- United States

- /

- Specialized REITs

- /

- NYSE:OUT

OUTFRONT Media (OUT) Is Up 14.0% After Digital Transit Fuels Q3 Earnings Growth and Dividend Boost

Reviewed by Sasha Jovanovic

- OUTFRONT Media Inc. recently reported third quarter 2025 earnings, with revenue rising to US$467.5 million and net income growing to US$51.3 million, driven by a 23.7% increase in its transit segment and accelerated digital transit revenues.

- The company's expansion in digital offerings, including a new partnership with AWS, has enhanced its planning, buying, and measurement capabilities, supporting continued growth and leading to the declaration of a US$0.30 per share quarterly dividend payable on December 31, 2025.

- To assess how OUTFRONT Media's investment narrative may shift, we'll explore the impact of its strong digital transit growth and operational momentum.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

OUTFRONT Media Investment Narrative Recap

To be a shareholder in OUTFRONT Media, you need to believe in the company’s ability to drive long-term growth through digital transformation, especially in its transit and digital display segments. The recent third quarter earnings beat and robust transit revenue growth are directly in line with this thesis, reinforcing digital transit as the key short-term catalyst; however, the structural decline in static (non-digital) advertising assets remains the biggest risk. The latest results do not materially alter these dynamics, but add evidence of solid progress in digital execution.

The most relevant recent announcement is OUTFRONT’s new partnership with Amazon Web Services, aimed at enhancing its digital planning, buying, and measurement capabilities. This initiative supports the momentum in digital transit revenues by modernizing buying workflows and could further expand the company’s ability to attract digital ad budgets, reinforcing one of the core growth catalysts identified earlier.

But while digital momentum is clear, investors should be aware that ongoing declines in static transit boards represent a structural risk that may limit the full potential of OUTFRONT’s transformation and ...

Read the full narrative on OUTFRONT Media (it's free!)

OUTFRONT Media's narrative projects $2.0 billion revenue and $194.1 million earnings by 2028. This requires 2.8% yearly revenue growth and a $95.4 million increase in earnings from the current $98.7 million.

Uncover how OUTFRONT Media's forecasts yield a $19.50 fair value, a 3% downside to its current price.

Exploring Other Perspectives

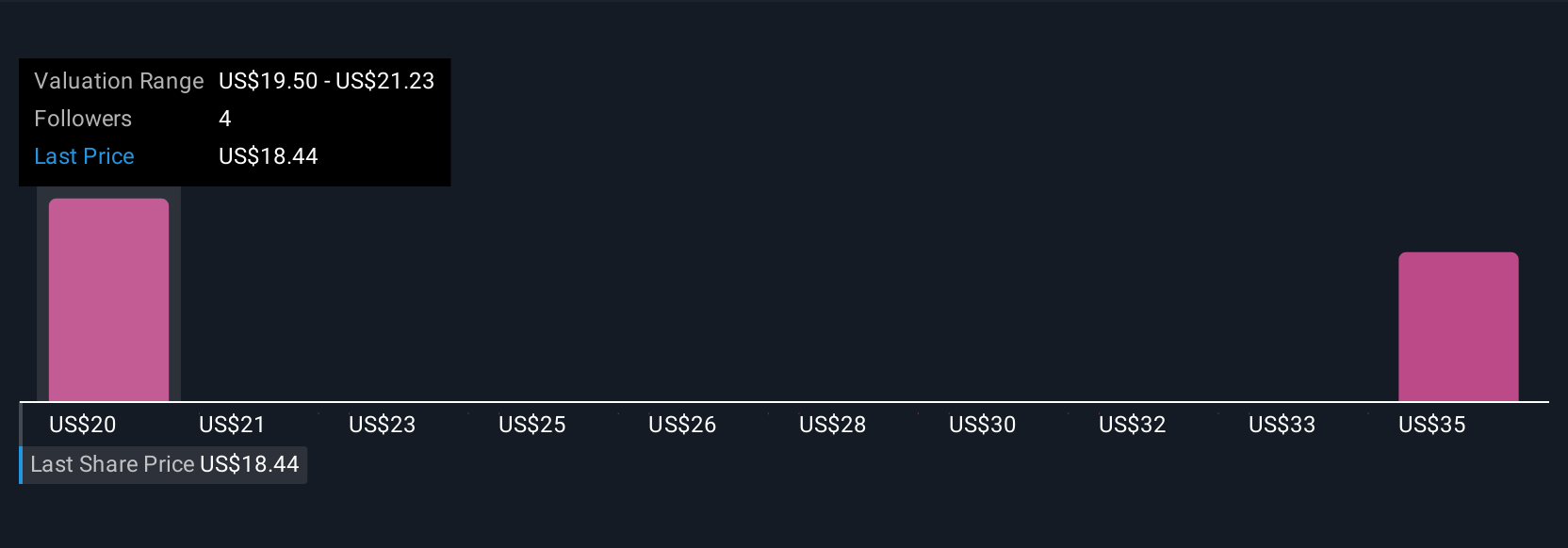

Simply Wall St Community fair value estimates for OUTFRONT Media range from US$19.50 to US$34.97 across two investor perspectives. While analysts point to digital transit growth as a major driver, your peers see room for widely different growth scenarios and risks, consider this diversity as you review your own outlook.

Explore 2 other fair value estimates on OUTFRONT Media - why the stock might be worth just $19.50!

Build Your Own OUTFRONT Media Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your OUTFRONT Media research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free OUTFRONT Media research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate OUTFRONT Media's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OUT

OUTFRONT Media

OUTFRONT is one of the largest and most trusted out-of-home media companies in the U.S., helping brands connect with audiences in the moments and environments that matter most.

Reasonable growth potential average dividend payer.

Market Insights

Community Narratives