- United States

- /

- Health Care REITs

- /

- NYSE:SILA

Sila Realty Trust (SILA): Earnings Growth of 54.5% Reinforces Bullish Margin Expansion Narratives

Reviewed by Simply Wall St

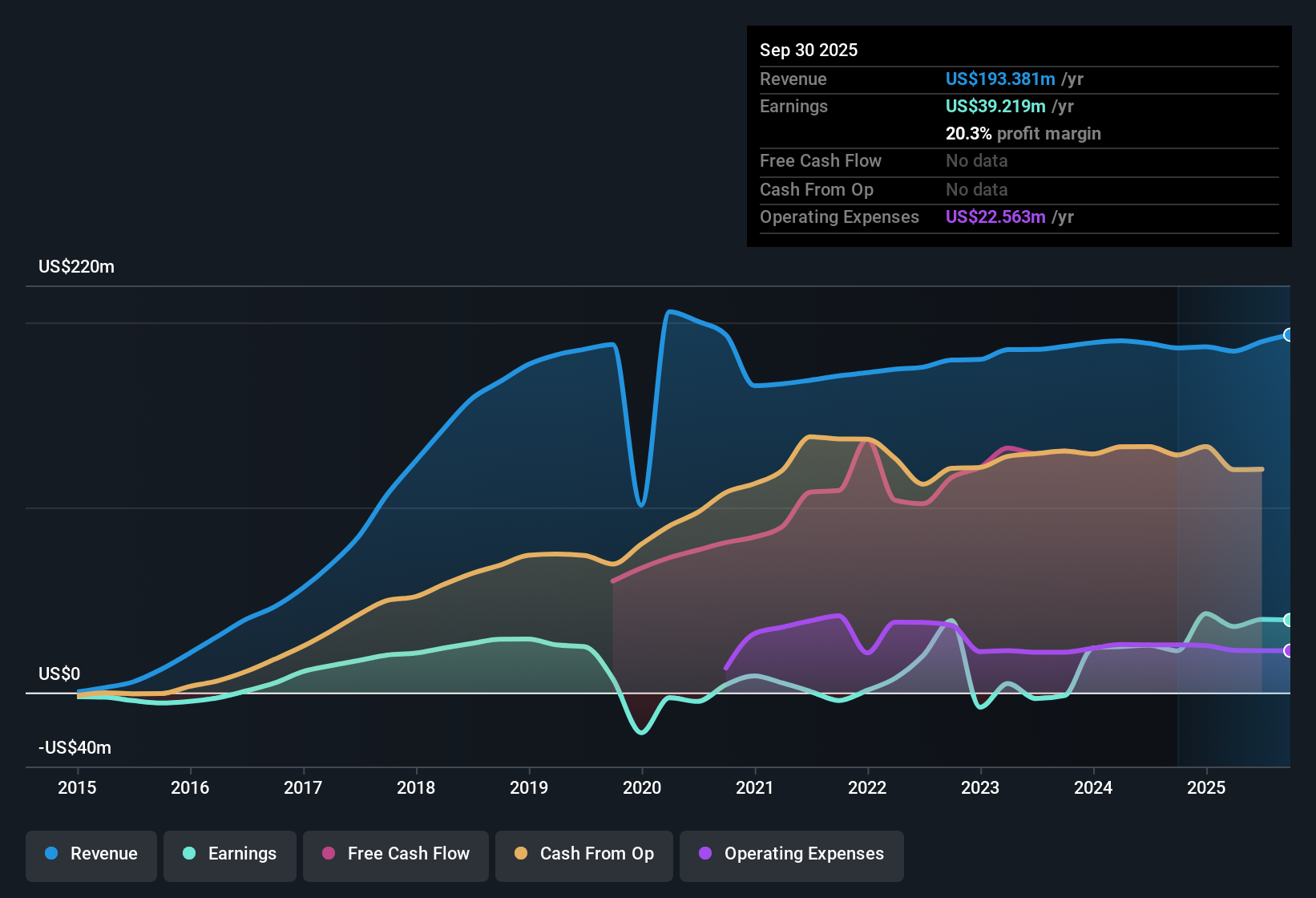

Sila Realty Trust (SILA) delivered another set of high quality earnings, with profitability expanding at an impressive 44.7% annually over the past five years and most recently recording earnings growth of 54.5%. Net profit margins have climbed to 20.9%, up from last year’s 13.6%. Revenue is forecast to grow at 9.6% per year, with earnings expected to rise 12.8% annually, even though both rates fall short of the broader US market. Trading below analyst estimates of fair value and with margins on the rise, Sila’s mix of accelerating profitability and attractive price metrics is likely to keep investors watching closely.

See our full analysis for Sila Realty Trust.Next, we will see how these earnings results compare with the most widely held narratives around Sila Realty Trust and which parts of the story could shift as a result.

See what the community is saying about Sila Realty Trust

DCF Fair Value Far Outpaces Current Price

- Sila Realty Trust’s current share price of $23.48 trades at a deep discount not just to its analyst target of $28.70, but also to a DCF fair value of $68.05. This signals a wide gap between market pricing and growth expectations.

- According to the analysts' consensus view, structural industry tailwinds from aging demographics and necessity-based healthcare further support the idea that Sila’s strategic focus offers stable occupancy and expanding margins.

- Revenue is projected to grow at 8.7% per year with profit margins expected to climb from 20.9% to 22.5% in three years, providing runway for continued price appreciation.

- Even after recent strong earnings, the consensus price target suggests nearly 22% upside from today’s share price, if the company hits its growth forecasts.

For a full breakdown of how analysts size up Sila’s risk and reward, and to see the major investment debates in detail, tap into the full consensus narrative. 📊 Read the full Sila Realty Trust Consensus Narrative.

Price-to-Earnings: Peer Discount, Sector Premium

- Sila’s price-to-earnings ratio is 32.6x, which is more attractive than its direct peers’ average of 42.8x, but higher than the broader global Health Care REITs benchmark of 24x. This positions the stock as a relative bargain locally but not versus the sector.

- Consensus narrative notes this P/E discount versus peers bolsters the value case for Sila, especially as its steady acquisition of specialized facilities and discipline in pruning underperforming assets aim for further margin expansion.

- Analysts see long-term cash flow growth as sustainable if Sila continues to execute on outpatient and specialty care acquisitions carrying above-average cap rates.

- However, the higher P/E than the sector average is a reminder that stability comes at a relative price; investors are paying a premium for perceived resilience and strategic focus within a growth industry.

Dividend and Financial Strength: Stability Versus Growth Risk

- Key risks flagged for Sila center on its financial position and dividend sustainability. While the company’s balance sheet is seen as conservative and liquidity robust, there are concerns about ongoing exposure to rising interest expenses and the sustainability of its dividend payouts.

- The consensus narrative emphasizes that, even with a track record of profit and revenue growth, issues like the Landmark Hospitals bankruptcy and episodic tenant vacancies make dividend maintenance a potential pressure point.

- Elevated funding costs from acquisition-driven borrowing and demolition expenses (such as $1.9 million at Stoughton) could erode funds available for dividends and restrict future growth.

- Catalysts for long-term dividend growth exist, but portfolio turnover due to underperforming tenants and lingering sector volatility should keep investors on alert for payout changes in the years ahead.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Sila Realty Trust on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Notice something others might have missed? It takes just a few minutes to build your own take and share your unique perspective. Do it your way

A great starting point for your Sila Realty Trust research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Sila Realty Trust faces growing concerns about its ability to sustain dividends as a result of rising interest expenses, episodic tenant vacancies, and sector volatility.

If you’re after reliability and want stronger payout stability, check out these 1979 dividend stocks with yields > 3% to spot income stocks with a track record of durable, higher-yield dividends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SILA

Sila Realty Trust

Sila Realty Trust, Inc., headquartered in Tampa, Florida, is a net lease real estate investment trust with a strategic focus on investing in the growing and resilient healthcare sector.

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives