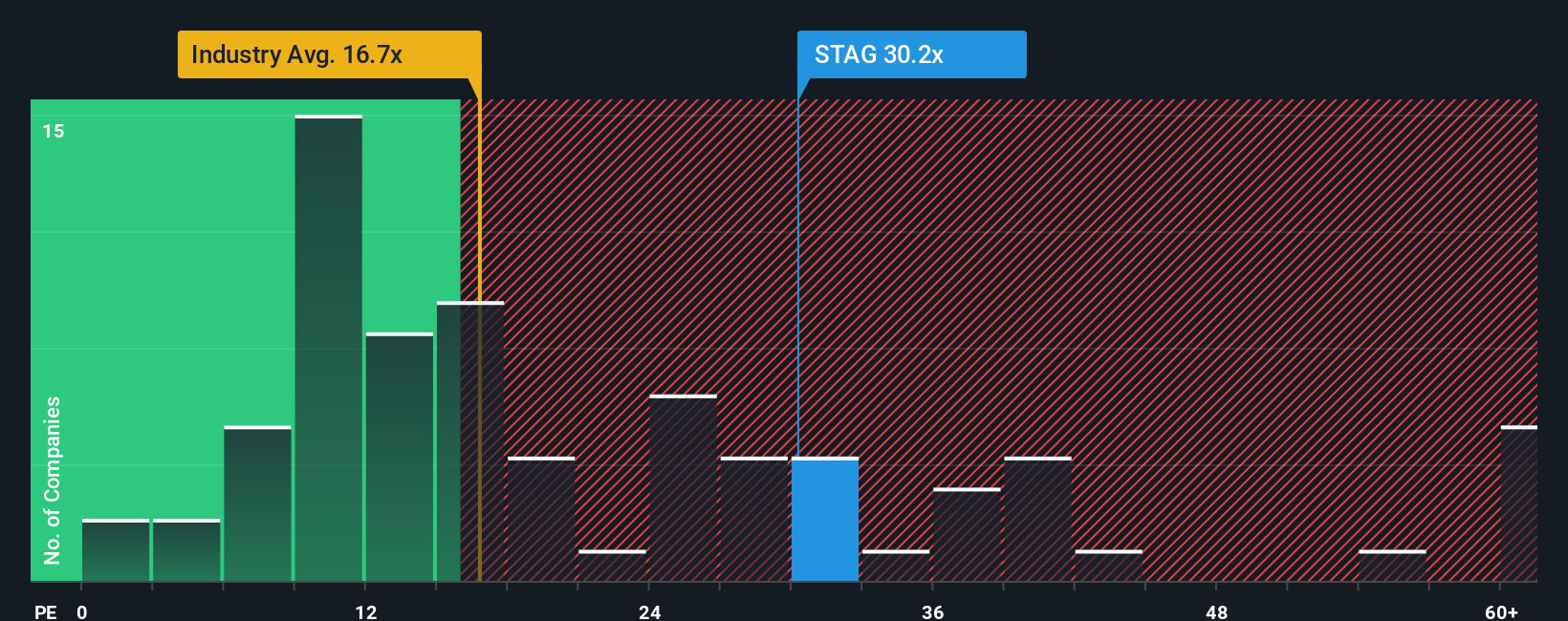

Another View: Market Multiples Tell a Cautionary Story

While the narrative suggests STAG Industrial is undervalued, a look at the price-to-earnings ratio paints a more cautious picture. The stock trades at 30.3 times earnings, which is higher than both the industry average of 16.1x and the peer average of 29.8x. The fair ratio, based on market expectations, also sits just below at 29.8x. This kind of premium indicates that investors are already paying for future growth, leaving less room for upside if results fall short. Does this high valuation signal untapped resilience, or could it limit future gains?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own STAG Industrial Narrative

If you see things differently or want to chart your own perspective, it’s easy to dive into the numbers yourself and shape your own story in just a few minutes. Do it your way

A great starting point for your STAG Industrial research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don't just stop with STAG Industrial. The Simply Wall Street Screener highlights opportunities that are too promising to leave on the table. Supercharge your portfolio by tapping into next-level investment trends you don't want to miss.

- Accelerate your returns by backing innovative firms powering tomorrow’s AI breakthroughs with these 25 AI penny stocks.

- Strengthen your cash flow with steady income from companies offering reliable yields through these 17 dividend stocks with yields > 3%.

- Jump on game-changing businesses that the market still undervalues by screening for potential standouts among these 918 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:STAG

STAG Industrial

A real estate investment trust focused on the acquisition, development, ownership, and operation of industrial properties throughout the United States.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives