- United States

- /

- Retail REITs

- /

- NYSE:NTST

How Investors May Respond To NETSTREIT (NTST) Returning to Profit and Raising Its Dividend

Reviewed by Sasha Jovanovic

- NETSTREIT Corp. recently reported third quarter 2025 results, posting US$45.03 million in sales and a net income of US$618,000, a turnaround from a net loss in the prior year period.

- The Board of Directors declared a quarterly cash dividend increase, taking the annualized payout to US$0.86 per share, signaling confidence in the company's ongoing earnings recovery.

- We will now examine how the improved profitability and increased dividend inform NETSTREIT’s investment outlook and risk profile.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

NETSTREIT Investment Narrative Recap

To be a NETSTREIT shareholder, you have to trust in the long-term appeal of necessity-based, single-tenant retail property, especially as population growth supports steady demand for these assets. The company’s return to profitability this quarter, along with a dividend raise, confirms operational progress, but near-term results do not fully resolve the largest challenge: potential vulnerability to shifts in retail tenant demand or market disruptions. Short-term catalysts remain mostly unaffected by these results.

The most relevant recent announcement is the Board’s decision to increase the cash dividend for the fourth quarter, for an annualized payout of US$0.86 per share. This signals continued confidence despite prior margin volatility, and may appeal to income-focused investors tracking consistent returns against retail sector risks and competitive forces.

In contrast, investors should be aware that continued growth in e-commerce could pressure tenant occupancy and underlying rent growth if demand for physical retail softens...

Read the full narrative on NETSTREIT (it's free!)

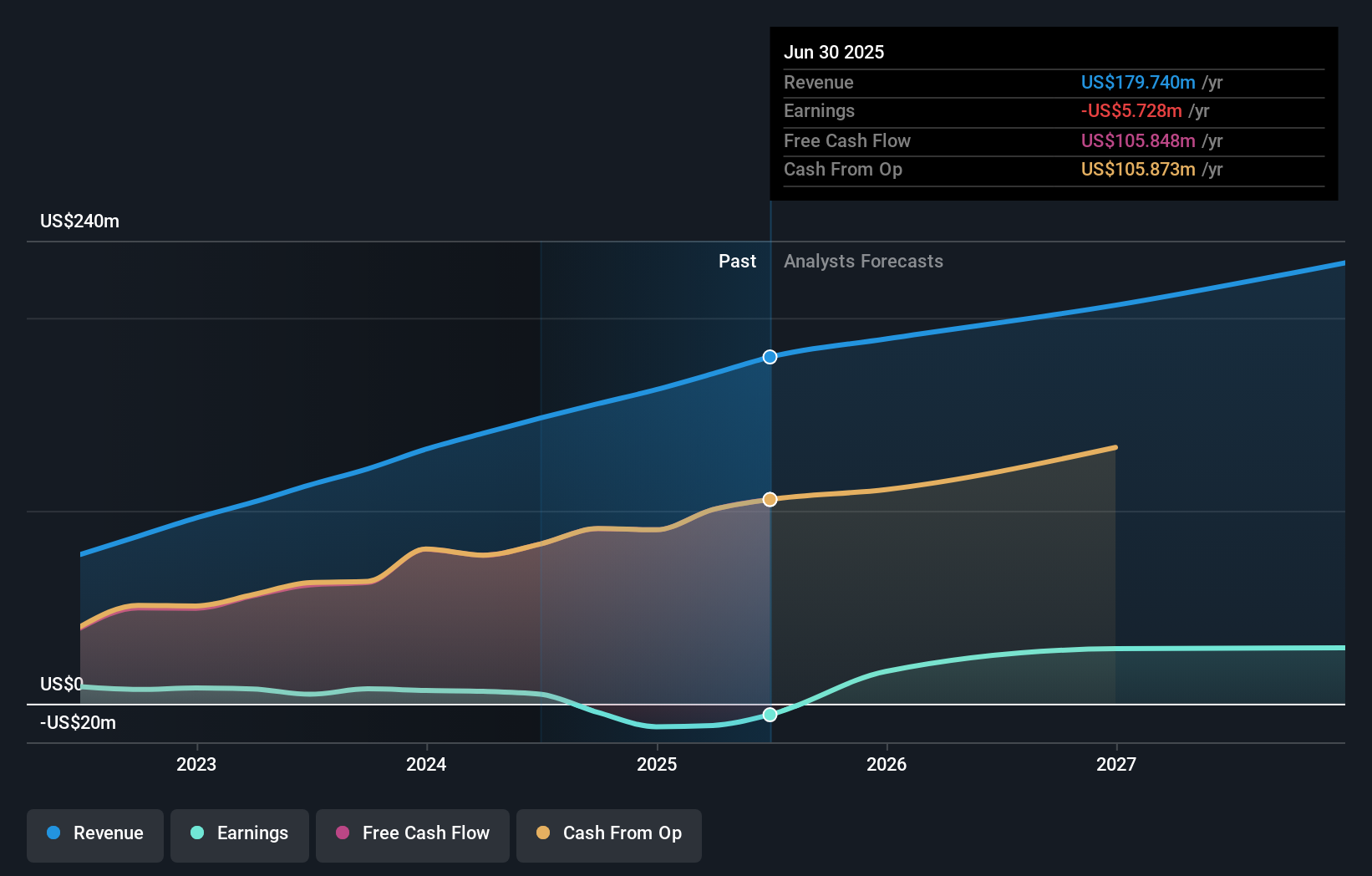

NETSTREIT's narrative projects $237.7 million revenue and $26.6 million earnings by 2028. This requires 9.8% yearly revenue growth and a $32.3 million earnings increase from -$5.7 million currently.

Uncover how NETSTREIT's forecasts yield a $20.36 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Two Simply Wall St Community estimates place NETSTREIT’s fair value between US$20.36 and US$41.52 per share. With this wide spread, make sure you consider how tenant exposure to e-commerce trends could affect future value and outlook.

Explore 2 other fair value estimates on NETSTREIT - why the stock might be worth over 2x more than the current price!

Build Your Own NETSTREIT Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NETSTREIT research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free NETSTREIT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NETSTREIT's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NETSTREIT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NTST

NETSTREIT

An internally managed real estate investment trust (REIT) based in Dallas, Texas that specializes in acquiring single-tenant net lease retail properties nationwide.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives