- United States

- /

- Industrial REITs

- /

- NYSE:PLD

Prologis (PLD): Assessing Valuation as Investor Interest Grows After Recent Stock Momentum

Reviewed by Simply Wall St

Prologis (PLD) has drawn attention from investors this week as its stock performance shows some interesting patterns compared to the broader market. The recent movement prompts a closer look at how the company is navigating the economic environment.

See our latest analysis for Prologis.

After a solid run in recent months, Prologis is showing renewed momentum, with a 90-day share price return of 12.69%. Over the last year, the total shareholder return stands at 12.60%, a pace that has attracted fresh interest among investors weighing valuation against growth potential.

If you want to see what other real estate leaders are doing, it’s worth checking out the fast growing stocks with high insider ownership screener for new ideas: fast growing stocks with high insider ownership

With Prologis outperforming many peers and inching close to analyst price targets, the key question for investors remains: Is there more upside to unlock, or has the market already factored in its future growth prospects?

Most Popular Narrative: 3.5% Undervalued

Prologis closed at $125.79, sitting just below the widely followed narrative’s fair value estimate of $130.30. This small premium hints that upbeat financial projections might be at play, even as the share price outpaces much of the industry.

Record-high leasing pipeline up 19% year-on-year, growing demand from large customers, and a historic level of build-to-suit signings point to pent-up demand. This is likely to translate to accelerated leasing activity and revenue growth as macro policy uncertainty dissipates.

Want to unravel the financial forecast fueling this premium pricing? Behind this fair value lies a mix of projected rental growth, surprising assumptions about future profit margins, and a bold revenue target that few expected. Only a closer look at the detailed narrative reveals the risk and the opportunity of the numbers driving this story.

Result: Fair Value of $130.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as elevated vacancies and cautious tenant decision-making could dampen leasing momentum and challenge the bullish outlook if macro conditions remain uncertain.

Find out about the key risks to this Prologis narrative.

Another View: What Do Earnings Multiples Say?

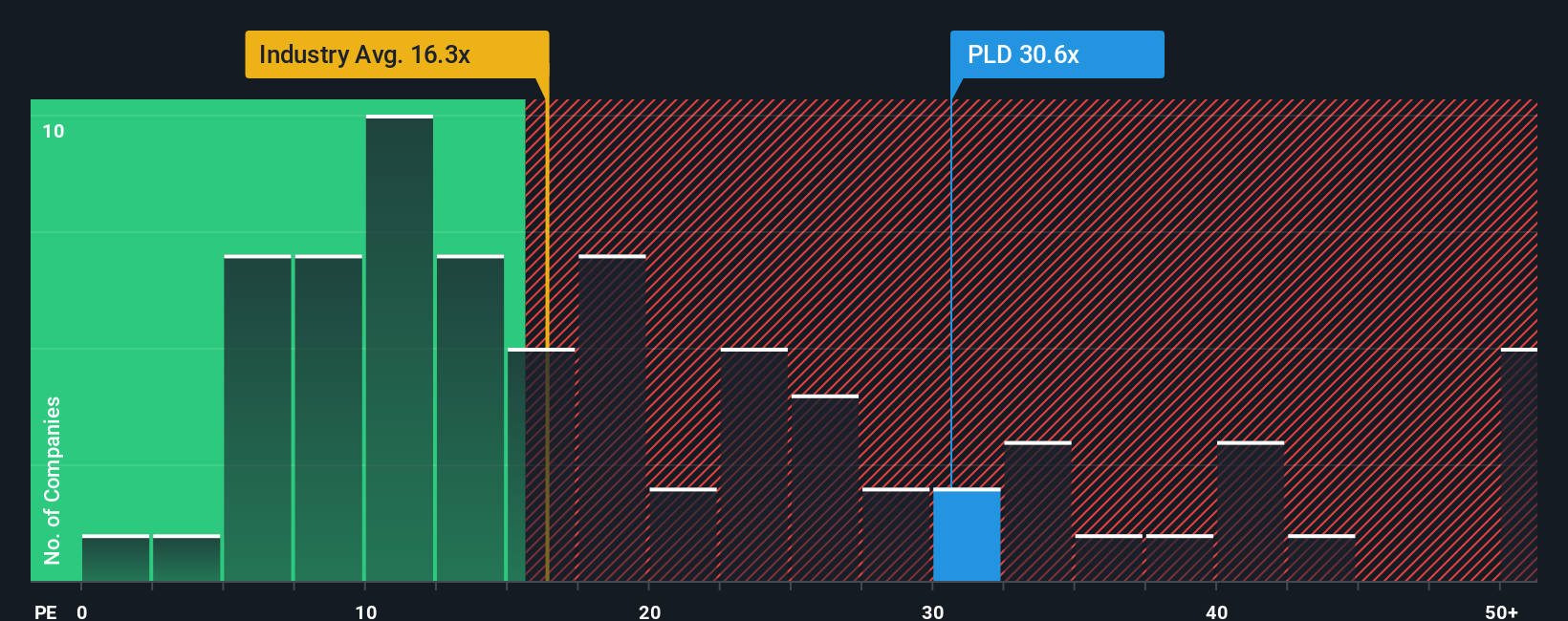

Taking a step back from fair value estimates, the latest market pricing puts Prologis’s price-to-earnings ratio at 36.5x. This is noticeably higher than both its U.S. peer average of 32.3x and the global industry average of 16.1x. The fair ratio stands at 33.9x, which hints Prologis may be trading at a premium. Does this premium mean investors are paying up for quality, or could it limit upside if growth stalls?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Prologis Narrative

If you see the numbers differently or want to follow your own line of research, try building your own view from scratch in just a few minutes. Do it your way

A great starting point for your Prologis research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never limit themselves to one opportunity. Branch out and gain an edge by applying our powerful screener tools to spot trends and untapped potential before the crowd does.

- Unlock steady income streams by targeting proven companies with strong yields using these 16 dividend stocks with yields > 3% for ideas that pay you back.

- Ride the artificial intelligence wave and spot future leaders early by leveraging these 26 AI penny stocks to access companies pushing the boundaries of innovation.

- Act now on value opportunities with these 926 undervalued stocks based on cash flows to uncover businesses trading for less than their true worth. Get ahead of the market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PLD

Prologis

Prologis, Inc., is the global leader in logistics real estate with a focus on high-barrier, high-growth markets.

Established dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives