- United States

- /

- Hotel and Resort REITs

- /

- NYSE:RHP

Ryman Hospitality Properties (RHP): Valuation in Focus After Analyst Initiation and Strategic Growth Moves

Reviewed by Kshitija Bhandaru

Ryman Hospitality Properties (RHP) caught investor attention after Cantor Fitzgerald initiated coverage with a constructive view. The firm highlighted the company’s $1 billion portfolio renovations, new JW Marriott Phoenix acquisition, and the announcement of a third-quarter cash dividend.

See our latest analysis for Ryman Hospitality Properties.

Ryman Hospitality Properties’ latest moves, including the major renovation push and new property acquisition, have put the spotlight back on its growth strategy. However, the market’s response has remained cool, with recent share price returns dipping slightly. Still, its five-year total shareholder return stands higher, hinting that long-term investors have seen value build over time even as short-term momentum has faded.

If you’re eager to see what other dynamic companies might be worth a closer look, now’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

With Ryman’s ongoing transformation and a share price still well below analyst targets, the question remains: is the market missing a real buying opportunity, or is it simply factoring in all the company’s future growth?

Most Popular Narrative: 21.5% Undervalued

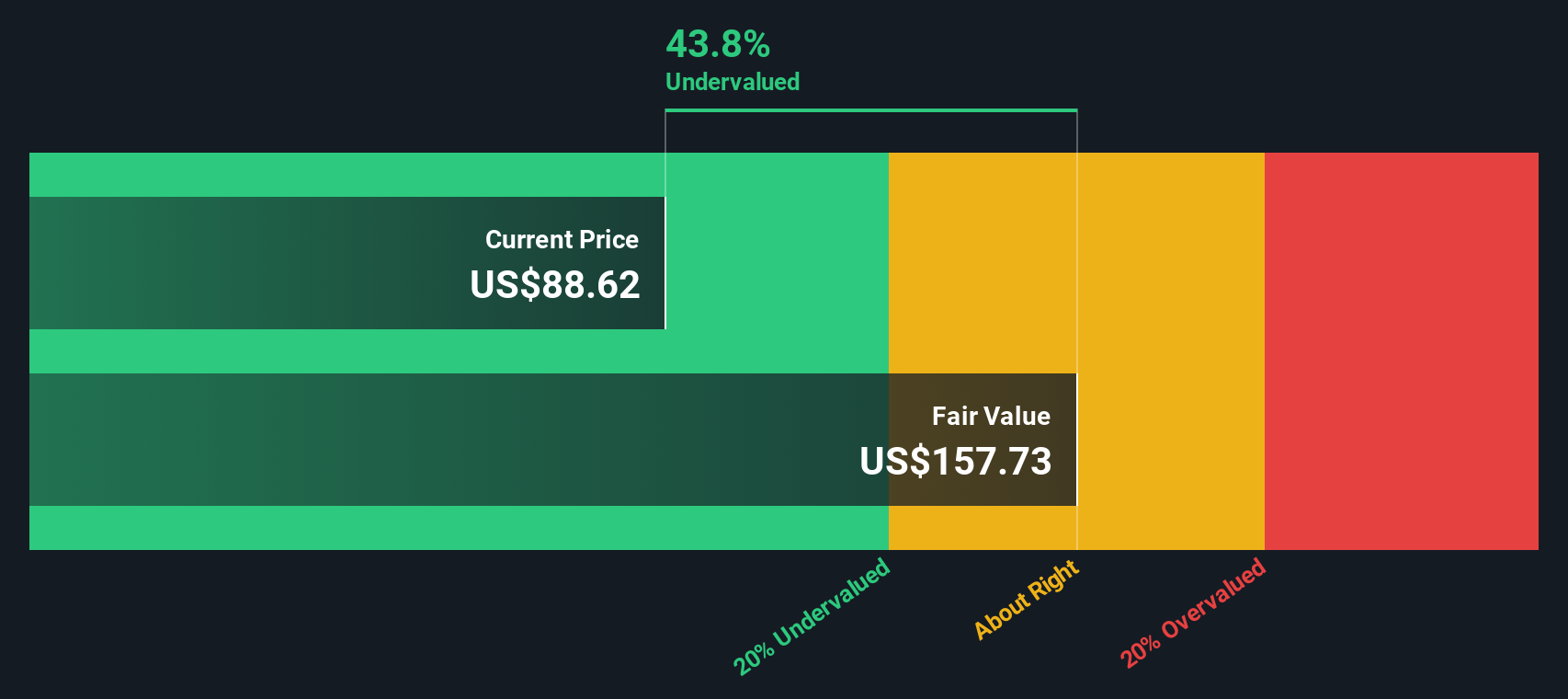

The narrative consensus points to a sizeable gap between Ryman Hospitality Properties' fair value and its last close, revealing bullish estimates that outpace the stock’s actual pricing. The optimistic valuation is rooted in major structural investments and positioning, which could set up a sharp rerating if the narrative proves right.

Recent acquisitions and ongoing capital investments (e.g., JW Marriott Desert Ridge, meeting space upgrades at Gaylord properties) put Ryman in a strong position to capitalize on renewed appetite for large-scale experiential travel and gatherings, supporting revenue growth and long-term cash flow.

Want to see what’s driving this hefty valuation premium? The narrative leans on aggressive assumptions for revenue, margins, and profit scaling, which could define the next chapter. Curious which bold projections and financial leaps push the fair value up? Unlock the full story and dig into the catalyst metrics behind this estimate.

Result: Fair Value of $115.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing competition in key markets and rising labor costs could undermine Ryman’s growth story if demand or margins do not meet expectations.

Find out about the key risks to this Ryman Hospitality Properties narrative.

Another View: What Does the SWS DCF Model Say?

Looking from a different angle, the SWS DCF model estimates Ryman Hospitality Properties’ fair value at $157.63, which is nearly 42% above its current share price. This deeper cash flow analysis suggests the stock could be much more undervalued than multiples alone indicate. Could the market be overlooking Ryman’s long-term fundamental value?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Ryman Hospitality Properties Narrative

If you want to dig deeper or weigh the numbers differently, you can craft your own perspective in just a few minutes. Do it your way

A great starting point for your Ryman Hospitality Properties research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Great investing goes beyond one company. Don’t let remarkable opportunities pass you by. Now is the time to target fast-changing markets and standout trends using our powerful screeners:

- Seize the momentum of digital innovation by checking out these 24 AI penny stocks, where companies are pioneering artificial intelligence breakthroughs and new business frontiers.

- Grab your share of hidden value by targeting these 896 undervalued stocks based on cash flows, revealing businesses priced well below their true potential based on future cash flows.

- Catch the wave of healthcare transformation with these 32 healthcare AI stocks and get ahead of the curve in AI-driven medical technology and biotech advances.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RHP

Ryman Hospitality Properties

Ryman Hospitality Properties, Inc. (NYSE: RHP) is a leading lodging and hospitality real estate investment trust that specializes in upscale convention center resorts and entertainment experiences.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives