- United States

- /

- Health Care REITs

- /

- NYSE:MPW

US$150 Million Share Buyback and New Leases Could Be a Game Changer for Medical Properties Trust (MPW)

Reviewed by Sasha Jovanovic

- Medical Properties Trust, Inc. recently announced the authorization of a US$150 million share repurchase program, coinciding with operational updates such as improved tenant performance and a new lease agreement with NOR Healthcare Systems for six California facilities.

- This combination of initiatives highlights management's focus on supporting shareholder value while addressing ongoing issues from tenant bankruptcies and delayed rent payments.

- We'll explore how the newly announced US$150 million share buyback program influences Medical Properties Trust's long-term investment outlook and risk profile.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Medical Properties Trust Investment Narrative Recap

To be a shareholder in Medical Properties Trust, one must see a path to consistent cash flows as rental payments ramp up from new and existing tenants while management addresses credit risks from past operator bankruptcies. The recently announced US$150 million share buyback program signals management's intent to support valuation, but, by itself, is unlikely to materially affect MPW's near-term catalyst: the need to stabilize rental income against persistent tenant payment delays. The most significant short-term risk remains the potential for further asset impairments or write-downs linked to distressed tenant sales, which could pressure both book value and confidence in future earnings stability.

Among recent announcements, the new lease agreement with NOR Healthcare Systems for six California facilities stands out as directly relevant, as it increases contractual rent coverage and may help offset lost rental income from former distressed tenants. This progress toward re-tenanting critical properties links closely to the key catalyst for the business: reaching the targeted US$1 billion in annualized cash rent by 2026, which is central to improved earnings prospects. Yet, concerns about ongoing asset sales below book value and future impairment charges remain front of mind for many shareholders.

However, it's critical for investors to be mindful of the ongoing risks tied to further property impairments and distressed asset dispositions, because...

Read the full narrative on Medical Properties Trust (it's free!)

Medical Properties Trust's narrative projects $1.1 billion in revenue and $136.7 million in earnings by 2028. This requires 3.1% yearly revenue growth and an increase in earnings of $1.54 billion from current earnings of -$1.4 billion.

Uncover how Medical Properties Trust's forecasts yield a $4.86 fair value, a 6% downside to its current price.

Exploring Other Perspectives

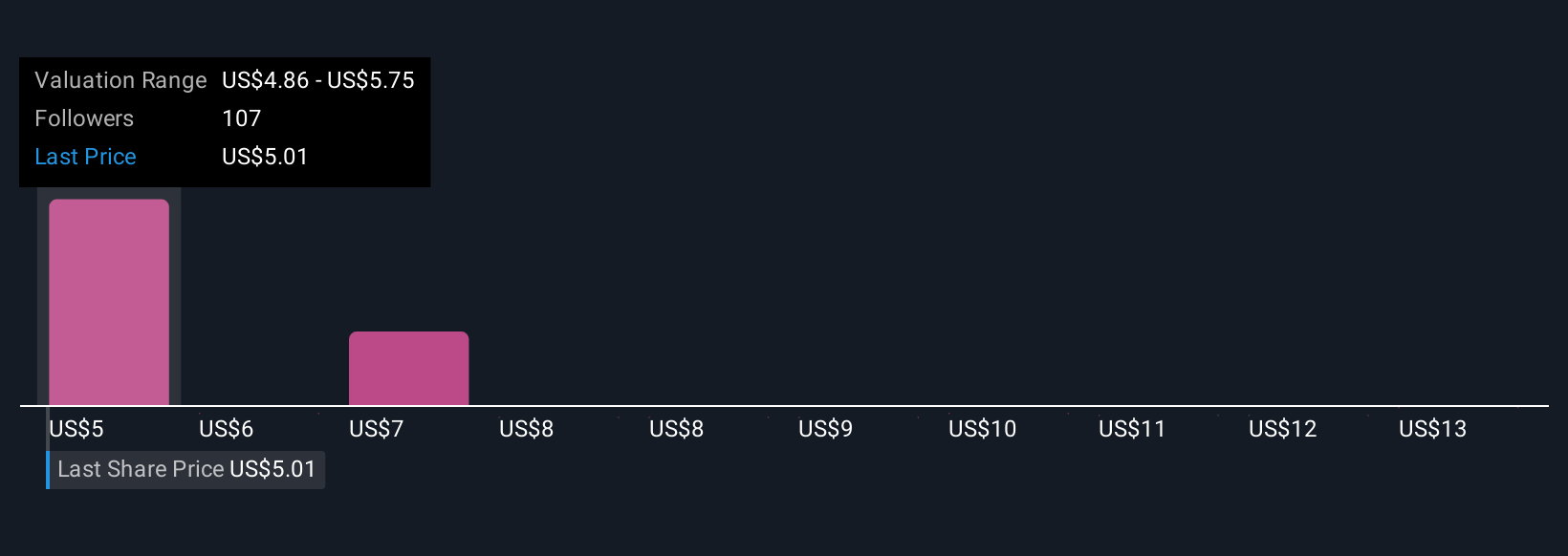

Eleven members of the Simply Wall St Community place Medical Properties Trust’s fair value between US$4.86 and US$13.43 per share. This wide range reflects uncertainty as the company works to ramp up rental income and address financial pressures, highlighting the importance of reviewing several viewpoints when considering MPW’s future.

Explore 11 other fair value estimates on Medical Properties Trust - why the stock might be worth over 2x more than the current price!

Build Your Own Medical Properties Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Medical Properties Trust research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Medical Properties Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Medical Properties Trust's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MPW

Medical Properties Trust

A self-advised real estate investment trust formed in 2003 to acquire and develop net-leased hospital facilities.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives