- United States

- /

- Health Care REITs

- /

- NYSE:SILA

Is Sila Realty Trust Fairly Priced After New Outpatient Facility Investment in 2025?

Reviewed by Bailey Pemberton

Trying to figure out what to do next with Sila Realty Trust stock? You are not alone. Investors are weighing their choices as Sila’s price has seen a few twists over the past year. The stock recently closed at $24.38. Over the last seven days, it slipped by 2.9%, and the last month shows a similarly cautious dip of 2.2%. Yet, zooming out a bit, Sila is up 1.6% so far this year and 2.7% over the last twelve months. While these are not wild swings, the steady, if modest, climb has caught the eye of many people looking for stable growth or a potential value play.

Much of this movement happens in the context of ongoing changes in the broader real estate market, with increasing attention on health-care-oriented REITs and their ability to weather economic uncertainty. For Sila, the risk perception seems to be easing, although not enough to spark a rally, but enough to keep downside moves limited. With many other real estate stocks facing more pressure, Sila’s resilience could signal potential that is not yet fully recognized by the market.

So, is Sila Realty Trust undervalued right now, or is the market already wise to its potential? According to our analysis, Sila’s valuation score comes in at 4 out of 6, meaning it is undervalued on four major valuation checks. But numbers are just the starting point. Next, I will break down each approach that goes into this score, and later, introduce you to a way of thinking about valuation that could offer an even clearer perspective.

Why Sila Realty Trust is lagging behind its peers

Approach 1: Sila Realty Trust Discounted Cash Flow (DCF) Analysis

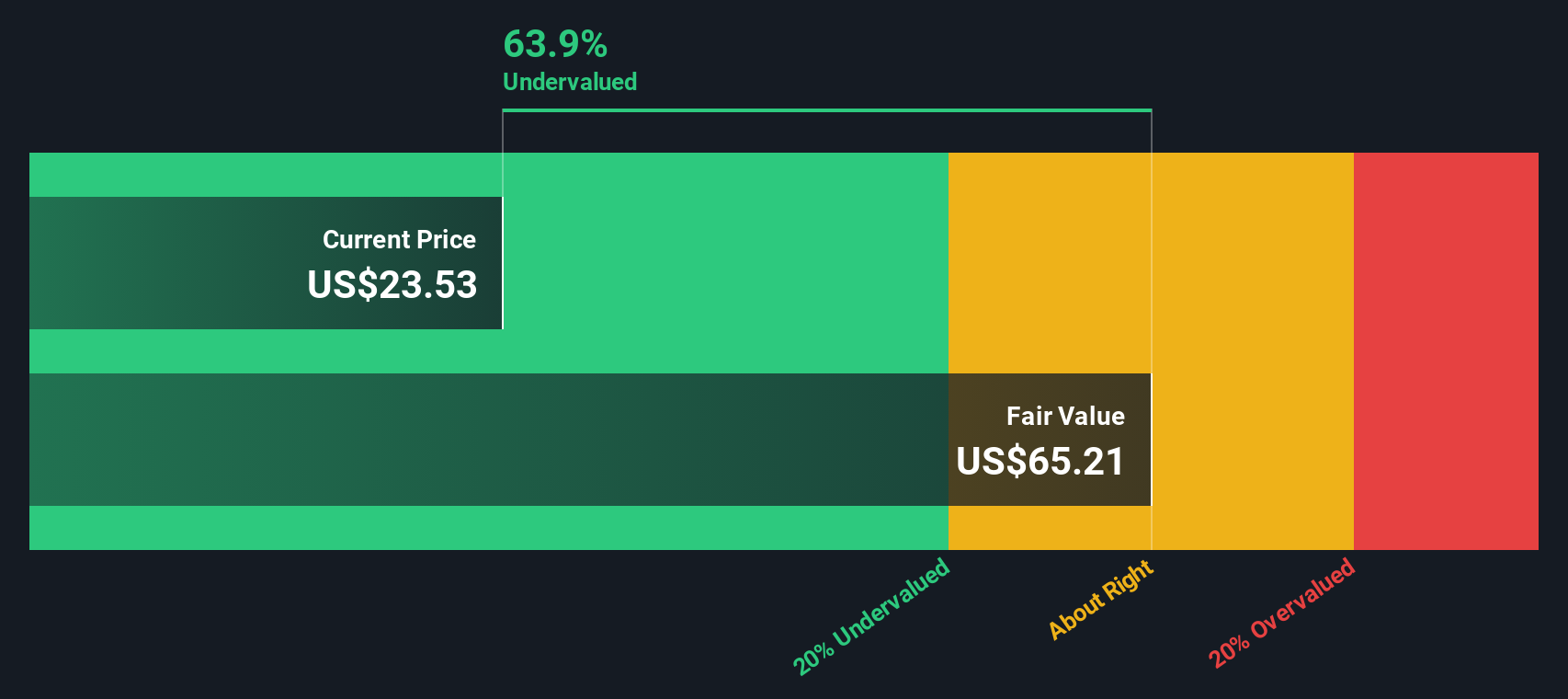

The Discounted Cash Flow (DCF) model estimates the true value of a business by projecting its future cash flows and discounting them back to present value. For Sila Realty Trust, this analysis is based on adjusted funds from operations, capturing how much cash the company is likely to generate that can be returned to shareholders.

Currently, Sila reports $131.08 million in free cash flow. Over the next five years, analyst forecasts suggest this number will increase steadily and reach $169.67 million by 2029. Beyond the analyst window, Simply Wall St extrapolates continued growth and estimates annual free cash flows topping $228 million by 2035. All figures are denominated in US dollars and should be viewed in the context of a stable, health-care-oriented REIT.

Based on these projections, Sila's intrinsic value per share is calculated at $65.60. With the current market price at $24.38, the DCF model indicates the stock is trading at a significant 62.8% discount to its estimated fair value. This strongly suggests the market is underappreciating Sila’s growth and cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Sila Realty Trust is undervalued by 62.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

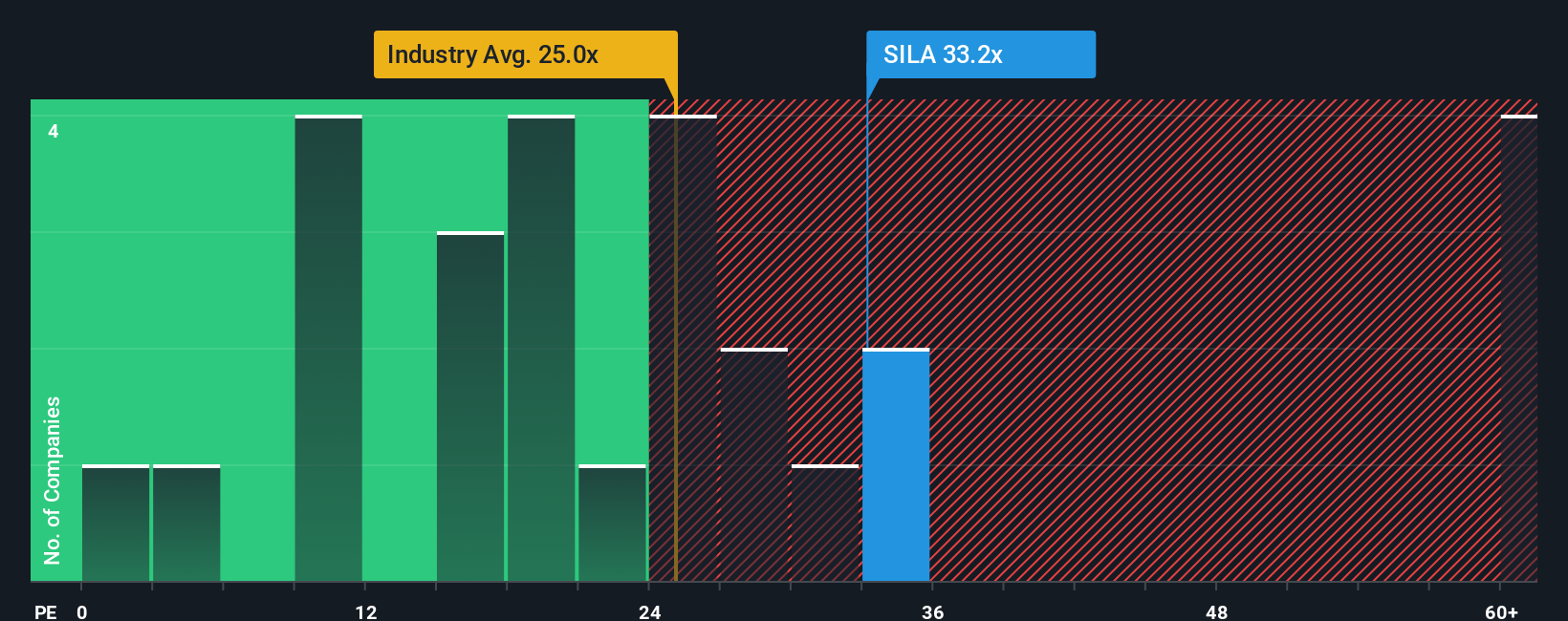

Approach 2: Sila Realty Trust Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like Sila Realty Trust, since it directly links the company’s market value to the earnings it generates for shareholders. A higher PE can signal stronger growth expectations or lower perceived risk. Conversely, a lower PE may point to slower growth, higher risk, or potential undervaluation. Determining what counts as a "fair" PE ratio often requires context, taking into account peers, growth rates, risks, and broader industry conditions.

At present, Sila trades at 34x earnings. This compares favorably to the average PE ratio of Health Care REITs at around 24.3x, as well as to its peer average of 43.5x. However, straightforward comparisons like these can miss the bigger picture because not every company’s risks or prospects are the same. This is where Simply Wall St’s proprietary "Fair Ratio" comes in. Calculated at 35.7x for Sila, this Fair Ratio weighs growth, profit margins, industry context, market cap, and risk profile specifically for the company, making it a more tailored benchmark than simple peer or industry averages.

When comparing Sila’s current PE of 34x to its Fair Ratio of 35.7x, the difference is very slight. This suggests the stock’s market price aligns very closely with what would be considered fair value based on its fundamentals and outlook.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Sila Realty Trust Narrative

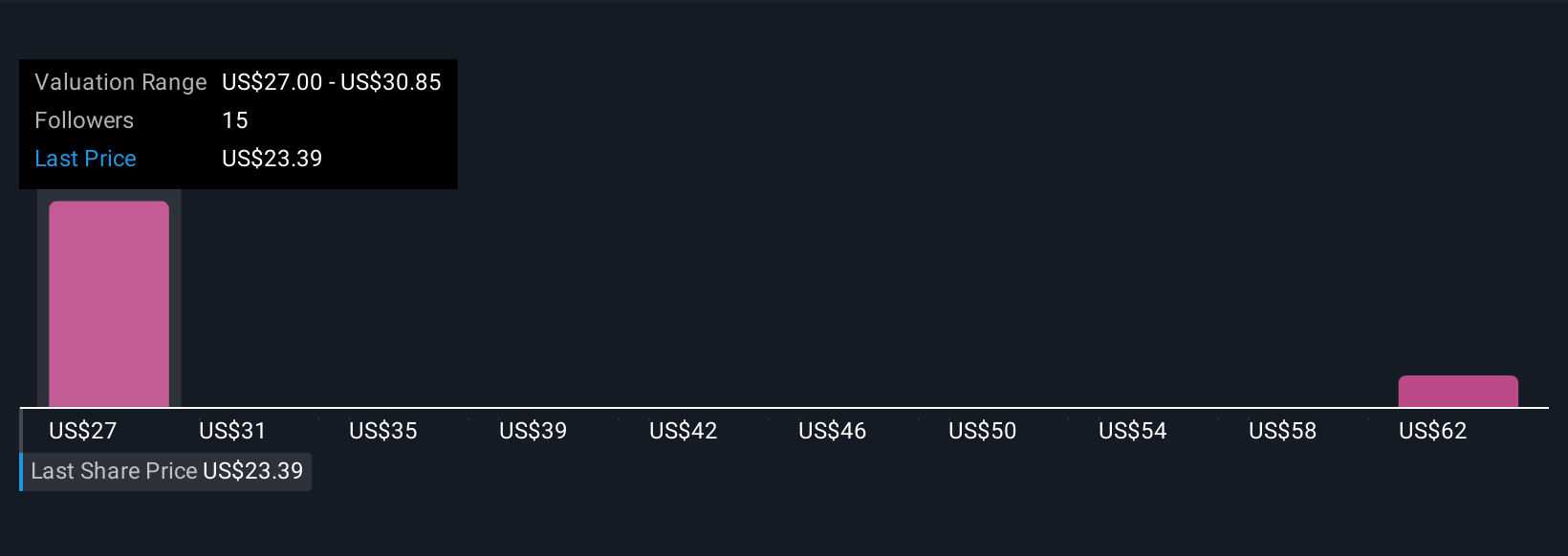

Earlier, we mentioned there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your story about a company, connecting your view or thesis (why you think Sila Realty Trust will outperform or underperform) to a set of financial forecasts, like future revenues, earnings, and margins. Instead of seeing numbers in isolation, Narratives let you link this story to a calculated fair value, drawing a clear line from your assumptions to the price you’re willing to pay.

Narratives are an easy, interactive feature on Simply Wall St’s Community page, used by millions of investors to share and test their thinking. They help you decide when to buy or sell by comparing your own Fair Value estimate, shaped by your Narrative, to the current share price. They update automatically as new news or earnings arrive so your assumptions stay fresh and relevant.

For example, one investor might build a bullish Narrative around Sila’s expansion into specialized outpatient care, forecasting strong earnings growth and arriving at a fair value of $35 per share. Another might see risks from regulatory changes and slower rent growth, assigning a much lower fair value of $25. By exploring these different Narratives, you can easily sense-check your own viewpoint, see where you agree or differ, and make investment decisions that are grounded in your unique understanding of Sila’s future.

Do you think there's more to the story for Sila Realty Trust? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SILA

Sila Realty Trust

Sila Realty Trust, Inc., headquartered in Tampa, Florida, is a net lease real estate investment trust with a strategic focus on investing in the growing and resilient healthcare sector.

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives