- United States

- /

- Specialized REITs

- /

- NYSE:OUT

OUTFRONT Media (OUT): Evaluating Current Valuation as Shares Recover in a Shifting Advertising Market

Reviewed by Simply Wall St

See our latest analysis for OUTFRONT Media.

While OUTFRONT Media’s share price has moved up over the last three months, up 5.2%, its year-to-date share price return remains in the red. Looking long term, the stock’s total shareholder return has outpaced many in its sector. This signals steady momentum even as the advertising landscape remains in flux.

If recent signs of a turnaround have you scanning for the next opportunity, it’s a great moment to broaden your search and explore fast growing stocks with high insider ownership

With OUTFRONT Media trading below its analyst price target and showing strong long-term returns, the big question is whether current prices offer untapped value or if the market has already factored in future growth potential.

Most Popular Narrative: 9.6% Undervalued

OUTFRONT Media’s latest close of $17.62 is seen by the most widely followed narrative as offering a notable gap to fair value. This is based on a thorough assessment of its future earnings, revenue, and margin potential. The current share price is below the narrative’s $19.50 fair value, making this analysis a significant counterpoint to short-term price moves.

OUTFRONT's ongoing digital conversion of static billboards and transit assets to digital displays enables higher ad rotation, dynamic content, and premium pricing. This directly supports accelerated top-line growth and long-term margin expansion. The company's enhanced focus on data analytics, programmatic buying, and improved audience measurement (via investment in ad tech and centralized operations) positions it to capture more digital ad budgets, driving higher occupancy rates and increased revenue per asset.

Curious about which forecasts are fueling this bullish view? The key lies in a bold margin expansion, tech-driven transformation, and future profit projections that outpace legacy expectations. Find out what’s behind these numbers and why the fair value calculation could surprise you.

Result: Fair Value of $19.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the rise of digital and social media ad budgets, along with ongoing pressure on traditional billboard revenues, could challenge OUTFRONT’s digital transformation story.

Find out about the key risks to this OUTFRONT Media narrative.

Another View: What Do Market Comparisons Say?

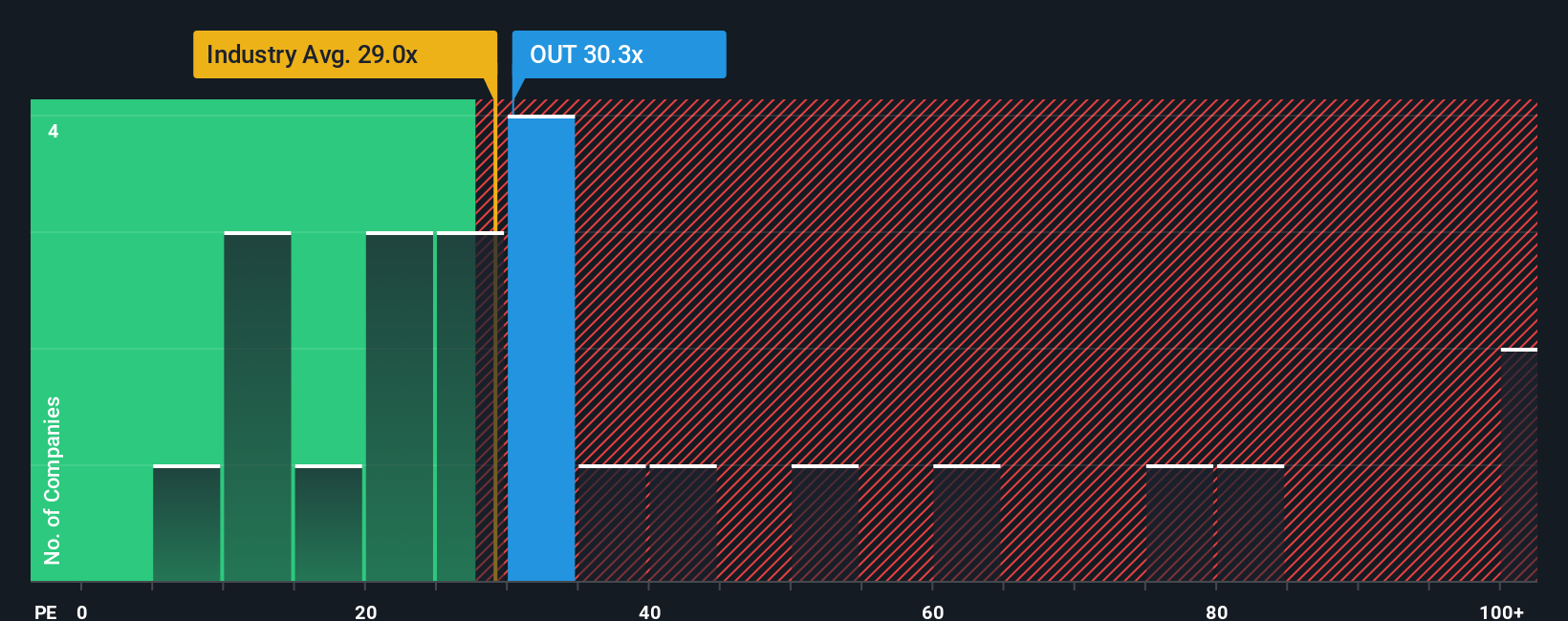

Looking at OUTFRONT Media’s price-to-earnings ratio, the stock trades at 29.9x earnings, which is higher than both the US Specialized REITs industry average of 25.7x and its peer group average of 20.2x. While this suggests investors are paying a premium for OUTFRONT’s future growth, the fair ratio stands even higher at 40.4x. This indicates that the market could push valuations up if optimism persists. Does this premium point to untapped momentum or heightened risk if growth slows?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own OUTFRONT Media Narrative

If you see things differently or want to dig deeper into OUTFRONT Media’s numbers, you can shape your own view in just a few minutes, and Do it your way.

A great starting point for your OUTFRONT Media research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors are always on the lookout for advantage. Let Simply Wall Street’s powerful Screener connect you to strategies and stocks making waves right now.

- Accelerate your potential returns by checking out these 848 undervalued stocks based on cash flows, featuring companies with strong fundamentals trading below intrinsic value.

- Tap future growth by browsing these 32 healthcare AI stocks, where innovation in medical technology is reshaping patient care and profitability.

- Secure steady income streams by reviewing these 17 dividend stocks with yields > 3%, home to stocks consistently delivering attractive dividend yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OUT

OUTFRONT Media

OUTFRONT is one of the largest and most trusted out-of-home media companies in the U.S., helping brands connect with audiences in the moments and environments that matter most.

Reasonable growth potential and fair value.

Market Insights

Community Narratives