- United States

- /

- Office REITs

- /

- NYSE:PSTL

Postal Realty Trust (PSTL): Net Margin Surge Reinforces Bullish Narratives Despite Financial Position Risk

Reviewed by Simply Wall St

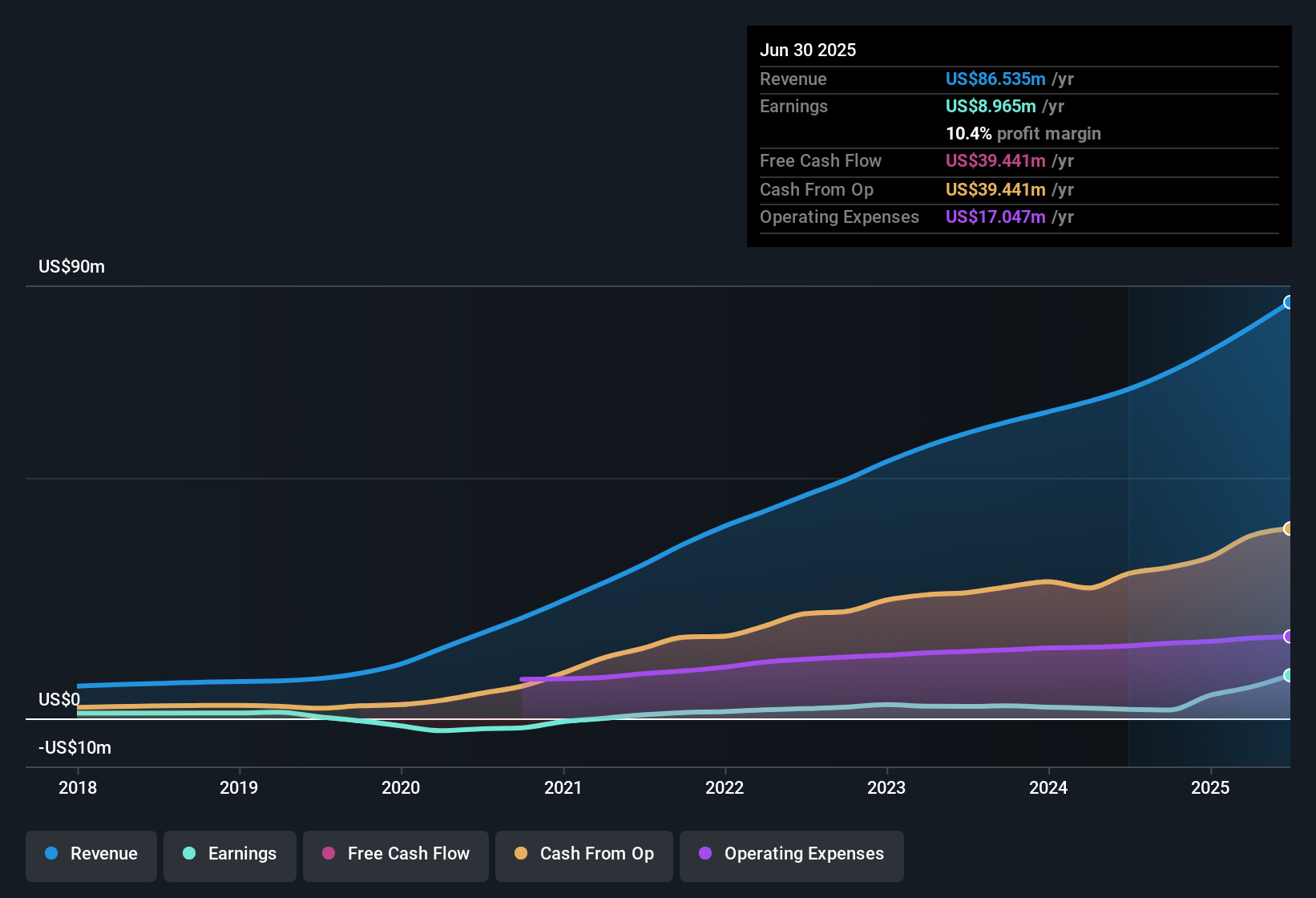

Postal Realty Trust (PSTL) delivered a net profit margin of 10.4%, a substantial leap from last year’s 2.7%, as robust earnings fueled a 377.6% jump in growth over the past year. The company has built a five-year track record of consistent profitability gains and, looking forward, earnings are projected to grow at roughly 10% annually with revenue forecast to rise 11.5% per year, ahead of the general US market. Investors are weighing these strong margin improvements and sustained profit growth against the fact that the stock trades at a premium to global office REITs. However, it still appears attractively valued against peers and its estimated fair value.

See our full analysis for Postal Realty Trust.Next up, we’ll see how these headline results compare to the most widely followed narratives among analysts and investors. Some assumptions may get confirmed, while others could be up for debate.

See what the community is saying about Postal Realty Trust

Share Price Lags DCF Valuation by Wide Margin

- Postal Realty Trust’s current share price of $15.23 is trading at a steep discount compared to its DCF fair value of $57.38. This is despite a price-to-earnings ratio of 44.1x, which sits above the global office REITs average of 22.3x.

- Analysts' consensus view emphasizes that the company’s relatively high P/E ratio, combined with its lower share price versus the DCF fair value, challenges the notion that Postal Realty Trust is overvalued by the market.

- While the share price is below both the estimated DCF fair value and the 17.18 analyst price target, the premium P/E compared to industry averages could signal market confidence in robust future growth or reflect a willingness to pay for perceived earnings safety.

- Analysts note that the small gap between the current share price and their price target suggests the market has already priced in much of the expected near-term growth, but a much larger upside remains open if DCF-based expectations play out.

See how the full narrative ties DCF value and price targets to analyst expectations in the complete Consensus Narrative. 📊 Read the full Postal Realty Trust Consensus Narrative.

Long-Term Leases Anchor Predictable Growth

- Over half of Postal Realty Trust’s portfolio now consists of 10-year leases with annual rent escalations. This solidifies a path to annual revenue growth that analysts peg at 12.8% for the next three years.

- Analysts' consensus view points out that lease duration and escalator features offer a stabilizing force, directly supporting predictable top-line growth. However, there is tension between the benefit of accretive acquisitions and the risks tied to capped rent escalations and heavy dependence on USPS.

- The concentration risk with a single tenant (USPS) makes sustained revenue growth more sensitive to any operational changes or restructuring at USPS.

- Attractive lease terms and recurring escalators help neutralize some of these risks, locking in much of the projected revenue uplift even as broader mail trends evolve.

Profitability Metrics Outpace Five-Year Trend

- Net profit margin reached 10.4% this year, far above the five-year average annual earnings growth rate of 51.3%. This showcases efficiency gains and operating leverage beyond just top-line expansion.

- According to the analysts' consensus view, this margin improvement heavily supports the stance that efficient cost management and economies of scale have broadened the company’s earnings base. However, ongoing capex for property upkeep and limited rental escalation caps are key considerations.

- Lower-than-expected recurring CapEx and general and administrative costs, as a percent of revenue, have directly contributed to rising margins and higher AFFO per share.

- Analysts flag that, as the property portfolio ages, renovation and compliance spending may rise, potentially placing future pressure on margins if not managed carefully.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Postal Realty Trust on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the results? Take a moment to turn your view into a personal narrative. Share your perspective in just a few minutes. Do it your way

A great starting point for your Postal Realty Trust research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite strong recent results, Postal Realty Trust’s heavy reliance on a single tenant and capped rent escalations highlight risks to sustained growth and predictable performance.

Choose a smarter path with stable growth stocks screener (2073 results) to find companies offering consistent growth and fewer surprises as their business conditions change.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PSTL

Postal Realty Trust

Postal Realty Trust, Inc. (NYSE: PSTL) is an internally managed real estate investment trust that owns properties primarily leased to the United States Postal Service ("USPS").

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives