- United States

- /

- Hotel and Resort REITs

- /

- NYSE:PK

A Look at Park Hotels & Resorts (PK) Valuation as Investor Sentiment Shifts

Reviewed by Kshitija Bhandaru

Park Hotels & Resorts (PK) stock is drawing investor attention lately, with shifts in its price performance over the past month raising new questions about the outlook for the company and the broader lodging sector.

See our latest analysis for Park Hotels & Resorts.

Park Hotels & Resorts has seen its share price edge lower over the year, with a modest 1-year total shareholder return of -11%. This suggests momentum has cooled, even as some recent quarterly moves hinted at renewed interest from investors. The long-term performance picture is more resilient, but short-term volatility underscores shifting perceptions around its growth and risk profile.

If the ups and downs in hospitality stocks have you thinking bigger, this could be your chance to discover fast growing stocks with high insider ownership

The recent volatility and lagging returns raise a key question: Is Park Hotels & Resorts currently trading below its true value, or are investor expectations for future growth already fully priced in?

Most Popular Narrative: 12.6% Undervalued

Park Hotels & Resorts last closed at $11.09, while the most widely followed narrative places fair value significantly higher. This suggests there is a gap between current trading and estimated potential. This sets up a debate over whether premium assets and strategic reshaping have truly been factored into the market’s pricing yet.

Strategic asset sales and portfolio reshaping, particularly the disposal of 18 non-core or underperforming hotels, are expected to improve portfolio quality, lift average RevPAR, and expand net margins. These actions could drive higher long-term earnings and reduce revenue volatility as focus shifts to premium, high-growth properties.

Curious how bullish assumptions could drive value higher? This narrative is pinned on ambitious forecasts for profit margin expansion, consistent revenue momentum, and a re-rating in future valuation multiples. Ready to discover which financial levers could spark a new cycle of earnings growth? Dive deep into the full story to unpack what’s behind this fair value.

Result: Fair Value of $12.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in international travel and the company’s significant upcoming debt maturities could still challenge Park Hotels & Resorts’ optimistic growth outlook.

Find out about the key risks to this Park Hotels & Resorts narrative.

Another View: Market Multiples Tell a Cautionary Tale

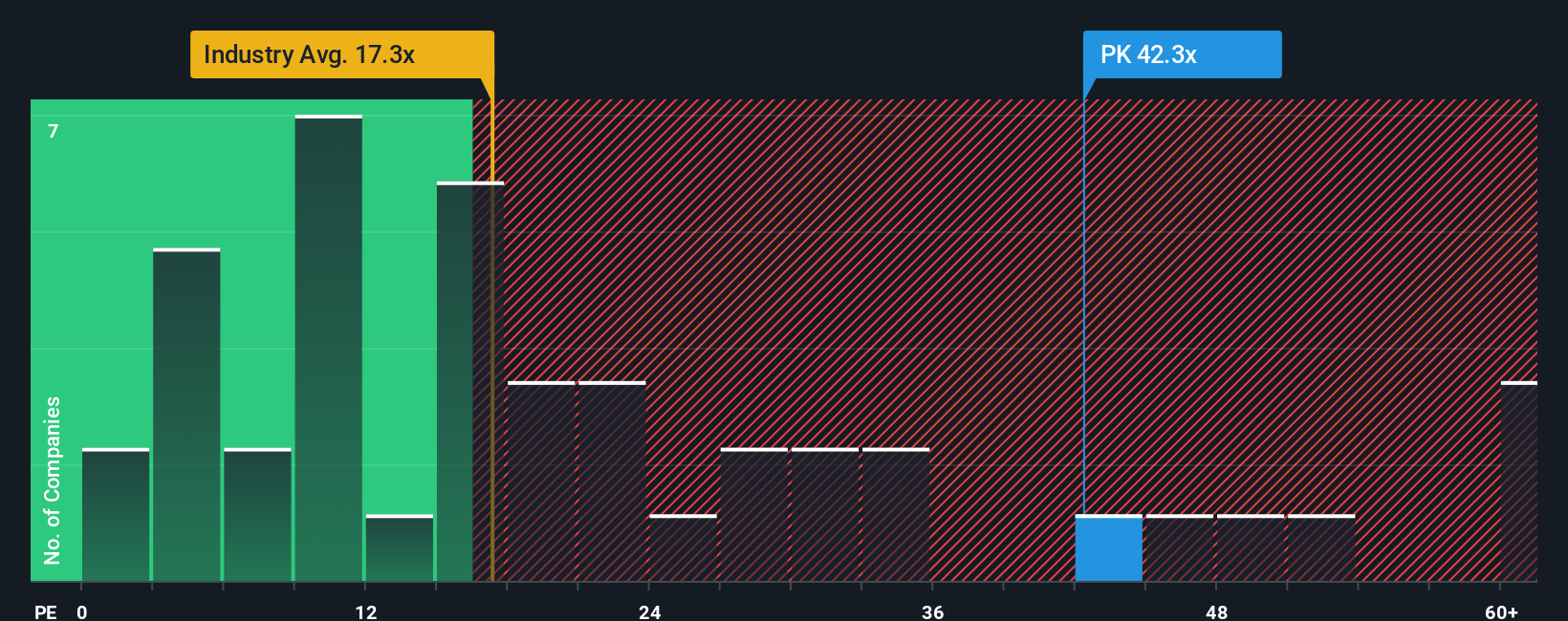

Looking at the price-to-earnings ratio, Park Hotels & Resorts appears expensive. Its ratio of 38.9x is well above both the industry average of 17.4x and its peer group at 24.7x. Even when compared to a fair ratio of 53.6x, this gap raises questions about the sustainability of its premium. Does this signal over-optimism or an overlooked growth story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Park Hotels & Resorts Narrative

If you want to take a different angle or dig into the numbers firsthand, you can explore your own perspective in just a few minutes with Do it your way.

A great starting point for your Park Hotels & Resorts research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let your search for returns end here. Unlock opportunities in different corners of the market by targeting the strategies and themes that matter most.

- Harness the momentum of smart automation by starting with these 24 AI penny stocks, where innovation is transforming global industries.

- Capture great value by investing in these 904 undervalued stocks based on cash flows, which stand out for their compelling cash flow potential.

- Tap into steady income streams with these 19 dividend stocks with yields > 3%, offering robust yields that can enhance your portfolio’s stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PK

Park Hotels & Resorts

Park is one of the largest publicly-traded lodging real estate investment trusts (“REIT”) with a diverse portfolio of iconic and market-leading hotels and resorts with significant underlying real estate value.

Undervalued average dividend payer.

Market Insights

Community Narratives