- United States

- /

- Hotel and Resort REITs

- /

- NYSE:SHO

A Look at Sunstone Hotel Investors's Valuation After $1.35 Billion Debt Refinancing and Balance Sheet Overhaul

Reviewed by Kshitija Bhandaru

Most Popular Narrative: Fairly Valued

The current analyst consensus views Sunstone Hotel Investors as fairly valued, with expectations grounded in a mix of steady revenue growth, rising earnings, and an evolving asset base.

Sustained outperformance at luxury resorts and branded lifestyle hotels, coupled with portfolio flexibility and a strong balance sheet, enables Sunstone to capitalize on the long-term preference shift toward unique, upscale lodging experiences. This supports resilient earnings and asset appreciation in inflationary environments.

Considering the narrative that underpins this fair valuation? There are bold projections and carefully chosen assumptions packed into the analysis, but only a handful of numbers truly tip the scales. The key question is how aggressive these underlying growth targets are for Sunstone. A closer look at the model may reveal surprises in the expectations it sets.

Result: Fair Value of $9.64 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent weakness in key markets and costly, ongoing renovations could undermine Sunstone’s bullish outlook and put near-term earnings growth at risk.

Find out about the key risks to this Sunstone Hotel Investors narrative.Another View: Discounted Cash Flow Perspective

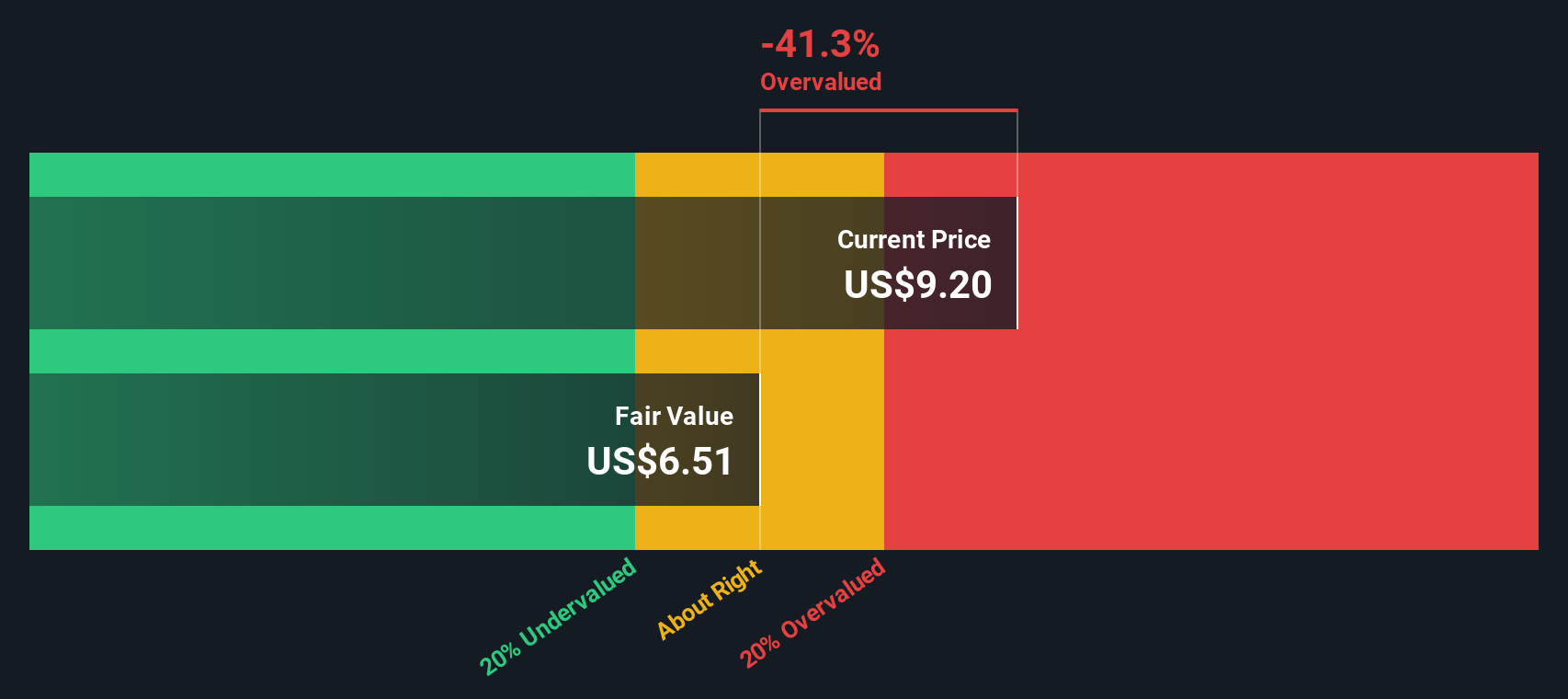

Taking a different tack, our DCF model paints a less optimistic picture. It suggests Sunstone’s shares may actually be overvalued if future cash flows do not grow as strongly as analysts assume. Which side will prove right?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Sunstone Hotel Investors Narrative

For those who want to dig into the numbers themselves or bring a different perspective, our tools make it easy to generate your own analysis in just a few minutes. Do it your way.

A great starting point for your Sunstone Hotel Investors research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Ready for More Winning Investment Ideas?

There’s never been a better time to grow your portfolio with game-changing strategies. Don’t miss out on these standout themes capturing real investor momentum right now:

- Unlock high yields and steady income to fuel your passive returns with leading opportunities in dividend stocks with yields > 3%.

- Accelerate your strategy by targeting tomorrow’s tech leaders and spot early-stage disruptors in artificial intelligence through AI penny stocks.

- Propel your search for misunderstood gems by zeroing in on companies trading below their true worth using our pick for undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SHO

Sunstone Hotel Investors

A lodging real estate investment trust ("REIT") that as of the date of this release owns 14 hotels comprised of 6,999 rooms, the majority of which are operated under nationally recognized brands.

Slight risk with moderate growth potential.

Market Insights

Community Narratives