- United States

- /

- Specialized REITs

- /

- NYSE:MRP

Is Millrose Properties Fairly Priced After Strategic Portfolio Acquisition and 46.8% Year-to-Date Gain?

Reviewed by Bailey Pemberton

- Wondering if Millrose Properties stock is a hidden gem or just getting started? Let’s dig into what could be driving value for investors right now.

- The stock’s up an impressive 46.8% year-to-date, though it did dip 0.6% over the last week. This hints at both upside potential and shifting market sentiment.

- Recent headlines point to big developments in Millrose’s core real estate markets, including a strategic portfolio acquisition that has attracted positive attention from analysts and investors alike. This move, combined with new zoning approvals, appears to be fueling optimism and volatility in the share price.

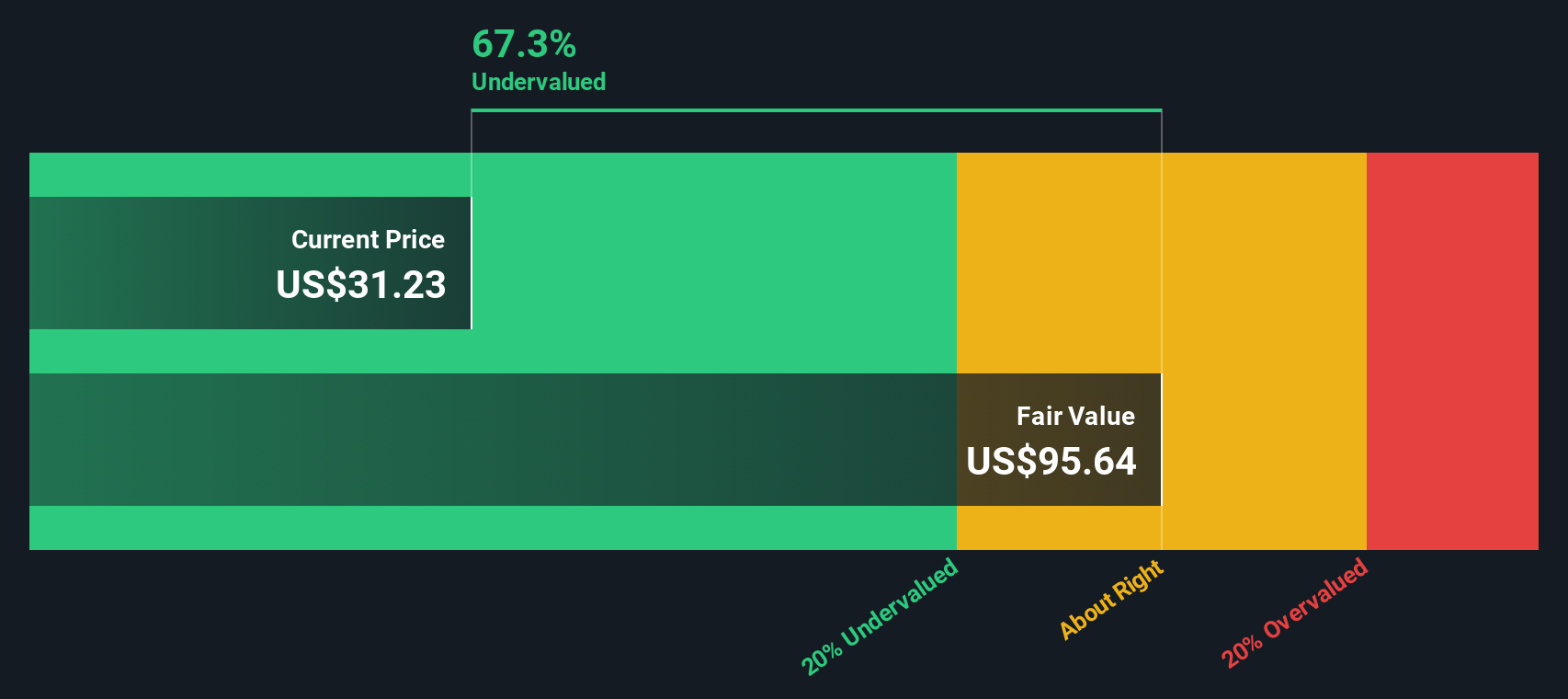

- On valuation, Millrose Properties scores 5 out of 6 on our valuation checks, marking it as undervalued in most key areas. We’ll break down what these methods reveal, and why the best path to real insight might surprise you at the end of the article.

Approach 1: Millrose Properties Dividend Discount Model (DDM) Analysis

The Dividend Discount Model (DDM) is a valuation method that estimates the intrinsic value of a stock based on its expected future dividend payments, discounted back to the present. Essentially, it asks: what are all the dividends a shareholder will receive in the future, and what are they worth today?

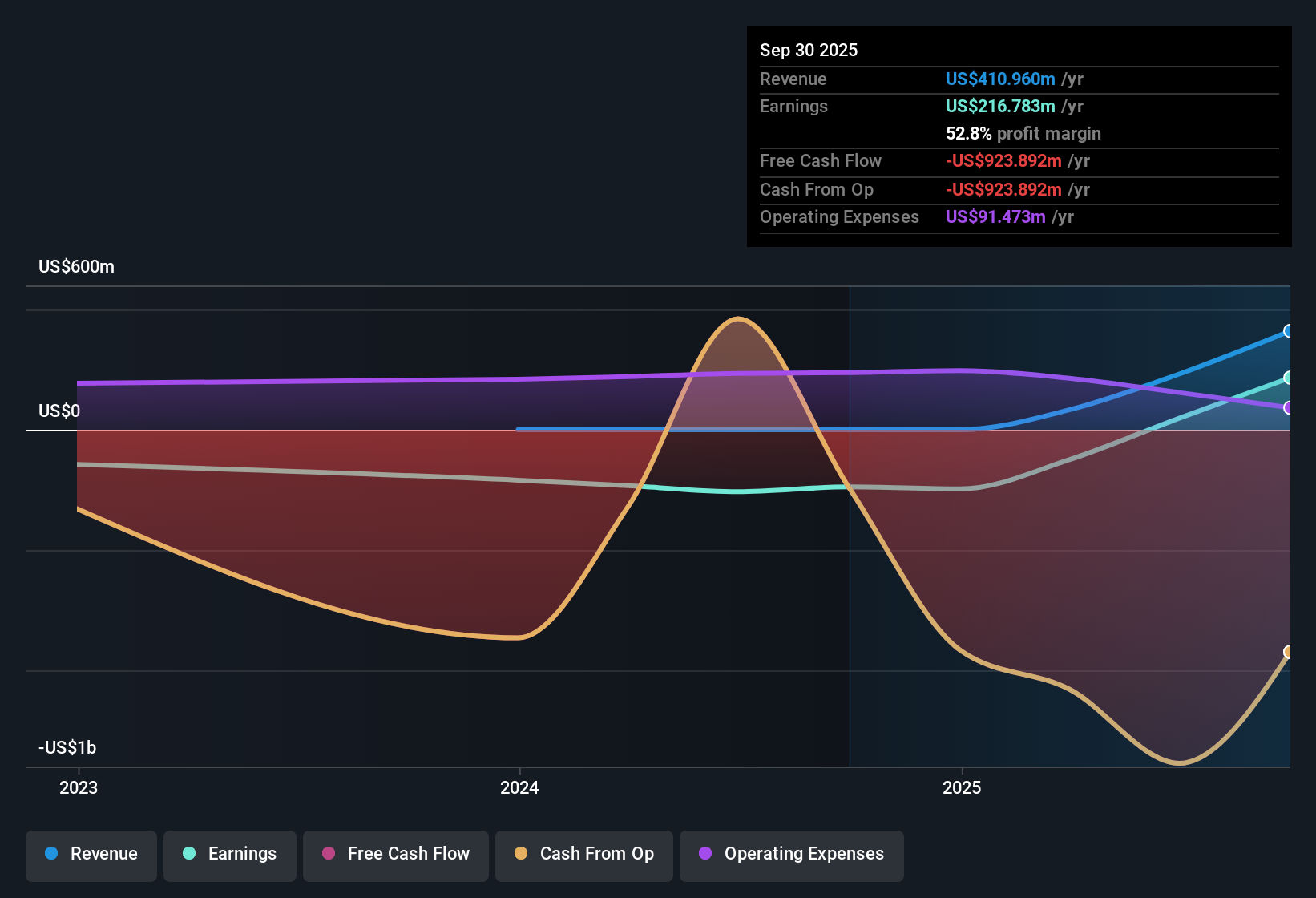

For Millrose Properties, the model uses a recent dividend per share of $2.90 and considers both the company’s return on equity and payout ratio. However, with a payout ratio of 106.6% and a negative return on equity of -2.41%, the sustainability of current dividend payments is a concern. When plugging these numbers into the DDM formula, the expected annual growth rate for dividends is just 0.16%, calculated from the combination of payout and return on equity.

Despite these red flags, the resulting intrinsic value from the DDM is $39.95 per share. The DDM indicates the stock is trading at a 19.4% discount to its estimated fair value. This suggests Millrose Properties stock is undervalued by this approach.

Result: UNDERVALUED

Our Dividend Discount Model (DDM) analysis suggests Millrose Properties is undervalued by 19.4%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: Millrose Properties Price vs Earnings

The Price-to-Earnings (PE) ratio stands out as the most widely used valuation metric for profitable companies like Millrose Properties. This ratio helps investors gauge how much they are paying for each dollar of the company’s earnings, making it a practical tool for comparing value across different stocks and sectors.

What qualifies as a “normal” or “fair” PE ratio depends on several factors, including a company’s earnings growth potential, risk profile, and the broader industry climate. Higher expected growth often justifies a higher PE, whereas greater risk or sluggish prospects typically warrant a lower multiple.

Currently, Millrose Properties trades at a PE ratio of 24.7x. For comparison, the average PE in the Specialized REITs industry is 17.3x, while the company's peer group averages 25.4x. On the surface, Millrose’s valuation appears fairly in line with similar companies—slightly below the peer average but significantly higher than the industry average.

However, Simply Wall St’s proprietary “Fair Ratio” provides another perspective. This specialized metric calculates what PE ratio the stock deserves based on not only its industry, but also its growth outlook, profit margin, market cap, and company-specific risks. By factoring in these nuances, the Fair Ratio (50.1x for Millrose Properties) offers a more personalized benchmark than a standard industry or peer average.

Comparing Millrose’s actual PE (24.7x) to its Fair Ratio of 50.1x suggests the stock is trading well below its estimated justified level, accounting for growth and risk factors.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1414 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Millrose Properties Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, powerful tool that lets you tell the story behind the numbers by connecting your perspective on a company’s outlook to your own forecasts of fair value and estimates for future revenue, earnings, and margins. More than just figures, Narratives tie these forecasts to a meaningful storyline, showing how a company’s trajectory (such as a promising new acquisition or industry headwinds) shapes its opportunities and risks.

On Simply Wall St’s Community page, used by millions of investors, Narratives make it easy and accessible: you can build or explore different viewpoints, and see how each Narrative links a story to updated forecasts and a dynamic fair value. With Narratives, you compare fair value with the current price, helping you spot smarter buy or sell opportunities as the market shifts. Narratives update in real time when new information like news or earnings is released, so your investment decision stays current and relevant.

For example, with Millrose Properties, some investors might see a bullish Narrative with a high fair value, while others may take a more conservative view, valuing it much lower, all based on their individual expectations and assumptions.

Do you think there's more to the story for Millrose Properties? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MRP

Millrose Properties

Millrose purchases and develops residential land and sells finished homesites to homebuilders by way of option contracts with predetermined costs and takedown schedules.

Undervalued with high growth potential.

Market Insights

Community Narratives