- United States

- /

- Hotel and Resort REITs

- /

- NYSE:RLJ

Will RLJ Lodging Trust's (RLJ) Focus on Non-Room Revenue Redefine Its Portfolio Strategy?

Reviewed by Sasha Jovanovic

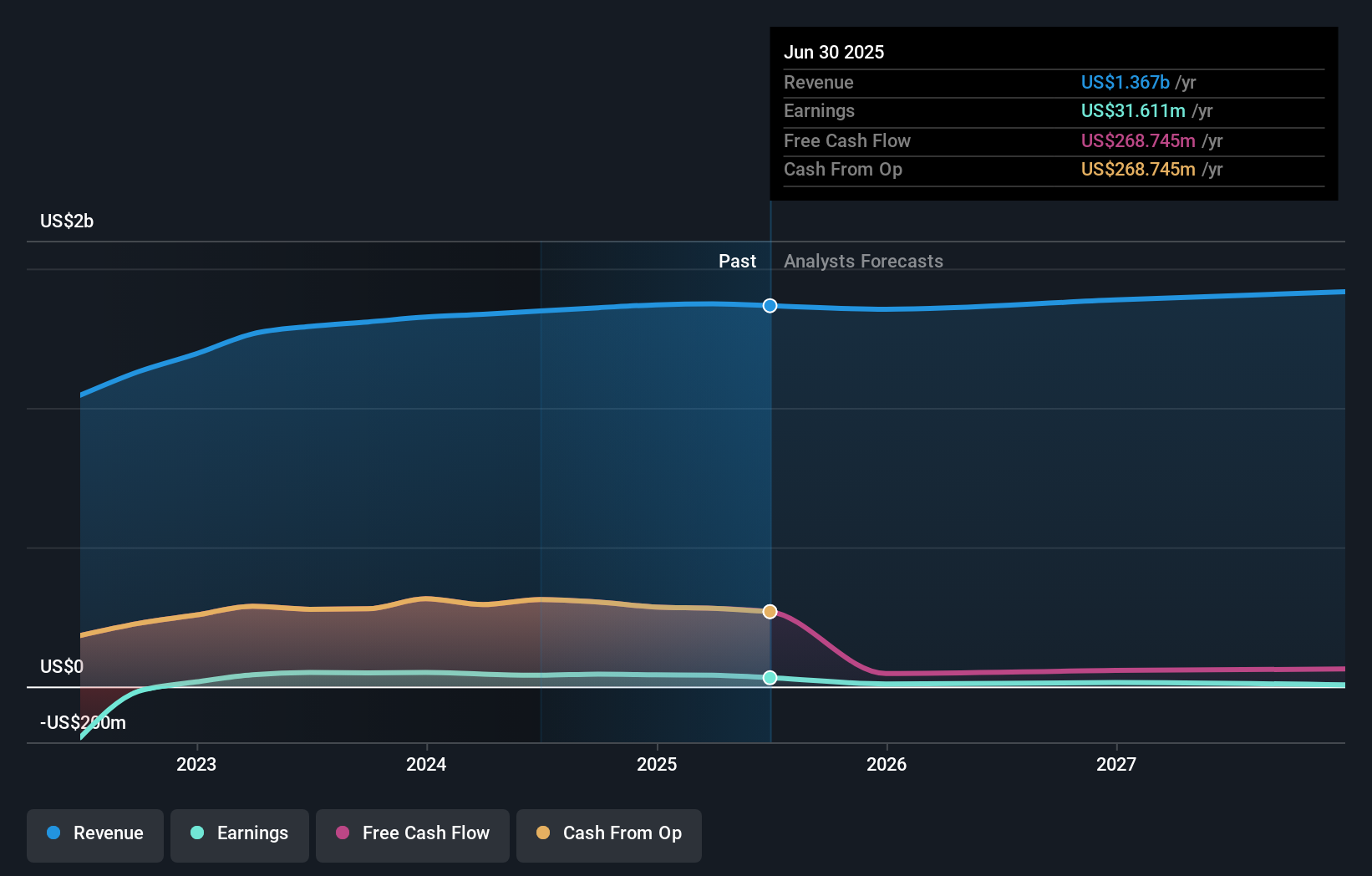

- RLJ Lodging Trust recently reported its third quarter 2025 earnings, revealing a net loss of US$3.74 million with revenues falling 4.5% year over year to US$330.05 million, while reaffirming full-year guidance and sharing updates on its renovation progress and property portfolio.

- The company’s increased non-room revenue and asset renovations signal a focus on unlocking long-term value despite short-term operational challenges such as market volatility and a slower ramp-up from recent projects.

- We’ll look at how RLJ Lodging Trust’s emphasis on out-of-room revenue growth informs its evolving investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is RLJ Lodging Trust's Investment Narrative?

For anyone considering RLJ Lodging Trust, the big picture hinges on whether you believe the company's turnaround plans, focused on property upgrades, non-room revenue streams, and capital recycling, can offset pressures from softening room demand and sector headwinds. This quarter’s net loss and diluted loss per share of US$0.07 point to ongoing operational hurdles, though the company reaffirmed its full-year earnings guidance. That signals management’s confidence, but results have sharpened scrutiny on short-term catalysts, especially the completion of key renovations and their ability to drive higher returns in urban markets. At the same time, risks such as macro volatility, higher financing costs, and ongoing competitive threats may weigh more heavily than before, especially with profit margins down and share price returns lagging benchmarks. While the immediate financial impact from this latest news event appears already digested by the market, investors are more likely to weigh operational execution and near-term performance against RLJ’s longer-term recovery story.

But there are growing concerns about pressure on profit margins, something investors should keep a close eye on. RLJ Lodging Trust's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 3 other fair value estimates on RLJ Lodging Trust - why the stock might be worth just $8.66!

Build Your Own RLJ Lodging Trust Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your RLJ Lodging Trust research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free RLJ Lodging Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate RLJ Lodging Trust's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RLJ

RLJ Lodging Trust

RLJ Lodging Trust ("RLJ") is a self-advised, publicly traded real estate investment trust that owns 94 premium-branded, rooms-oriented, high-margin, urban-centric hotels located within the heart of demand locations.

Average dividend payer with moderate growth potential.

Market Insights

Community Narratives