- United States

- /

- Retail REITs

- /

- NYSE:NTST

A Look at NETSTREIT (NTST) Valuation After Third Quarter Profit Growth and Dividend Boost

Reviewed by Simply Wall St

NETSTREIT (NTST) just delivered a double dose of news for investors, announcing improved profits and growth for the third quarter and boosting its quarterly and annual dividend by $0.02 per share.

See our latest analysis for NETSTREIT.

With shares up 31.7% year-to-date and posting a 19.8% total shareholder return over the past year, NETSTREIT’s momentum has steadily built on the back of improved earnings and a growing dividend, even as some peers have treaded water. The company’s recent return to profitability and upgraded dividend indicate management’s confidence about future prospects. This is reflected in investor sentiment and upward stock movement.

If you’re searching for new ideas beyond NETSTREIT’s growth, now’s an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

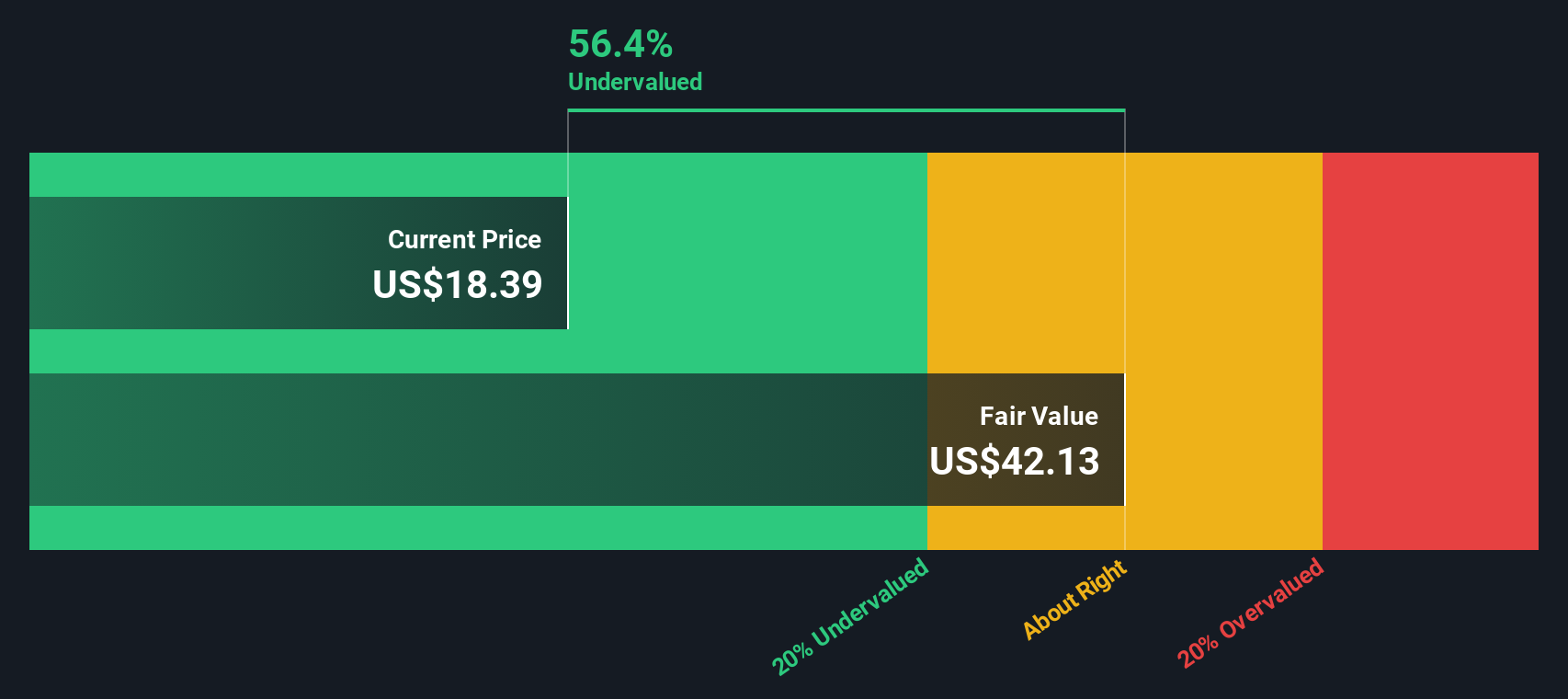

So with NETSTREIT’s shares already up sharply this year and future growth top of mind for investors, is the stock still undervalued at this stage, or has the market already priced in what is to come?

Most Popular Narrative: 9.8% Undervalued

With the most popular narrative placing NETSTREIT’s fair value at $20.36 per share versus the last close of $18.36, there is a clear conviction that the stock’s future performance is not yet fully appreciated by the market. The difference calls attention to the drivers, both quantitative and strategic, that may be behind this perceived discount.

"Conservative balance sheet management, ample liquidity, and an improving cost of capital position NETSTREIT to pursue attractive external growth opportunities, enabling the company to accelerate accretive acquisitions that should positively impact AFFO per share and long-term earnings."

Want to know why analysts think such aggressive earnings growth and margin expansion are within reach? The real story is hidden in the bold profit assumptions and an eye-popping valuation multiple typically reserved for high-growth disruptors. What is the hidden logic driving this price target? Dive in to see just how ambitious the road map really is.

Result: Fair Value of $20.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising interest rates or a sudden shift in consumer retail behavior could quickly challenge NETSTREIT’s current growth outlook and long-term earnings assumptions.

Find out about the key risks to this NETSTREIT narrative.

Another View: SWS DCF Model Points to Substantial Undervaluation

While the popular narrative focuses on analyst price targets and earnings multiples, our DCF model draws a different conclusion. It suggests NETSTREIT’s fair value is $41.47, which is far above the current share price. Could the market be overlooking long-term cash flow potential, or is this optimism misplaced?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own NETSTREIT Narrative

If you see things differently or want to chart your own course, you can dive into the numbers and develop your own view in just minutes, Do it your way

A great starting point for your NETSTREIT research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you want to get ahead of the crowd, let the Simply Wall Street Screener point you toward innovative stocks and fresh investment angles you might not have spotted yet.

- Catch high yields for your portfolio and boost your income with these 16 dividend stocks with yields > 3% that consistently deliver strong dividends above 3%.

- Ride the AI wave by seeking out these 25 AI penny stocks at the forefront of artificial intelligence, automation, and digital transformation trends.

- Position yourself early in the next financial evolution by targeting these 82 cryptocurrency and blockchain stocks pushing the boundaries in blockchain and cryptocurrency technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NETSTREIT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NTST

NETSTREIT

An internally managed real estate investment trust (REIT) based in Dallas, Texas that specializes in acquiring single-tenant net lease retail properties nationwide.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives