- United States

- /

- Specialized REITs

- /

- NYSE:MRP

Does Millrose Properties Pullback Offer a Chance After Expansion News?

Reviewed by Bailey Pemberton

- Ever wondered if Millrose Properties is actually a bargain right now, or if there’s something hiding under the surface? You’re not alone in wanting to understand whether this stock could offer standout value.

- After a huge run earlier this year, Millrose has pulled back, dropping 6.4% in the past week and 11.5% over the last month. It still boasts a strong 33.3% gain year-to-date, sparking plenty of conversation about what’s driving these swings.

- Recent headlines have focused on Millrose’s expansion into new commercial properties in key urban markets. Some analysts say this could be behind the fresh momentum and shifts in risk perception. Stories about increased tenant demand and strategic acquisitions have definitely added new angles for investors to consider.

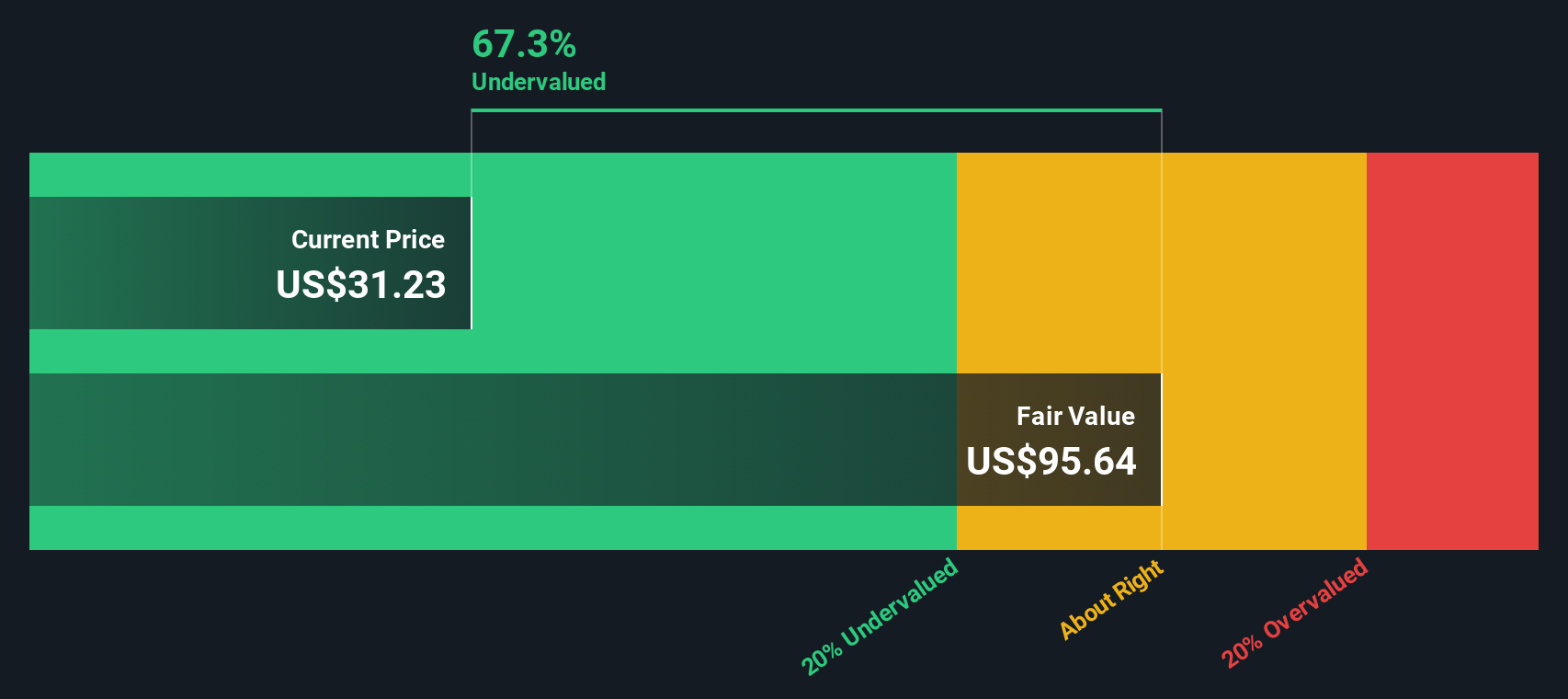

- On the numbers front, Millrose scores a perfect 6 out of 6 on our value checks, which means it’s undervalued in every single one—a rare feat. Let’s break down exactly what goes into this score using a few common valuation approaches. There is also an even smarter way to spot a stock’s fair value that we’ll cover at the end.

Approach 1: Millrose Properties Dividend Discount Model (DDM) Analysis

The Dividend Discount Model estimates a company's intrinsic value by forecasting its future dividend payments and discounting them back to today's value. This model is especially useful for companies such as Millrose Properties, where dividends make up a significant part of investor returns.

For Millrose, the latest annual dividend per share stands at $2.90. What really stands out is their payout ratio, which is over 106%. This means the company is currently paying out more in dividends than it earns. This number is not sustainable long term. The model uses a growth projection of just 0.16%, calculated from the company’s negative return on equity and outsized payout ratio. This reflects an expectation for minimal dividend growth going forward.

After applying these assumptions, the Dividend Discount Model estimates an intrinsic value of $37.31 per share. This is about 21.6% above the current share price, signaling that Millrose Properties may be significantly undervalued by the market according to this metric.

Result: UNDERVALUED

Our Dividend Discount Model (DDM) analysis suggests Millrose Properties is undervalued by 21.6%. Track this in your watchlist or portfolio, or discover 918 more undervalued stocks based on cash flows.

Approach 2: Millrose Properties Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies because it connects a company’s share price with its reported earnings. For investors, the PE ratio can be especially helpful when assessing companies like Millrose Properties, as it translates overall profitability into a single, comparable figure.

Growth expectations and perceived risk are major factors in what a “normal” or “fair” PE ratio looks like for a stock. Generally, companies with stronger growth prospects or lower risk profiles tend to have higher PE ratios, while those facing headwinds or uncertainties trade at discounted multiples.

Currently, Millrose Properties trades at a PE ratio of 22.39x. This is slightly below its peer average of 23.14x, but notably higher than the broader Specialized REITs industry average of 17.05x. While these benchmarks offer some context, they do not always tell the full story given every company’s unique situation.

This is where Simply Wall St’s “Fair Ratio” comes in. The Fair Ratio estimates what Millrose’s PE ratio should be, accounting for its growth rate, margins, risk factors, market cap, and how it compares within its own industry. This method provides a more custom-fit benchmark compared to basic peer or industry comparisons.

For Millrose Properties, the Fair Ratio is calculated at 61.61x, which is substantially above its actual PE of 22.39x. That significant gap suggests the current market pricing may not fully reflect the company’s growth and risk profile, making the stock appear undervalued on this measure.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1423 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Millrose Properties Narrative

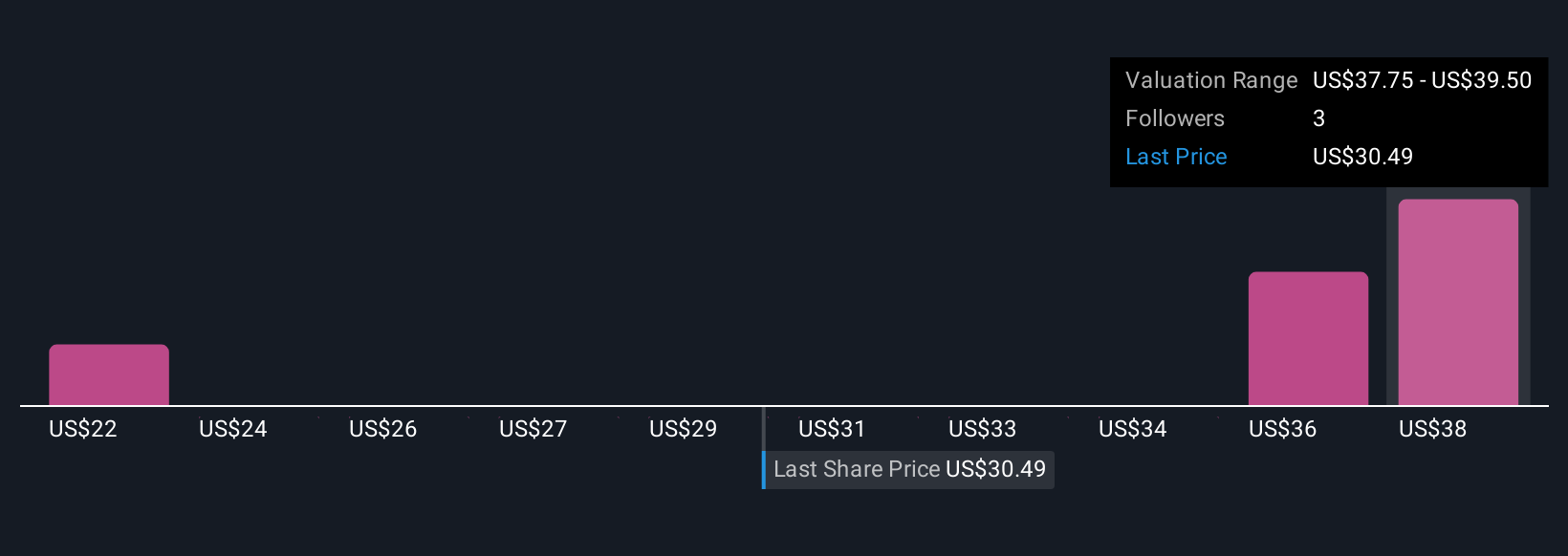

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a concise story that represents your individual view of a company, tying together your assumptions about its future revenue, earnings, and margins into a single, coherent outlook. Instead of just relying on standard ratios or models, Narratives help you weave the company’s story into a dynamic financial forecast, which then calculates your own version of fair value.

Narratives are easy to use and fully accessible within the Community page on Simply Wall St, where millions of investors share and compare their perspectives. By crafting or reviewing Narratives, you can more confidently decide when to buy or sell by simply comparing your Narrative’s fair value with the current share price for real-time context.

The best part is these Narratives automatically update whenever new news or earnings data is released, keeping your insights relevant and actionable. For example, one Millrose Properties Narrative sees a fair value of $41 based on bullish rent growth, while another estimates just $33 due to concerns over long-term debt. Narratives make it easy for you to understand not just what the numbers say, but what the underlying story means for your investment decisions.

Do you think there's more to the story for Millrose Properties? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MRP

Millrose Properties

Millrose purchases and develops residential land and sells finished homesites to homebuilders by way of option contracts with predetermined costs and takedown schedules.

Very undervalued with high growth potential.

Market Insights

Community Narratives